- Japan

- /

- Metals and Mining

- /

- TSE:5464

3 High Yield Dividend Stocks On The Japanese Exchange Offering Up To 3.5%

Reviewed by Simply Wall St

Amid a backdrop of rising wages and unexpected contractions in consumer spending, Japan's stock markets have recently achieved all-time highs, demonstrating a complex yet robust economic landscape. In such an environment, high yield dividend stocks on the Japanese exchange offer an intriguing option for investors seeking to capitalize on up to 3.5% yields amidst these dynamic market conditions.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.79% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.49% | ★★★★★★ |

| Globeride (TSE:7990) | 3.84% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.43% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.13% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.61% | ★★★★★★ |

| Innotech (TSE:9880) | 4.03% | ★★★★★★ |

Click here to see the full list of 388 stocks from our Top Japanese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Warabeya Nichiyo Holdings (TSE:2918)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Warabeya Nichiyo Holdings Co., Ltd. operates in the manufacturing and sale of food products primarily for convenience stores, both in Japan and internationally, with a market capitalization of approximately ¥44.15 billion.

Operations: Warabeya Nichiyo Holdings Co., Ltd. generates revenue primarily through its Food Related Business, which brought in ¥180.61 billion, followed by its Logistics Business and Food Materials Businesses, contributing ¥18.14 billion and ¥11.68 billion, respectively.

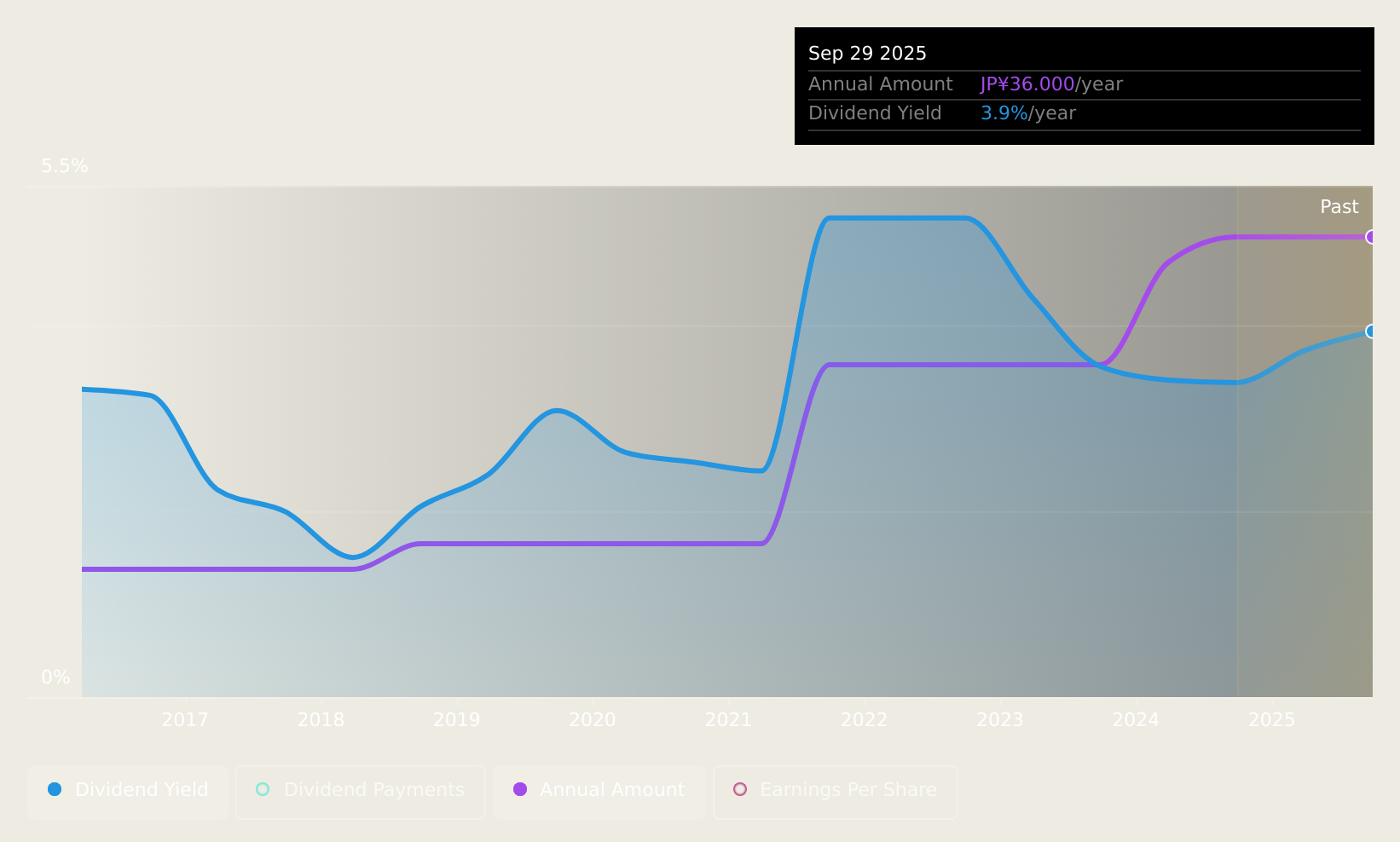

Dividend Yield: 3.6%

Warabeya Nichiyo Holdings maintains a stable dividend, consistently paying JPY 45.00 per share, reflecting reliability over the past decade. Despite a low payout ratio of 36.8%, indicating that dividends are well-covered by earnings, the dividends aren't supported by free cash flow, raising concerns about sustainability. The firm's financial outlook shows steady growth with expected revenues reaching ¥230 billion and an operating profit of ¥4.5 billion for FY2025. Trading below industry average P/E ratios suggests relative value but highlights potential liquidity risks in funding future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Warabeya Nichiyo Holdings.

- The valuation report we've compiled suggests that Warabeya Nichiyo Holdings' current price could be quite moderate.

Mory Industries (TSE:5464)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mory Industries Inc., operating in Japan, specializes in the manufacture and sale of stainless steel and welded carbon steel products, with a market capitalization of approximately ¥42.93 billion.

Operations: Mory Industries Inc. generates its revenue through the production and distribution of stainless steel and welded carbon steel products.

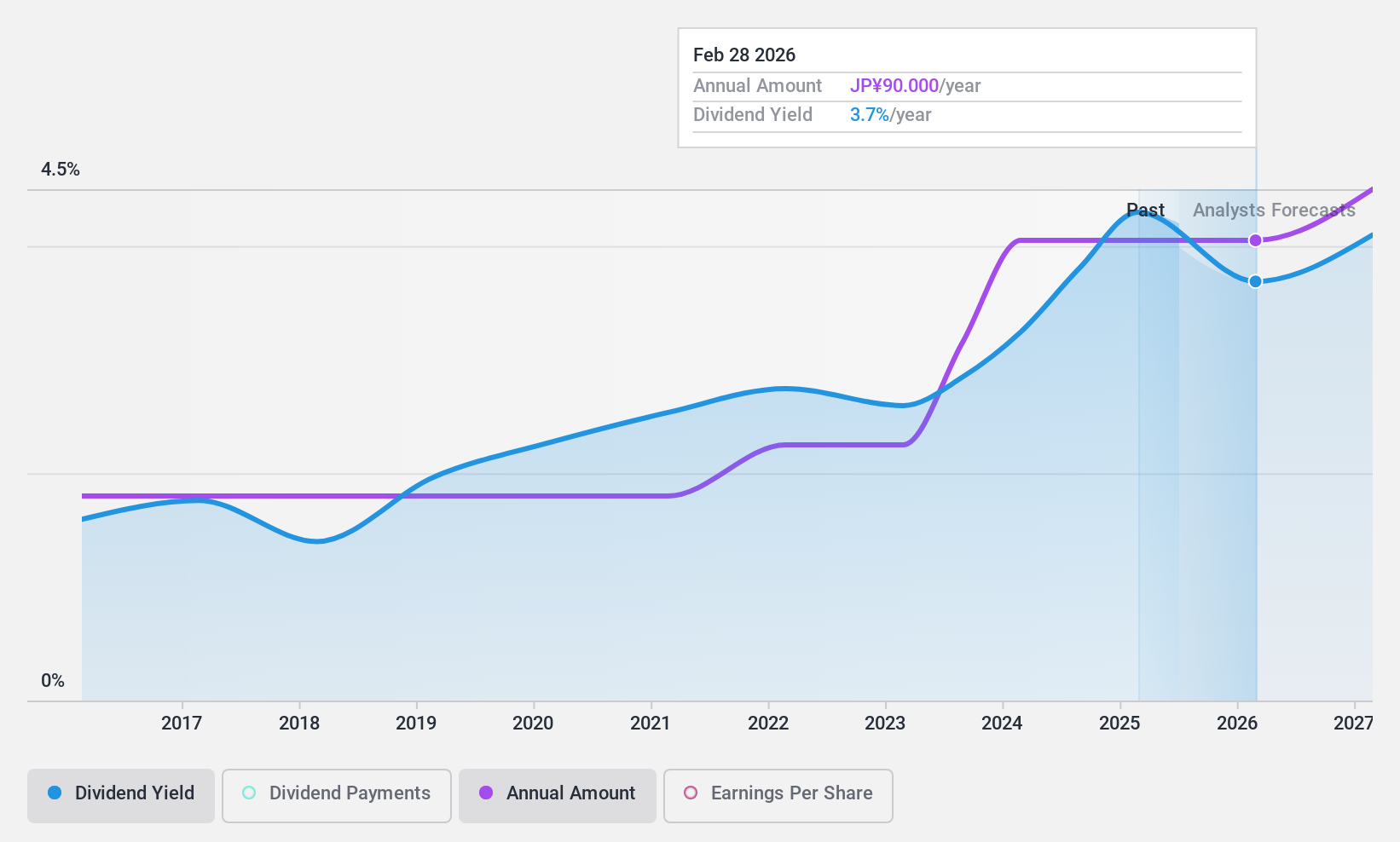

Dividend Yield: 3.3%

Mory Industries offers a modest dividend yield of 3.26%, slightly below the top quartile for Japanese dividend stocks. Over the past decade, dividends have shown growth and stability, supported by a low payout ratio of 34.9% and a cash payout ratio of 25.6%, indicating that earnings and cash flows sufficiently cover dividend payments. Despite its value trading at 67.3% below estimated fair value, potential investors might be cautious due to its highly volatile share price in recent months.

- Delve into the full analysis dividend report here for a deeper understanding of Mory Industries.

- Our expertly prepared valuation report Mory Industries implies its share price may be lower than expected.

NHK Spring (TSE:5991)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NHK Spring Co., Ltd. operates in Japan, offering products across automobile, data communications, and industry and lifestyle sectors with a market capitalization of approximately ¥372.93 billion.

Operations: NHK Spring Co., Ltd. generates revenue through its automobile, data communications, and industry and lifestyle product segments.

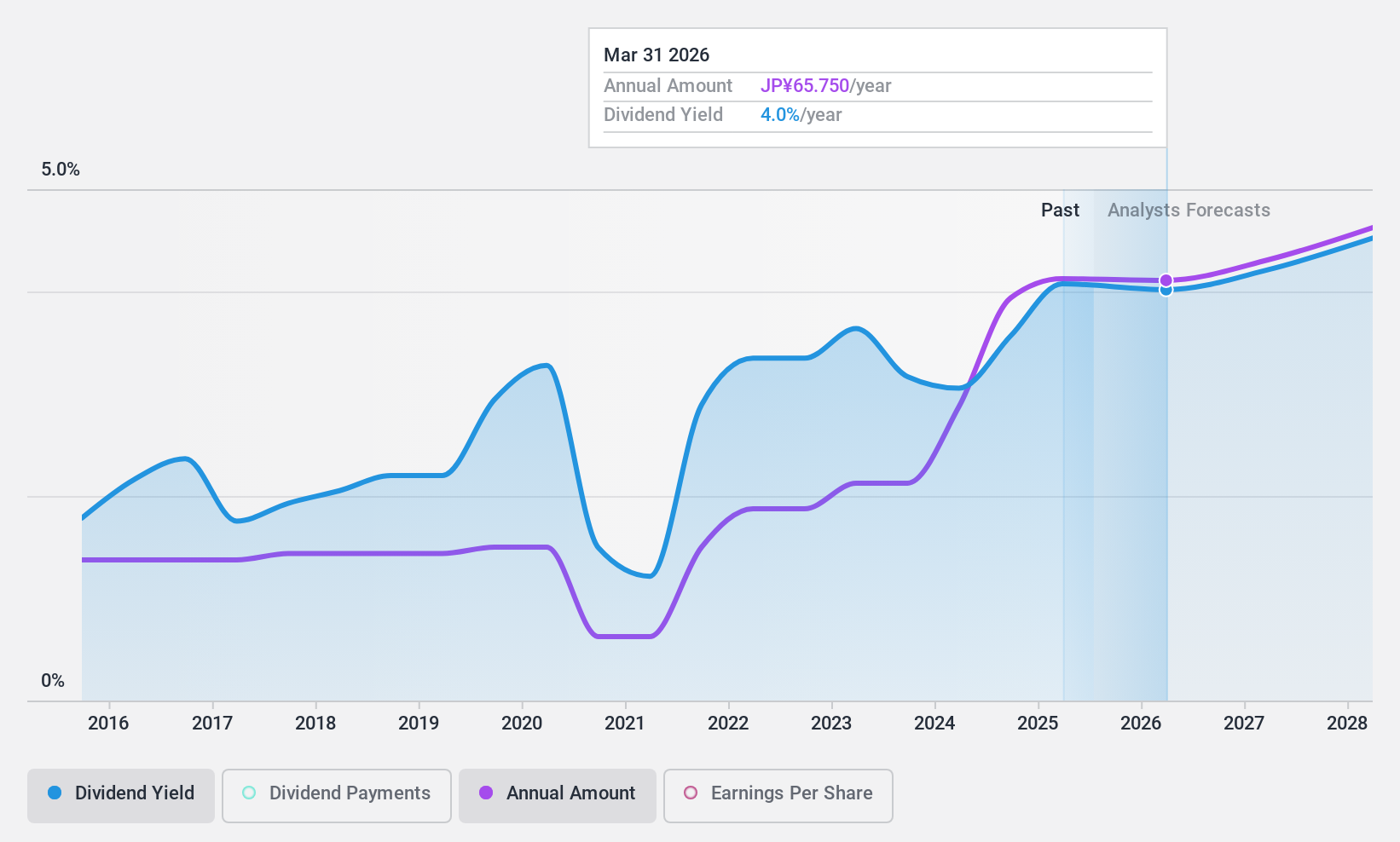

Dividend Yield: 3.3%

NHK Spring has demonstrated a decade of dividend growth, yet its dividend yield of 3.28% remains slightly below the top quartile in Japan's market. Dividends are well-supported by earnings and cash flows, with payout ratios at 40.9% and 37.3%, respectively. However, dividends have shown volatility over the past ten years, and recent shareholder activism reflects potential governance concerns. The company's share repurchase program completed in May 2024 may indicate confidence in its financial stability despite these challenges.

- Click here to discover the nuances of NHK Spring with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of NHK Spring shares in the market.

Make It Happen

- Take a closer look at our Top Japanese Dividend Stocks list of 388 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5464

Mory Industries

Manufactures and sells stainless steel and welded carbon steel products in Japan.

Flawless balance sheet established dividend payer.