Asahi PrintingLtd And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic signals, investors are increasingly seeking stability through dividend stocks. In this context, Asahi Printing Ltd and two other prominent dividend-paying companies can offer attractive options for those looking to enhance their portfolios with reliable income streams amidst current market uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

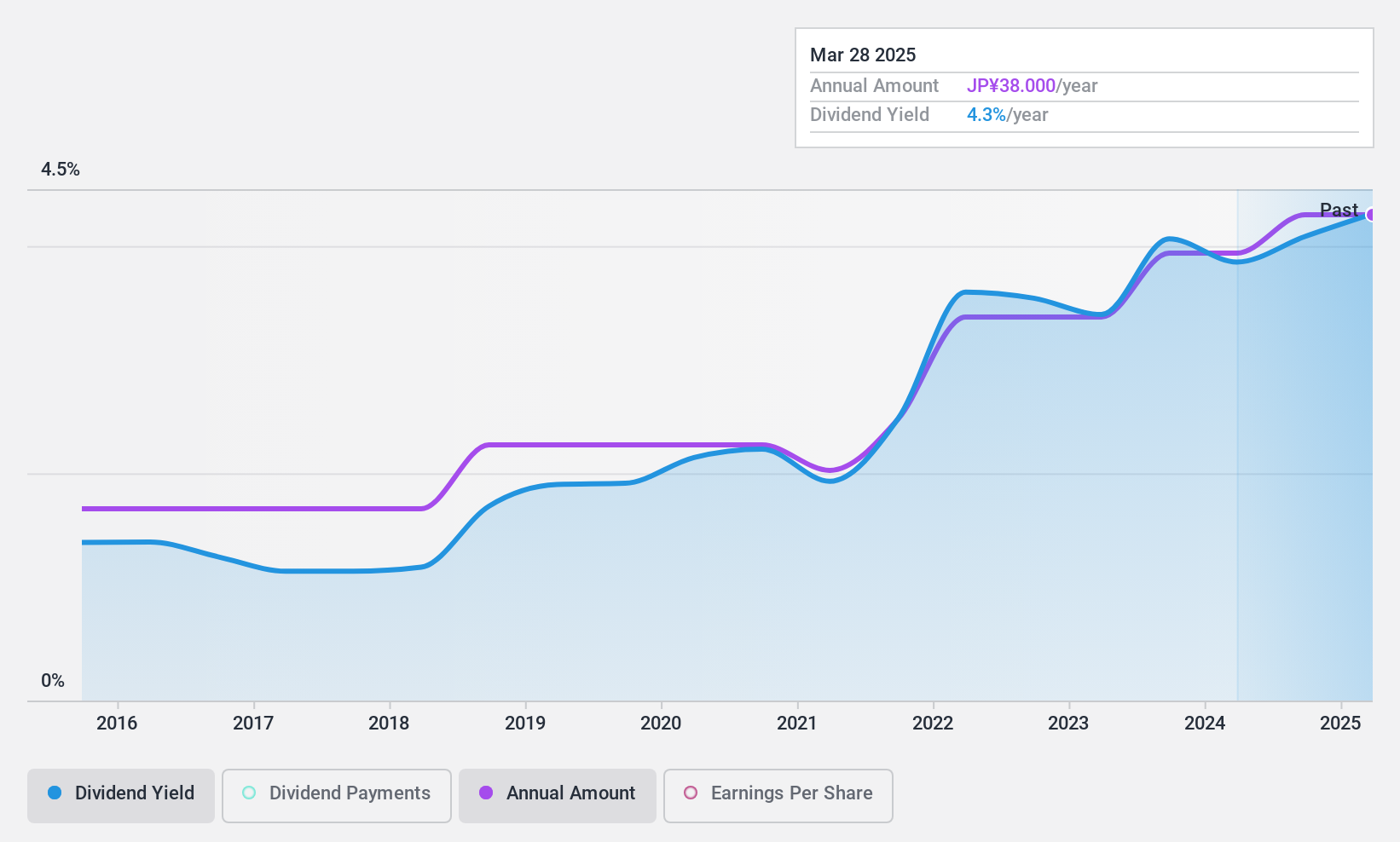

Asahi PrintingLtd (TSE:3951)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asahi Printing Co., Ltd. manufactures and sells printing and packaging materials for the pharmaceutical and cosmetic markets primarily in Japan, with a market cap of ¥18.82 billion.

Operations: Asahi Printing Co., Ltd.'s revenue is primarily derived from its Printed Packaging Business, generating ¥39.25 billion, and its Packaging System Sales Business, contributing ¥2.87 billion.

Dividend Yield: 4.3%

Asahi Printing Ltd.'s dividend payments are supported by earnings and cash flows, with payout ratios of 49.8% and 53.3%, respectively. The dividend yield of 4.29% ranks in the top 25% of JP market payers, though its reliability is questionable due to volatility over the past decade. Despite this, dividends have grown over ten years, offering potential value as the stock trades significantly below estimated fair value.

- Click to explore a detailed breakdown of our findings in Asahi PrintingLtd's dividend report.

- In light of our recent valuation report, it seems possible that Asahi PrintingLtd is trading beyond its estimated value.

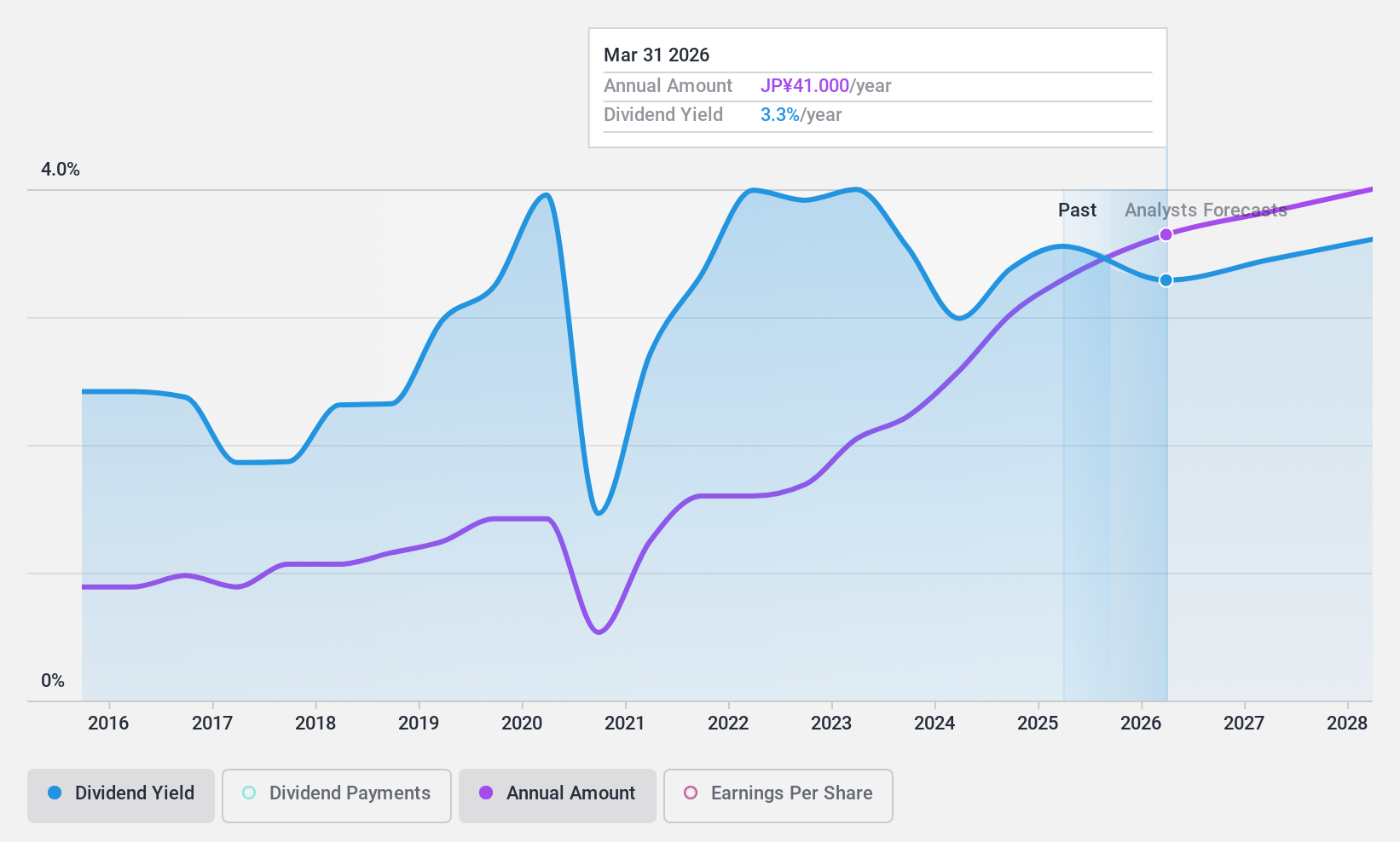

Riken Technos (TSE:4220)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Riken Technos Corporation operates in the compound, film, and food wrapping film industries both in Japan and internationally, with a market cap of ¥56.63 billion.

Operations: Riken Technos Corporation generates revenue through its operations in the compound, film, and food wrapping film sectors across domestic and international markets.

Dividend Yield: 3.4%

Riken Technos' dividend payments are well-supported by earnings and cash flows, with payout ratios of 25.6% and 20.2%, respectively, indicating sustainability despite a historically unstable track record. The dividend yield of 3.44% is below the top tier in Japan's market but has shown growth over the past decade. Recent buybacks totaling ¥2.43 billion may enhance shareholder value as the stock trades significantly below its estimated fair value, offering potential investment appeal.

- Unlock comprehensive insights into our analysis of Riken Technos stock in this dividend report.

- The valuation report we've compiled suggests that Riken Technos' current price could be quite moderate.

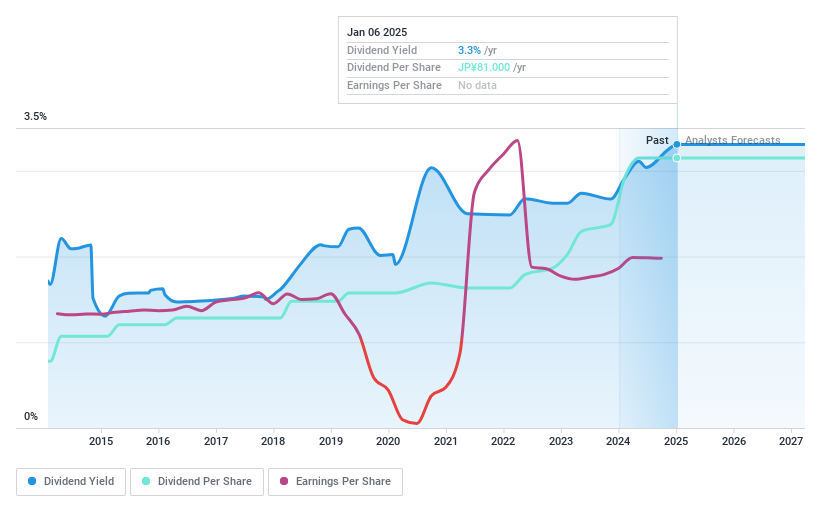

Riken Vitamin (TSE:4526)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riken Vitamin Co., Ltd. operates in Japan, focusing on food ingredients, food improving agents, health care products, consumer and commercial foods, chemical improving agents, and vitamins businesses with a market cap of approximately ¥74.47 billion.

Operations: Riken Vitamin Co., Ltd.'s revenue segments include Overseas operations generating ¥23.07 billion, Domestic Food Business contributing ¥64.34 billion, and Domestic Chemical Products and Other Businesses adding ¥7.86 billion.

Dividend Yield: 3.3%

Riken Vitamin's dividends are well-covered by both earnings and cash flows, with payout ratios of 34.2% and 57.3%, respectively, ensuring sustainability. The company recently announced an interim dividend of ¥40.50, reflecting its commitment to returning value to shareholders. Despite a lower yield of 3.3% compared to top-tier payers in Japan, Riken Vitamin offers reliable and stable dividends that have grown over the past decade while trading below estimated fair value, suggesting potential investment appeal.

- Delve into the full analysis dividend report here for a deeper understanding of Riken Vitamin.

- Our comprehensive valuation report raises the possibility that Riken Vitamin is priced lower than what may be justified by its financials.

Seize The Opportunity

- Delve into our full catalog of 1946 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4526

Riken Vitamin

Engages in the food ingredient, food improving agents, health care, consumer and commercial foods, and chemical improving agents, and vitamins businesses in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives