Earnings Not Telling The Story For Suntory Beverage & Food Limited (TSE:2587)

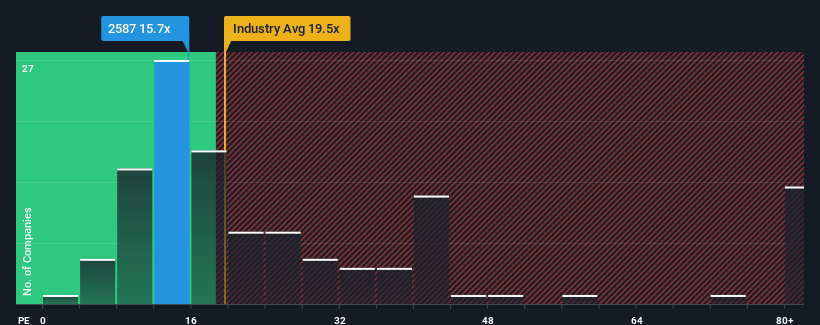

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider Suntory Beverage & Food Limited (TSE:2587) as a stock to potentially avoid with its 15.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Suntory Beverage & Food has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Suntory Beverage & Food

How Is Suntory Beverage & Food's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Suntory Beverage & Food's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's bottom line. The latest three year period has also seen an excellent 54% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 2.7% per annum during the coming three years according to the nine analysts following the company. That's shaping up to be materially lower than the 10% per annum growth forecast for the broader market.

With this information, we find it concerning that Suntory Beverage & Food is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Suntory Beverage & Food's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Suntory Beverage & Food with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Suntory Beverage & Food, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Suntory Beverage & Food, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2587

Suntory Beverage & Food

Engages in manufacture and sale of alcoholic and non-alcoholic beverages, and foods in Japan, Asia-Pacific, Europe, and the Americas.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives