As trade tensions between the U.S. and China continue to influence market sentiment, Asian stock markets have experienced fluctuations, with investors closely monitoring economic indicators and policy developments. In this environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on market inefficiencies, particularly when these stocks demonstrate strong fundamentals amid broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Tenchen Controls (SHSE:603085) | CN¥9.88 | CN¥19.33 | 48.9% |

| Yangtze Optical Fibre And Cable Limited (SEHK:6869) | HK$36.68 | HK$72.75 | 49.6% |

| Shanghai Conant Optical (SEHK:2276) | HK$38.02 | HK$75.70 | 49.8% |

| LITALICO (TSE:7366) | ¥1237.00 | ¥2421.92 | 48.9% |

| Jiangsu Xinquan Automotive TrimLtd (SHSE:603179) | CN¥66.19 | CN¥130.82 | 49.4% |

| Japan Eyewear Holdings (TSE:5889) | ¥2065.00 | ¥4080.86 | 49.4% |

| EverProX Technologies (SZSE:300548) | CN¥95.70 | CN¥186.23 | 48.6% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩9200.00 | ₩17964.31 | 48.8% |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥31.00 | CN¥61.23 | 49.4% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.19 | CN¥54.06 | 49.7% |

Let's explore several standout options from the results in the screener.

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells soft drinks in Japan with a market cap of ¥110.15 billion.

Operations: The company's revenue is primarily derived from its Beverage and Leaf Business, which generated ¥46.67 billion.

Estimated Discount To Fair Value: 18.7%

Lifedrink Company appears undervalued based on cash flows, trading at ¥2,124, which is 18.7% below its estimated fair value of ¥2,612.49. Despite high debt levels and recent share price volatility, the company shows promising revenue growth forecasts at 11.3% annually—outpacing the JP market's 4.4%. Recent strategic moves include a share buyback program and production expansion in Iwate Prefecture for tea-based beverages with an investment of ¥8.2 billion to enhance capacity.

- The growth report we've compiled suggests that Lifedrink Company's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Lifedrink Company.

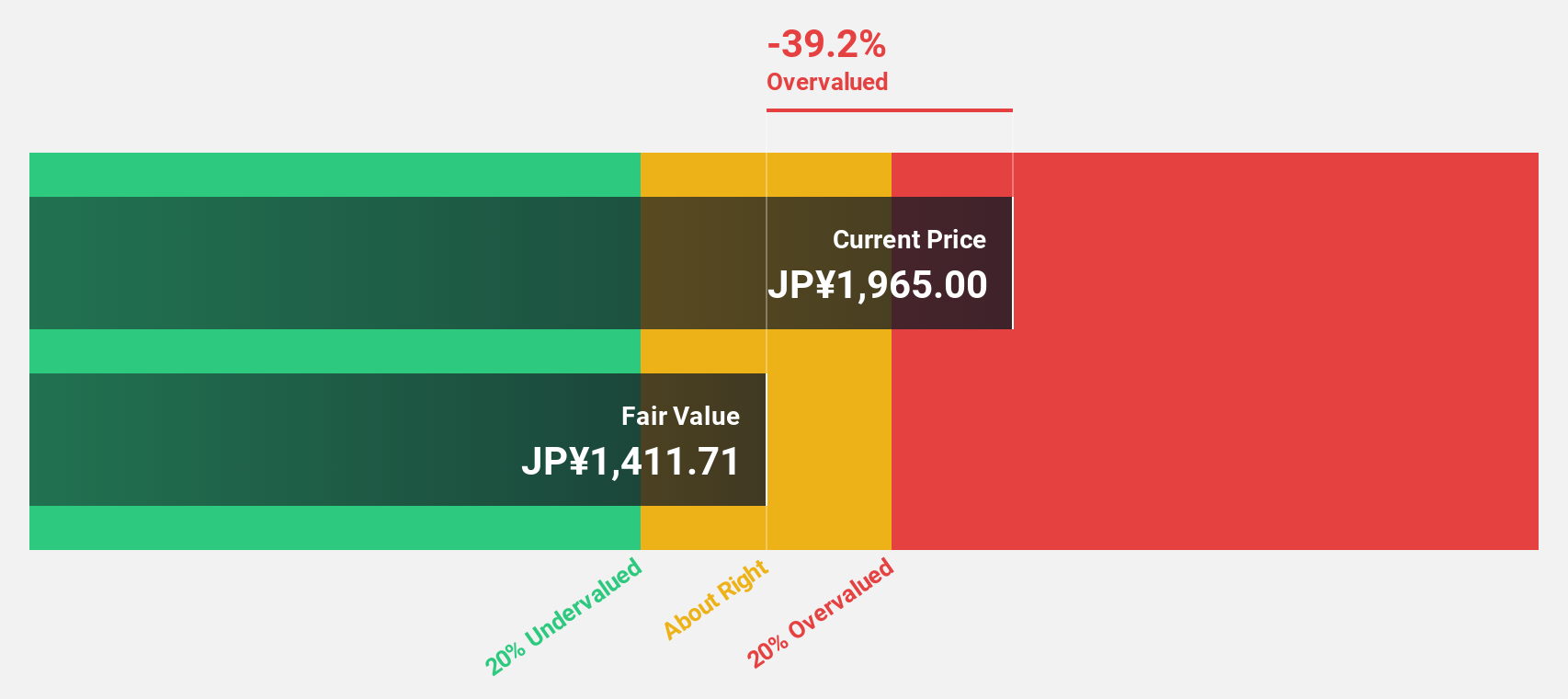

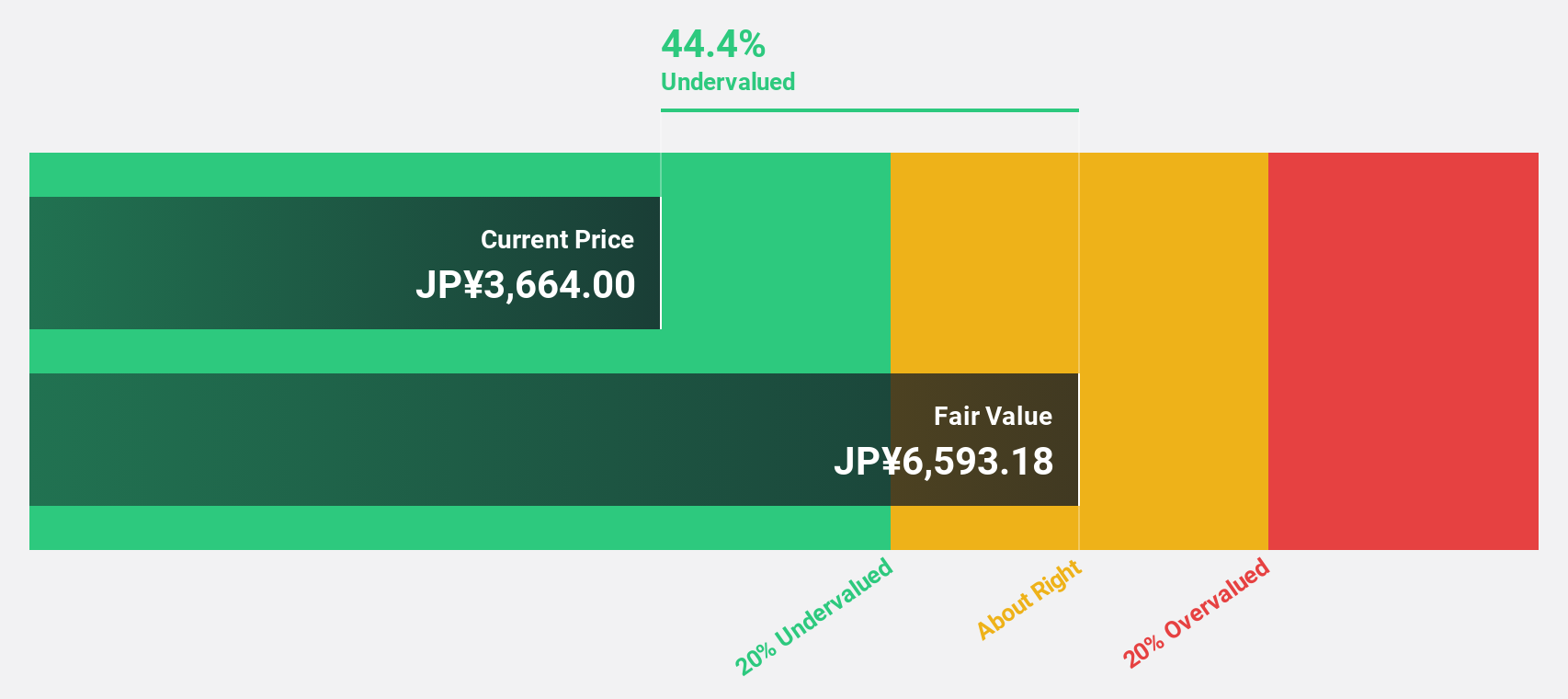

H.U. Group Holdings (TSE:4544)

Overview: H.U. Group Holdings, Inc., along with its subsidiaries, operates in the healthcare sector across Japan, the United States, Europe, and other international markets with a market cap of ¥211.88 billion.

Operations: H.U. Group Holdings generates revenue through its healthcare operations in Japan, the United States, Europe, and various international markets.

Estimated Discount To Fair Value: 42.2%

H.U. Group Holdings is trading at ¥3,729, significantly below its estimated fair value of ¥6,455.03, indicating undervaluation based on cash flows. Despite recent share price volatility and a dividend not fully covered by earnings, the company has revised its profit forecast upward due to gains from asset sales. Earnings are projected to grow substantially at 46.7% annually over the next three years, outpacing the broader Japanese market's growth rate of 8%.

- Upon reviewing our latest growth report, H.U. Group Holdings' projected financial performance appears quite optimistic.

- Dive into the specifics of H.U. Group Holdings here with our thorough financial health report.

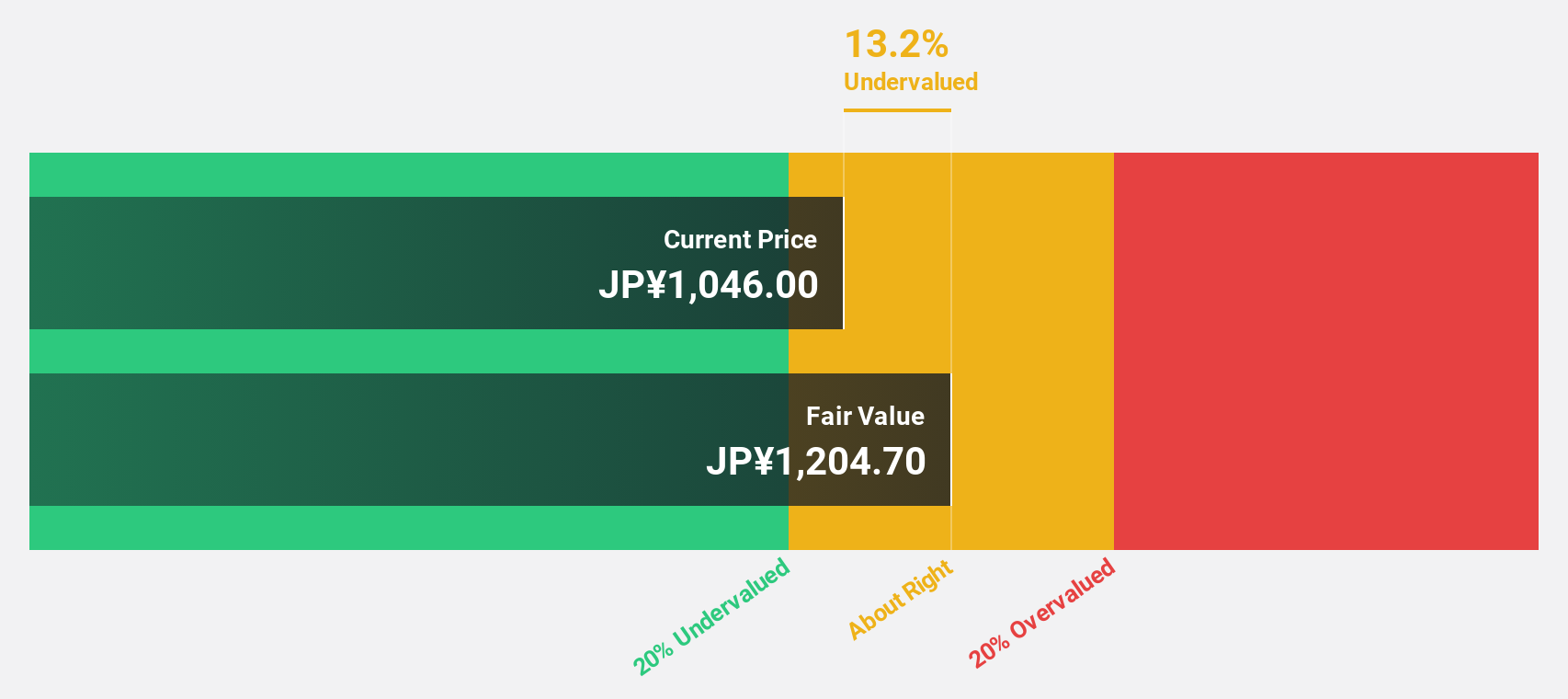

Tadano (TSE:6395)

Overview: Tadano Ltd. is a company that, along with its subsidiaries, manufactures and sells construction and vehicle-mounted cranes as well as aerial work platforms both in Japan and internationally, with a market cap of approximately ¥133.43 billion.

Operations: The company's revenue is derived from several regions, with ¥192.30 billion from Japan, ¥93.18 billion from Europe, ¥12.37 billion from the Americas, ¥10.85 billion from Oceania, and ¥7.83 billion from other regions.

Estimated Discount To Fair Value: 10.8%

Tadano is trading at ¥1,057.5, below its estimated fair value of ¥1,185.28, suggesting undervaluation based on cash flows. Despite a low return on equity forecast and unsustainable dividend coverage by free cash flows, earnings are projected to grow significantly at 26.5% annually over the next three years, surpassing the Japanese market's growth rate of 8%. Recent guidance revisions indicate improved financial performance with increased net sales and operating profit expectations for 2025.

- Insights from our recent growth report point to a promising forecast for Tadano's business outlook.

- Get an in-depth perspective on Tadano's balance sheet by reading our health report here.

Make It Happen

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 271 more companies for you to explore.Click here to unveil our expertly curated list of 274 Undervalued Asian Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tadano might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6395

Tadano

Manufactures and sells construction and vehicle-mounted cranes, aerial work platforms, and transport machinery in Japan and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives