- Japan

- /

- Medical Equipment

- /

- TSE:4543

Terumo (TSE:4543): Exploring Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Terumo (TSE:4543): Is the Latest Dip a Sign to Reconsider?

If you follow Terumo (TSE:4543), you might have noticed the share price has taken a breather in recent weeks, which naturally leads investors to wonder what’s next. There is no headline event behind the latest move, and sometimes these stretches of quiet can spark as much curiosity as a major announcement. With the stock sliding quietly this month, the lack of any clear trigger makes it all the more interesting for value-focused investors asking whether the dip signals an opportunity or something more cautionary.

Looking at the bigger picture, Terumo’s performance has been mixed over the past year. After a steady run, momentum has faded, and the stock is now down roughly 13% year-to-date. Despite this, it is still up a modest 2% over the past twelve months and has gained 17% over three years. Recent sessions have been subdued, with slight declines throughout the past week and month. Even so, the company’s solid financial growth and long-term track record keep Terumo firmly on many watchlists.

With shares dipping and growth still on the table, is this the moment to take advantage of an undervalued price, or is the market already factoring in Terumo’s future potential?

Most Popular Narrative: 19.3% Undervalued

The dominant narrative currently sees Terumo as undervalued, with its fair value priced notably higher than today's share price. This view is based on forecasts of robust earnings and revenue growth, justified by strong performance drivers in global healthcare markets.

Strong volume growth and sustained demand in the U.S. and China, driven by an aging population and rising chronic disease prevalence, are resulting in record-high quarterly revenues for Terumo. These structural health trends are likely to support ongoing top-line growth.

Curious what’s behind the optimism? The narrative’s fair value is not just guesswork. It hinges on bold financial projections, intricate margin calculations, and a profit multiple more typical for high-growth sectors. Wondering which assumptions push the price target skyward? The underlying growth recipe might surprise you.

Result: Fair Value of ¥3,239.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including uncertainty around passing higher costs to customers, and the potential for lagging innovation to impact longer-term growth.

Find out about the key risks to this Terumo narrative.Another View: Market Multiples Raise Questions

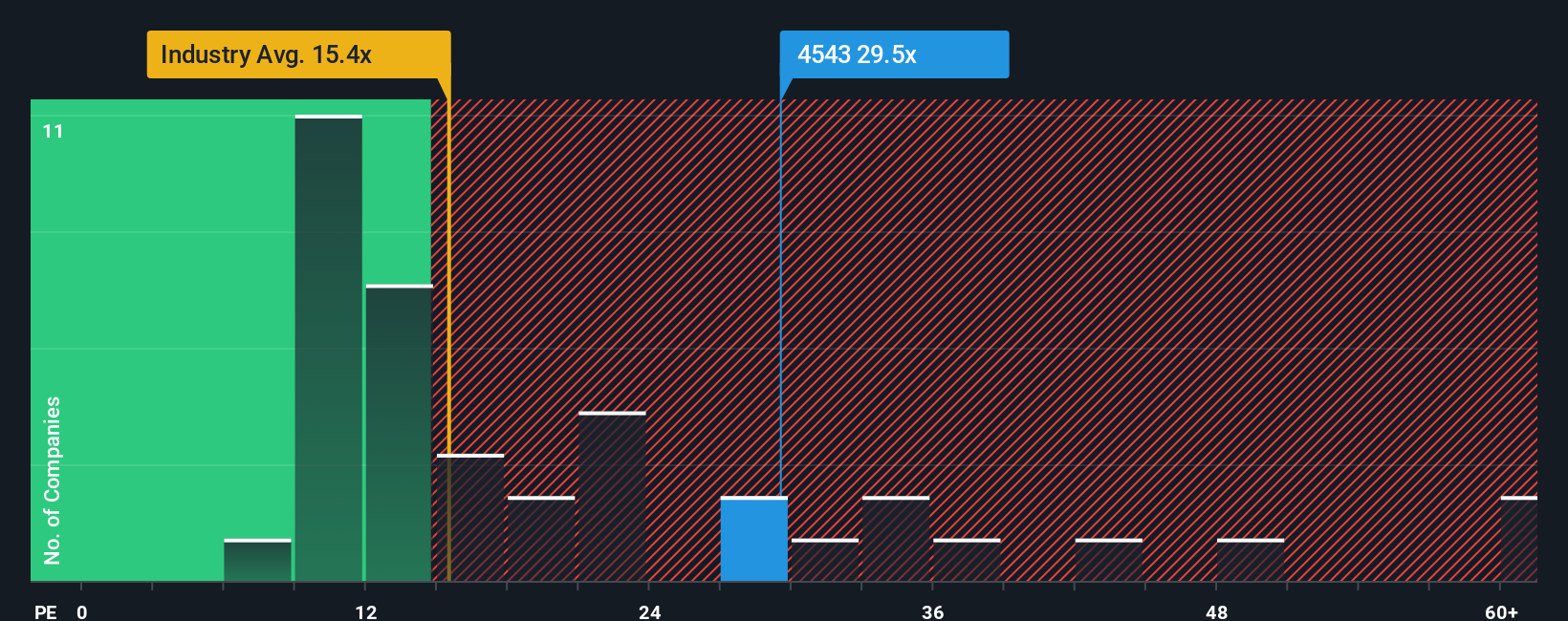

While analysts see Terumo as undervalued based on future growth, a comparison with the average valuation of similar companies in the medical equipment sector tells a different story. This approach suggests Terumo is actually trading at a premium. Could the market be overestimating its potential?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Terumo to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Terumo Narrative

If you think the story might unfold differently, or would rather draw your own conclusions from the data, you can build your perspective in just a few minutes as well, so why not Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Terumo.

Looking for More Investment Ideas?

Smart investors keep their options open. Don’t settle for just one perspective when your next opportunity could be right around the corner. Make the most of Simply Wall Street’s powerful stock screeners today.

- Capitalize on tomorrow’s tech with AI penny stocks that are reshaping industries through machine learning and automation breakthroughs.

- Grow your income stream by uncovering dividend stocks with yields > 3% boasting robust yields and a track record of steady payouts.

- Seize undervalued opportunities and track down undervalued stocks based on cash flows that could be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives