- Japan

- /

- Healthcare Services

- /

- TSE:2784

Is Alfresa’s Government-Backed Biosimilars Venture Reshaping the Investment Case for Alfresa Holdings (TSE:2784)?

Reviewed by Sasha Jovanovic

- On October 6, 2025, Alfresa Holdings and its partners announced a joint venture to establish a domestic biosimilars manufacturing facility, supported by a Japanese Ministry of Health, Labour and Welfare subsidy program and located on the premises of Alfresa Fine Chemical.

- This initiative not only aims to ensure a stable domestic supply of biosimilars in Japan but also underscores Alfresa's expanded role in the nation's biopharmaceutical value chain.

- We’ll look at how Alfresa’s involvement in building a government-backed biosimilars facility could reshape its long-term investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Alfresa Holdings' Investment Narrative?

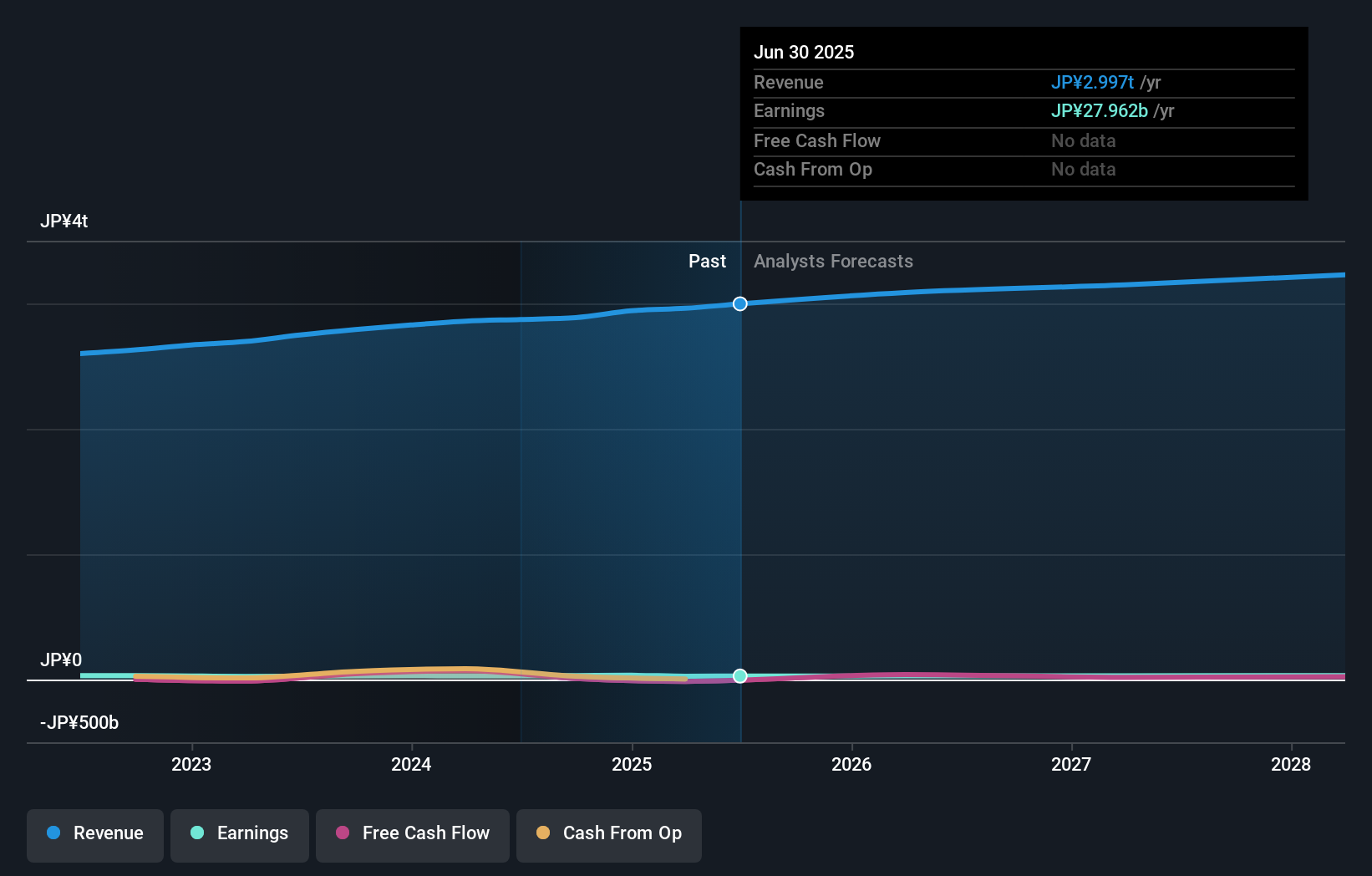

For anyone considering Alfresa Holdings, the company's broad focus on pharmaceutical distribution and healthcare services has generally meant modest, steady growth, buoyed by a history of operational stability and reliable, though slow, earnings improvement. The latest joint venture to create a government-backed biosimilars manufacturing facility could shift some of the company's traditional risk and catalyst profile: on one hand, Alfresa’s new role in domestic drug production may help position it within Japan’s expanding biopharmaceutical sector and diversify revenue, but on the other, ramping up in biosimilars involves both execution risks and potentially higher upfront spending. This isn't necessarily a game-changer for near-term results given the long timelines in drug manufacturing, but it adds new possibilities, and uncertainties, that analysts could soon start to weigh into their outlooks. Much will depend on how Alfresa balances its core business with these new ventures at a time when profit margins remain slim and revenue growth lags the wider market.

But against this excitement, investors should also weigh the execution risks in entering new manufacturing segments. Alfresa Holdings' shares are on the way up, but they could be overextended by 22%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Alfresa Holdings - why the stock might be worth just ¥999999!

Build Your Own Alfresa Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alfresa Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alfresa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alfresa Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2784

Alfresa Holdings

Through its subsidiaries, engages in the manufacture, wholesale, marketing, and import/export of pharmaceuticals, diagnostic reagents, and medical devices/equipment in Japan and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives