Investors Interested In Asahi Group Holdings, Ltd.'s (TSE:2502) Earnings

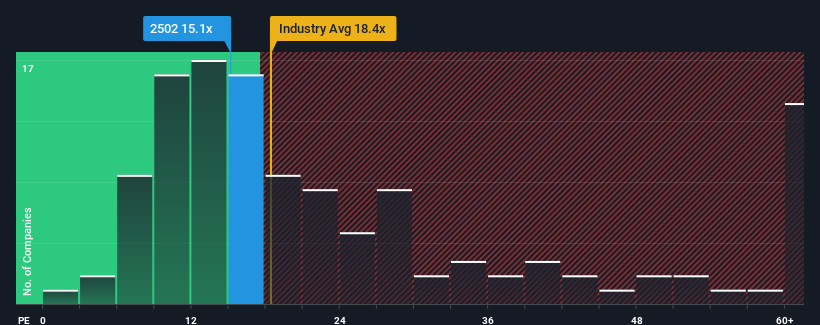

With a median price-to-earnings (or "P/E") ratio of close to 13x in Japan, you could be forgiven for feeling indifferent about Asahi Group Holdings, Ltd.'s (TSE:2502) P/E ratio of 15.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Asahi Group Holdings has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Asahi Group Holdings

Does Growth Match The P/E?

In order to justify its P/E ratio, Asahi Group Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 17% gain to the company's bottom line. As a result, it also grew EPS by 27% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 8.4% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 9.3% per annum, which is not materially different.

With this information, we can see why Asahi Group Holdings is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Asahi Group Holdings' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Asahi Group Holdings' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Asahi Group Holdings, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Asahi Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2502

Asahi Group Holdings

Manufactures and sells beer, alcohol and non-alcohol beverages, and food products in Japan, Europe, Oceania, and Southeast Asia.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives