- Japan

- /

- Healthtech

- /

- TSE:2150

Investors Appear Satisfied With CareNet, Inc.'s (TSE:2150) Prospects As Shares Rocket 40%

CareNet, Inc. (TSE:2150) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

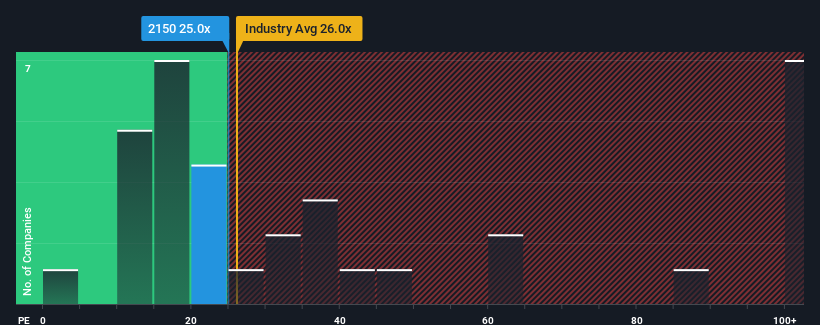

Following the firm bounce in price, CareNet's price-to-earnings (or "P/E") ratio of 25x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, CareNet's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for CareNet

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, CareNet would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 29% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 25% each year during the coming three years according to the dual analysts following the company. With the market only predicted to deliver 9.4% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that CareNet's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On CareNet's P/E

Shares in CareNet have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that CareNet maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with CareNet.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2150

CareNet

Engages in the pharmaceutical digital transformation and medical platform businesses in Japan.

Excellent balance sheet with reasonable growth potential.