- Japan

- /

- Interactive Media and Services

- /

- TSE:6535

3 Top Japanese Dividend Stocks Yielding Up To 4.6%

Reviewed by Simply Wall St

Japan's stock markets experienced sharp losses recently as political developments and monetary policy shifts influenced investor sentiment, with the Nikkei 225 and TOPIX indices both registering declines. Despite these fluctuations, dividend stocks remain an attractive option for investors seeking stable income, especially in uncertain economic climates. A good dividend stock typically offers a reliable payout ratio and a history of consistent dividends, making it appealing even amid market volatility.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.24% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.78% | ★★★★★★ |

| Innotech (TSE:9880) | 4.85% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.24% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.30% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

Click here to see the full list of 439 stocks from our Top Japanese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Japan Petroleum Exploration (TSE:1662)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Petroleum Exploration Co., Ltd. explores, develops, produces, and sells oil, natural gas, and other energy resources across Japan, Europe, North America, and the Middle East with a market cap of ¥303.77 billion.

Operations: Japan Petroleum Exploration Co., Ltd.'s revenue segments include the exploration, development, production, and sale of oil, natural gas, and other energy resources across various regions including Japan, Europe, North America, and the Middle East.

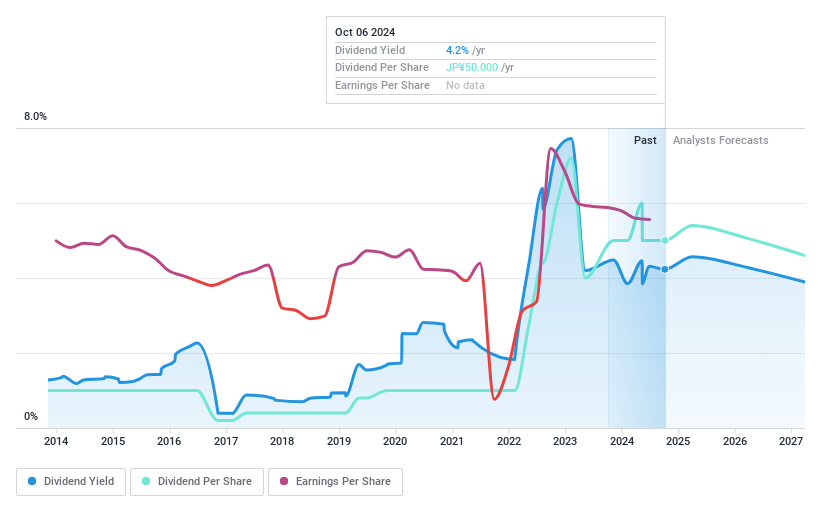

Dividend Yield: 4.2%

Japan Petroleum Exploration's dividend yield is in the top 25% of the Japanese market, with a payout ratio of 30.8%, indicating dividends are well-covered by earnings. Despite this, its dividend history has been volatile over the past decade. Recent strategic moves include executive changes and a completed share buyback program amounting to ¥18.41 billion, potentially signaling confidence in financial stability and shareholder value enhancement amidst declining earnings forecasts for the near future.

- Take a closer look at Japan Petroleum Exploration's potential here in our dividend report.

- Our valuation report here indicates Japan Petroleum Exploration may be undervalued.

Vital KSK Holdings (TSE:3151)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vital KSK Holdings, Inc. operates in Japan, focusing on the wholesale and retail sale of pharmaceutical products, with a market cap of ¥65.05 billion.

Operations: Vital KSK Holdings, Inc.'s revenue is primarily derived from the Pharmaceutical Wholesale Business at ¥565.04 billion, followed by the Pharmacy Business at ¥19.33 billion and the Veterinary Pharmaceutical Wholesale Business at ¥10.95 billion.

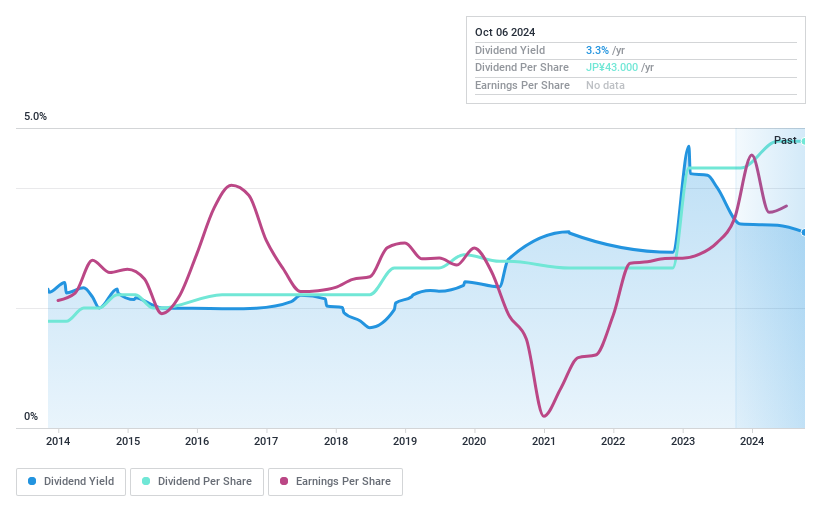

Dividend Yield: 3.3%

Vital KSK Holdings has a sustainable dividend payout with a low cash payout ratio of 11.5%, ensuring dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility and unreliability over the past decade. Recent buyback activity, totaling ¥1.64 billion for 2.61% of shares, may indicate efforts to enhance shareholder value despite its below-top-tier dividend yield in Japan's market landscape.

- Get an in-depth perspective on Vital KSK Holdings' performance by reading our dividend report here.

- Our valuation report unveils the possibility Vital KSK Holdings' shares may be trading at a discount.

i-mobileLtd (TSE:6535)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: i-mobile Co., Ltd. operates in the Internet advertising sector in Japan with a market cap of ¥32.27 billion.

Operations: i-mobile Co., Ltd. generates revenue primarily from its Consumer Service segment, contributing ¥15.95 billion, and its Internet Advertising Business segment, which adds ¥2.76 billion.

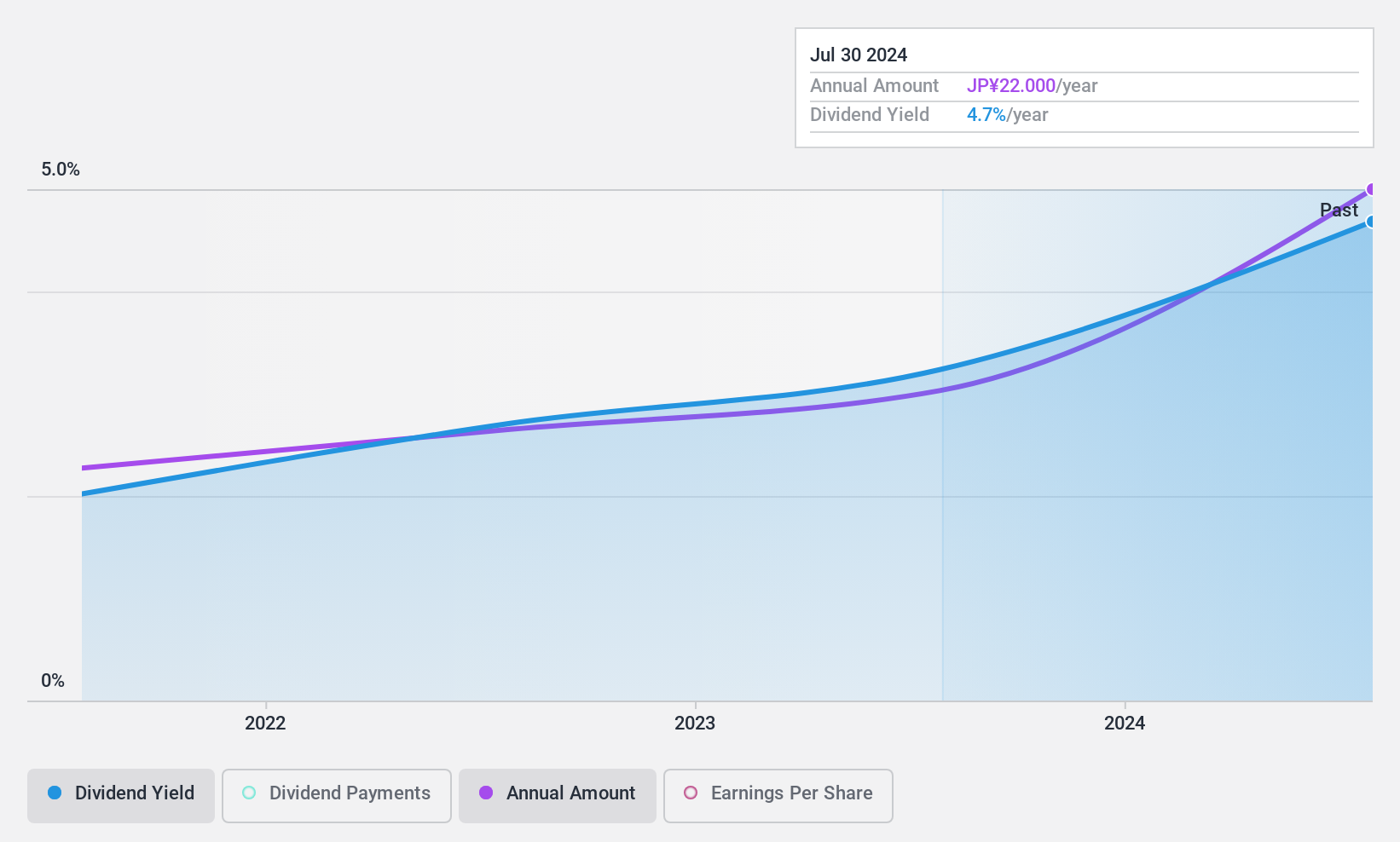

Dividend Yield: 4.6%

i-mobile Ltd. offers a compelling dividend yield of 4.64%, placing it in the top 25% of JP market payers, with dividends well-covered by earnings and cash flows (payout ratios of 52.2% and 44.9%, respectively). Although its dividend track record is under a decade, recent increases from ¥13.33 to ¥22 per share, with guidance for further growth to ¥26 per share next year, reflect a positive trajectory supported by robust earnings growth and strategic initiatives like Furunavi Travel Reservations launch.

- Dive into the specifics of i-mobileLtd here with our thorough dividend report.

- The analysis detailed in our i-mobileLtd valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Get an in-depth perspective on all 439 Top Japanese Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if i-mobileLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6535

Flawless balance sheet, good value and pays a dividend.