BASE FOOD (TSE:2936) Turns Profitable, Profitability Challenges Concerns on Premium Valuation

Reviewed by Simply Wall St

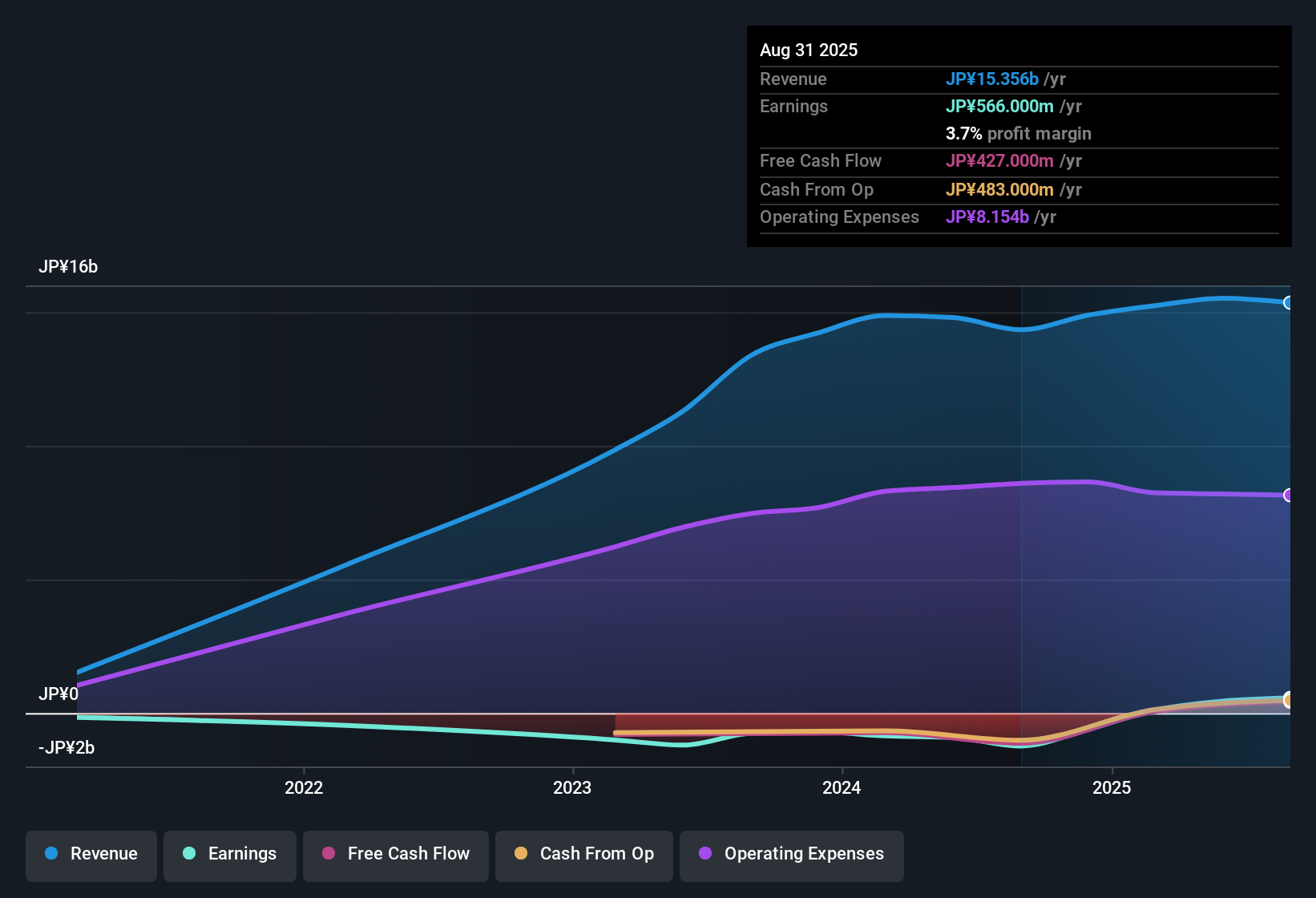

BASE FOOD (TSE:2936) has achieved profitability for the first time this year, backed by high quality earnings and an impressive annual earnings growth rate of 20.8% over the past five years. The company currently trades at ¥370 per share, which represents a Price-To-Earnings Ratio of 34.8x. This is more than double the JP Food industry average of 16.1x and well above the peer average of 14.8x. However, with the share price above an estimated fair value of ¥25.77 and some recent price volatility, investors are weighing strong profit growth against a substantial valuation premium and uncertain short-term momentum.

See our full analysis for BASE FOOD.Next, we’ll see how these headline numbers compare to the dominant narratives about BASE FOOD, and where expectations might clash with reality.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Benefit from High-Quality Growth

- BASE FOOD posted annual earnings growth of 20.8% over five years, a pace that signals strong operational momentum anchored in quality profits rather than unsustainable cost cutting or one-off gains.

- Recent market coverage suggests the company’s momentum is underpinned by innovative offerings and proactive expansion efforts.

- Positive reports highlight BASE FOOD’s alignment with the rising demand for convenient, health-focused food products.

- Market attention centers on unique product development and successful tapping into health-conscious consumer trends, which supports the notion of durable margin strength as the company gains scale.

Share Price Volatility Surfaces as a Risk

- The share price has shown instability over the last three months, contrasting with the otherwise positive performance of becoming profitable within the year. This disconnect may reflect investors’ unease about sustainability at current valuation levels.

- While product traction amplifies growth optimism, there are persistent concerns that the functional food sector’s intense competition and cost pressures could challenge lasting profitability.

- Bears commonly argue that being surrounded by rivals increases the danger of price wars and margin erosion in the near term.

- Cautious voices point to competitive dynamics as a check on BASE FOOD’s ability to turn early momentum into reliable cash flow and steady share price gains.

Valuation Premium Looms Over Growth Story

- BASE FOOD’s Price-To-Earnings ratio of 34.8x is not only more than double the JP Food industry average of 16.1x but also stands well above peers at 14.8x, while the current share price of ¥370 far exceeds its DCF fair value of ¥25.77.

- The prevailing market view weighs whether the premium valuation is justified, emphasizing that ongoing differentiation and rapid execution are now essential for shares to hold or expand their premium.

- The wide gap between share price and DCF fair value raises expectations for outsized growth and innovation. Any stumble could sharply re-rate the stock toward sector norms.

- Investors face a clear trade-off: paying up for the company’s demonstrated pace of growth and quality, while accepting near-term swings and higher sensitivity to execution risk than in more reasonably valued stocks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BASE FOOD's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong earnings growth, BASE FOOD’s significant valuation premium and recent share price volatility make its future performance more uncertain compared to industry peers.

If you want opportunities with stronger value upside and less risk of overpaying, look for investments trading at attractive prices using these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASE FOOD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2936

Proven track record with adequate balance sheet.

Market Insights

Community Narratives