Assessing Nissin Foods (TSE:2897) Valuation Following Turkish Expansion and Factory Acquisition

Reviewed by Kshitija Bhandaru

Nissin Foods Holdings Ltd (TSE:2897) is moving forward with the creation of a new subsidiary in Turkey and has signed an agreement to acquire an instant noodle factory in Sakarya Province. This step reflects the company's commitment to expanding operations in overseas markets.

See our latest analysis for Nissin Foods HoldingsLtd.

Despite Nissin Foods Holdings Ltd’s bold push into international markets and its recent strategic moves in Turkey, the stock’s momentum has been fading. Its year-to-date share price return is down 29.2%, while the one-year total shareholder return sits even lower at -33.7%. Longer-term results have also trailed well behind the market, hinting that this wave of overseas expansion has yet to sway investor sentiment or change the overall picture of risk and valuation.

If this pivot towards global growth has you thinking beyond the obvious, it could be the perfect moment to uncover new opportunities with fast growing stocks with high insider ownership

With the company now making bold international moves, are investors overlooking hidden value in Nissin’s shares, or is the market already anticipating the next phase of overseas expansion?

Price-to-Earnings of 15.2x: Is it justified?

Nissin Foods Holdings Ltd currently trades at a price-to-earnings (P/E) ratio of 15.2x, with its last close at ¥2662. This figure points to the shares being valued below both peer and industry averages and hints at a potential valuation opportunity for investors.

The P/E ratio measures how much investors are willing to pay today for a company's earnings. For consumer staples and food businesses like Nissin, it reflects expectations for reliable profits and steady performance in a typically lower-growth sector. A P/E of 15.2x suggests the market is expecting moderate future earnings growth for Nissin.

Compared to its peers in the Japanese Food industry, whose average P/E stands at 16.6x, and the broader industry average of 16.4x, Nissin appears attractively valued. Notably, the fair price-to-earnings ratio for Nissin is estimated at 19.6x, which indicates that the market's current valuation could shift upward if investor sentiment changes or company fundamentals improve.

Explore the SWS fair ratio for Nissin Foods HoldingsLtd

Result: Price-to-Earnings of 15.2x (UNDERVALUED)

However, sluggish share price momentum and only modest revenue growth could overshadow potential upside for investors if these trends continue.

Find out about the key risks to this Nissin Foods HoldingsLtd narrative.

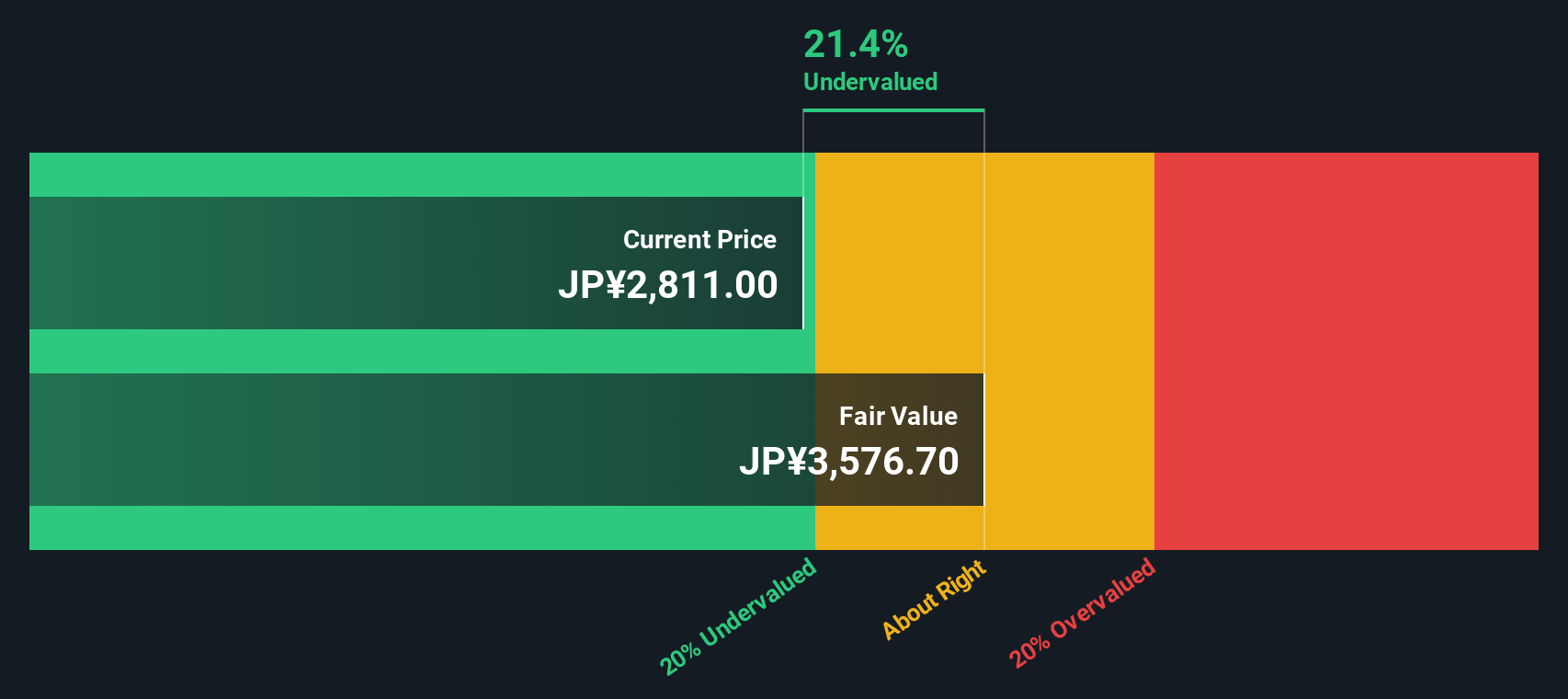

Another View: Our DCF Model Signals Deeper Value

While the market's current ratio points to undervaluation based on earnings, our SWS DCF model provides an even brighter perspective. According to this approach, Nissin Foods Holdings Ltd trades at a 25.9% discount to its estimated fair value. Could this signal an opportunity that is greater than it first appears?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nissin Foods HoldingsLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nissin Foods HoldingsLtd Narrative

If you want to see things from a fresh perspective or dig into the numbers on your own terms, you can shape a personalized view in just minutes with Do it your way.

A great starting point for your Nissin Foods HoldingsLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to make your next winning move? Take charge of your portfolio and uncover fresh possibilities, handpicked from unique strategies you might have missed.

- Capture hidden value opportunities by reviewing these 892 undervalued stocks based on cash flows, which are trading well below their potential based on robust cash flows and financial fundamentals.

- Maximize your income stream when you assess these 19 dividend stocks with yields > 3%, offering yields above 3 percent for investors seeking both stability and growth.

- Capitalize on tech’s next wave by scanning these 24 AI penny stocks, featuring companies advancing artificial intelligence and reshaping global industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissin Foods HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2897

Nissin Foods HoldingsLtd

Manufactures and sells instant foods in Japan, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives