As global markets grapple with heightened trade tensions and economic uncertainty, investors are closely monitoring the impact of new tariffs on growth prospects. Amid this volatility, insider ownership in growth companies can signal confidence from those who know the business best, offering a potential anchor of stability for investors seeking opportunities in turbulent times.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's take a closer look at a couple of our picks from the screened companies.

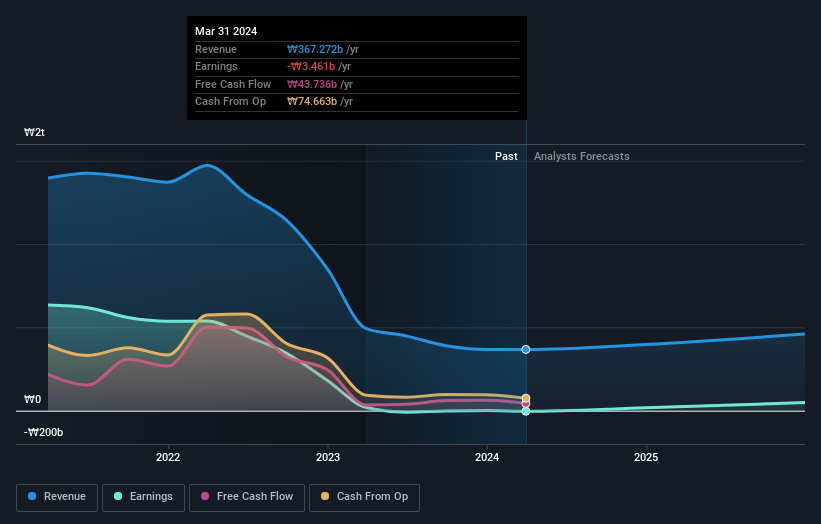

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. is a company that manufactures and sells molecular diagnostics products globally, with a market cap of approximately ₩1.09 trillion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 33.1%

Earnings Growth Forecast: 100.5% p.a.

Seegene is forecast to become profitable over the next three years, with earnings expected to grow significantly at 100.53% per year, although its Return on Equity is projected to remain low at 7.5%. Trading below estimated fair value and offering good relative value compared to peers, it faces challenges with unsustainable dividends. Recent advancements include the development of CURECA™, a system aimed at automating PCR testing workflows, potentially enhancing laboratory efficiency and reducing human error risks.

- Delve into the full analysis future growth report here for a deeper understanding of Seegene.

- Insights from our recent valuation report point to the potential undervaluation of Seegene shares in the market.

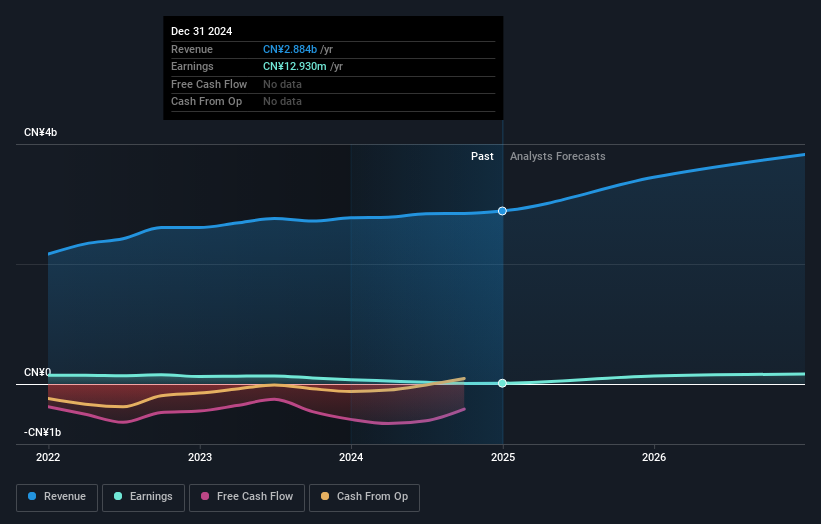

Shanghai Titan Scientific (SHSE:688133)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Titan Scientific Co., Ltd. offers laboratory products and supporting services for scientific researchers and quality control personnel, with a market cap of CN¥3.88 billion.

Operations: The company generates revenue of CN¥2.88 billion from its research services segment.

Insider Ownership: 28.2%

Earnings Growth Forecast: 73.9% p.a.

Shanghai Titan Scientific is set for significant earnings growth at 73.89% annually, outpacing the Chinese market's 23.9%. Despite this, revenue growth remains moderate at 13.9%, slightly above the market average of 12.7%. Recent financials show sales increasing to CNY 2.88 billion, yet net income dropped to CNY 12.93 million from CNY 72.57 million last year, reflecting margin pressures with a decline in profit margins from 2.6% to just 0.4%.

- Take a closer look at Shanghai Titan Scientific's potential here in our earnings growth report.

- The analysis detailed in our Shanghai Titan Scientific valuation report hints at an inflated share price compared to its estimated value.

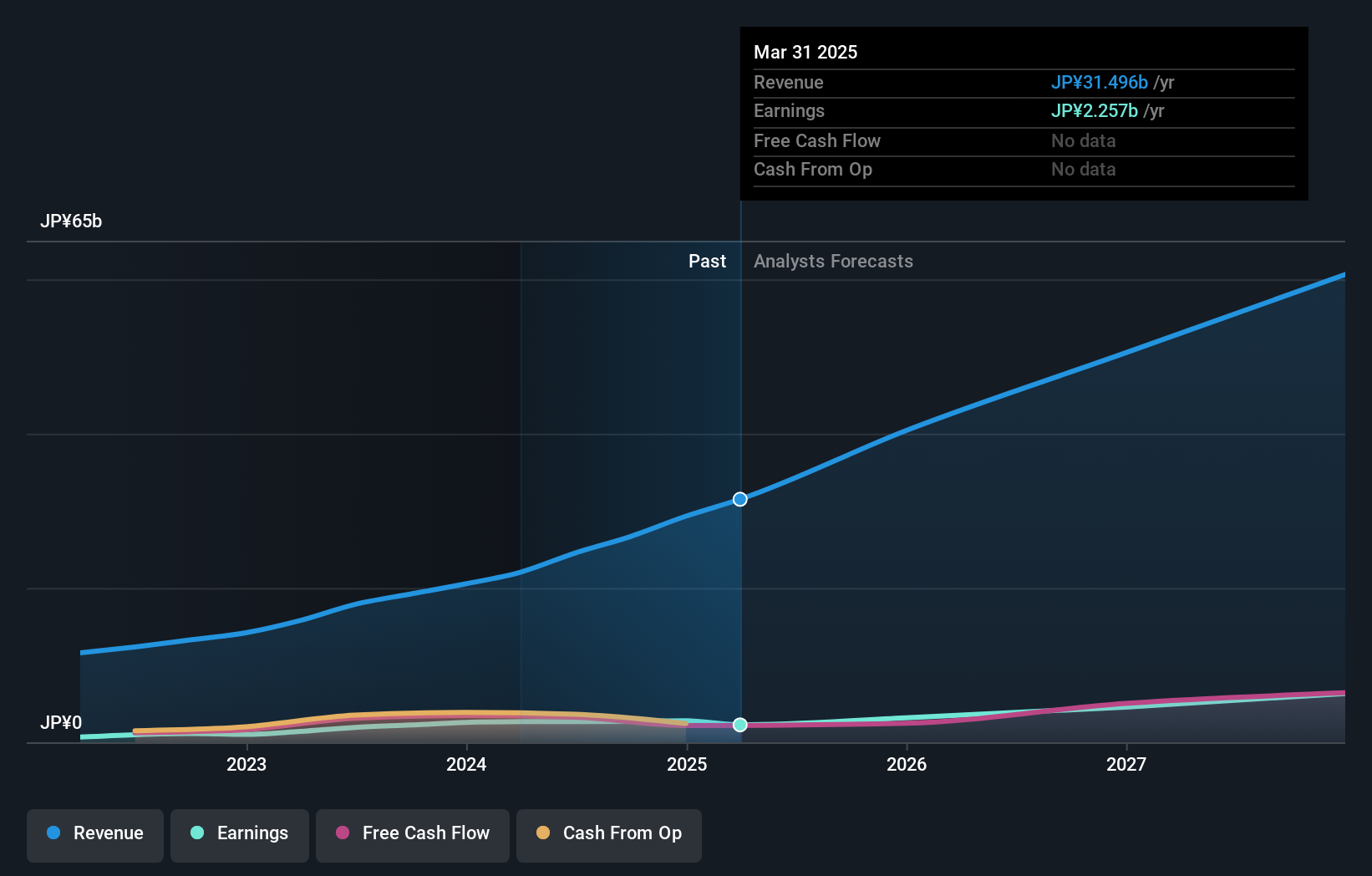

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medley, Inc. operates recruitment and medical business platforms in Japan and the United States, with a market cap of ¥100.38 billion.

Operations: The company generates revenue through its platforms in the recruitment and medical sectors across Japan and the United States.

Insider Ownership: 34.5%

Earnings Growth Forecast: 23% p.a.

Medley is poised for substantial earnings growth, forecasted at 23.03% annually, surpassing the Japanese market's 7.8%. Revenue is expected to grow at 17.5%, outpacing the market's 4.3%. Despite high volatility in share price recently, Medley trades at a significant discount to its estimated fair value. The company has initiated a buyback program worth ¥1 billion to enhance shareholder returns and adapt to share price fluctuations, reflecting strategic insider confidence in its growth trajectory.

- Get an in-depth perspective on Medley's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Medley implies its share price may be too high.

Taking Advantage

- Access the full spectrum of 868 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Shanghai Titan Scientific, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688133

Shanghai Titan Scientific

Provides laboratory products and supporting services for scientific researchers and quality control personnel.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives