- Japan

- /

- Medical Equipment

- /

- TSE:7733

Olympus (TSE:7733) Valuation Insights as New International GI Device Distribution Deal Expands Strategic Reach

Reviewed by Kshitija Bhandaru

Olympus (TSE:7733) has just signed an exclusive international distribution deal with W. L. Gore & Associates, positioning itself to broaden commercialization of GI devices, starting in Europe and expanding into new markets.

See our latest analysis for Olympus.

Olympus’s move to expand its GI device distribution comes shortly after a recently completed share buyback and has caught investor attention as the company continues to build its medical device reach internationally. While the past year delivered a slightly negative 1-year total shareholder return, long-term performance has been fairly muted, signaling the market is still waiting for clear momentum to take hold.

If Olympus’s evolving strategy sparks your curiosity, it could be the perfect moment to uncover other industry leaders with our See the full list for free..

Yet given Olympus’s underwhelming long-term returns and its recent strategic moves, investors face a familiar question: is Olympus trading at a bargain ahead of growth, or is the market already pricing in its future potential?

Most Popular Narrative: 3.1% Undervalued

Olympus's latest fair value estimate is slightly above its last close and hints at latent upside just as new strategies take shape. This narrative sets the tone for a measured but cautiously optimistic outlook amid ongoing business shifts.

The reorganization into more customer-focused divisions, including the creation of the Gastrointestinal Solutions Division (GIS) and the Surgical and Interventional Solutions Division (SIS), is expected to improve efficiency and execution. This change aims to drive market penetration and unlock recurring revenue streams, positively impacting revenue and net margins.

Curious what kind of top-line growth, profitability tweaks, and recurring revenue streams might power this verdict? Discover which core initiatives and future earnings projections have the consensus betting on Olympus’s potential to outperform its recent share price. Only the full narrative reveals the numbers and assumptions behind this call.

Result: Fair Value of $2006 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in China and high R&D expenses could still undermine Olympus’s growth story and test the resilience of its latest strategy.

Find out about the key risks to this Olympus narrative.

Another View: The Multiples Perspective

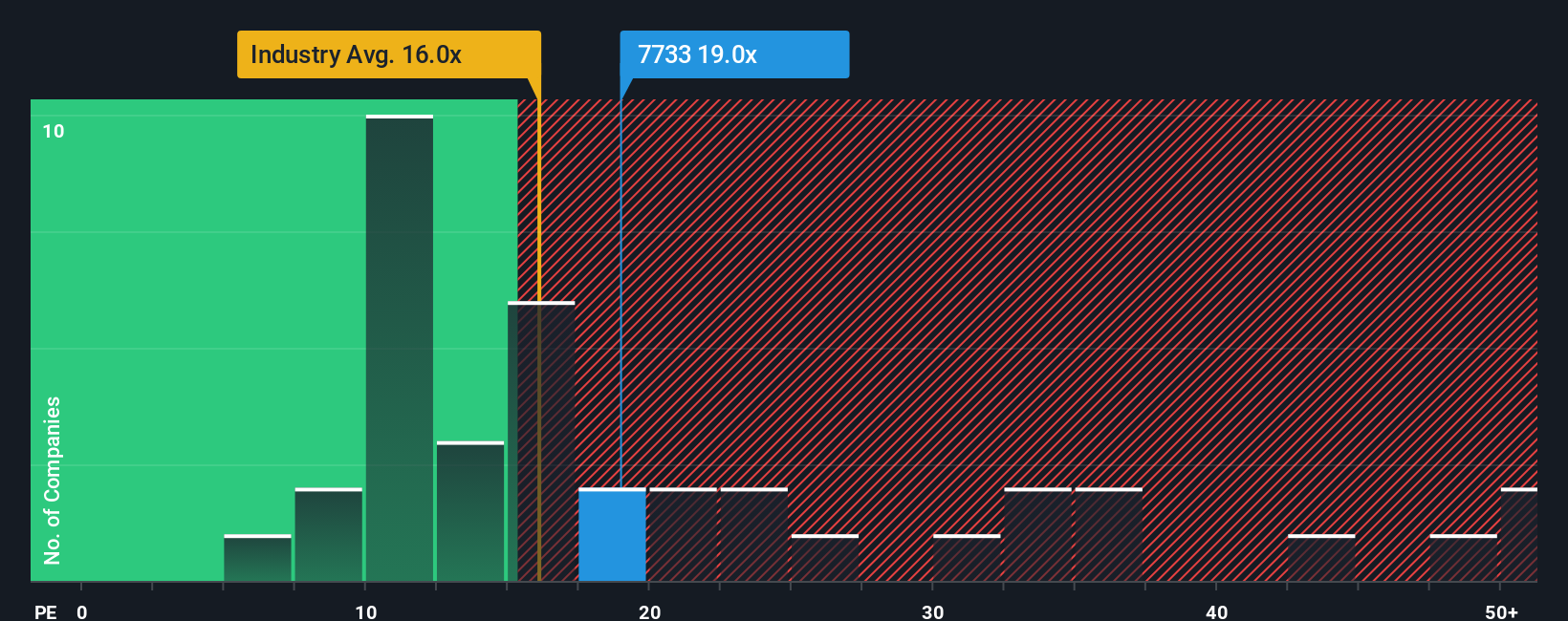

Looking at Olympus through the lens of its current price-to-earnings ratio, the picture shifts. The company trades at 19.2x earnings, noticeably below the peer average of 25.1x but still above the broader JP Medical Equipment industry average of 15.6x. The fair ratio sits even higher at 28.9x, suggesting potential room for upside or simply that investors see more risks than peer companies. With this spread, is the market cautious or is there a hidden value opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Olympus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Olympus Narrative

If these takes don’t match your outlook or you’d rather dig into the details firsthand, it’s quick and easy to craft your own take: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Olympus.

Ready for More Smart Investment Opportunities?

Stop letting potential winners slip by. Use the Simply Wall Street Screener to instantly surface focused investment ideas and put your money where trends are heading next.

- Capture tomorrow’s tech game changers and scan these 24 AI penny stocks set to dominate with breakthroughs in artificial intelligence and machine learning.

- Unlock passive income streams by selecting from these 19 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Seize undervalued growth potential by zeroing in on these 885 undervalued stocks based on cash flows currently trading below intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7733

Olympus

Manufactures and sells precision machineries and instruments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives