Asahi (TSE:2502): Is the Beverage Leader Undervalued After Recent Share Price Moves?

Reviewed by Simply Wall St

Asahi Group Holdings (TSE:2502) is back in the spotlight, catching the attention of investors who are weighing what comes next for the beverage giant. While there hasn’t been a headline-grabbing event this week, the recent movements in the company’s shares are raising questions. Could this be a signal, or just noise in a year that has already seen market swings?

Over the past year, Asahi Group Holdings has delivered moderate gains, with its stock price ticking up 3%. It has experienced stronger momentum in the year to date, climbing nearly 16% even as the past month has seen a pullback. These shifts reflect changing investor sentiment towards the group, especially against a backdrop of slow but steady revenue and net income growth, along with evolving expectations in Japan’s food and beverage sector.

With the latest moves in the share price, is Asahi Group Holdings now undervalued, or has the market already accounted for future growth potential?

Price-to-Earnings of 16.1x: Is it Justified?

Asahi Group Holdings is currently trading at a price-to-earnings (P/E) ratio of 16.1x, which is notably lower than both the peer average (67.8x) and the Asian Beverage industry average (20.2x). This suggests that the market sees Asahi as relatively undervalued compared to its sector rivals.

The price-to-earnings ratio compares a company’s current share price to its earnings per share, providing insight into how much investors are willing to pay for a unit of earnings. In the beverage industry, the P/E multiple is often used to assess whether a company’s growth outlook or earnings quality justifies a price premium.

Given Asahi’s steady, though not stellar, earnings growth and high quality earnings, its modest P/E could indicate that the market is underpricing its future profit potential. At the same time, subdued revenue growth and recent board changes may be factors that keep the valuation conservative for now.

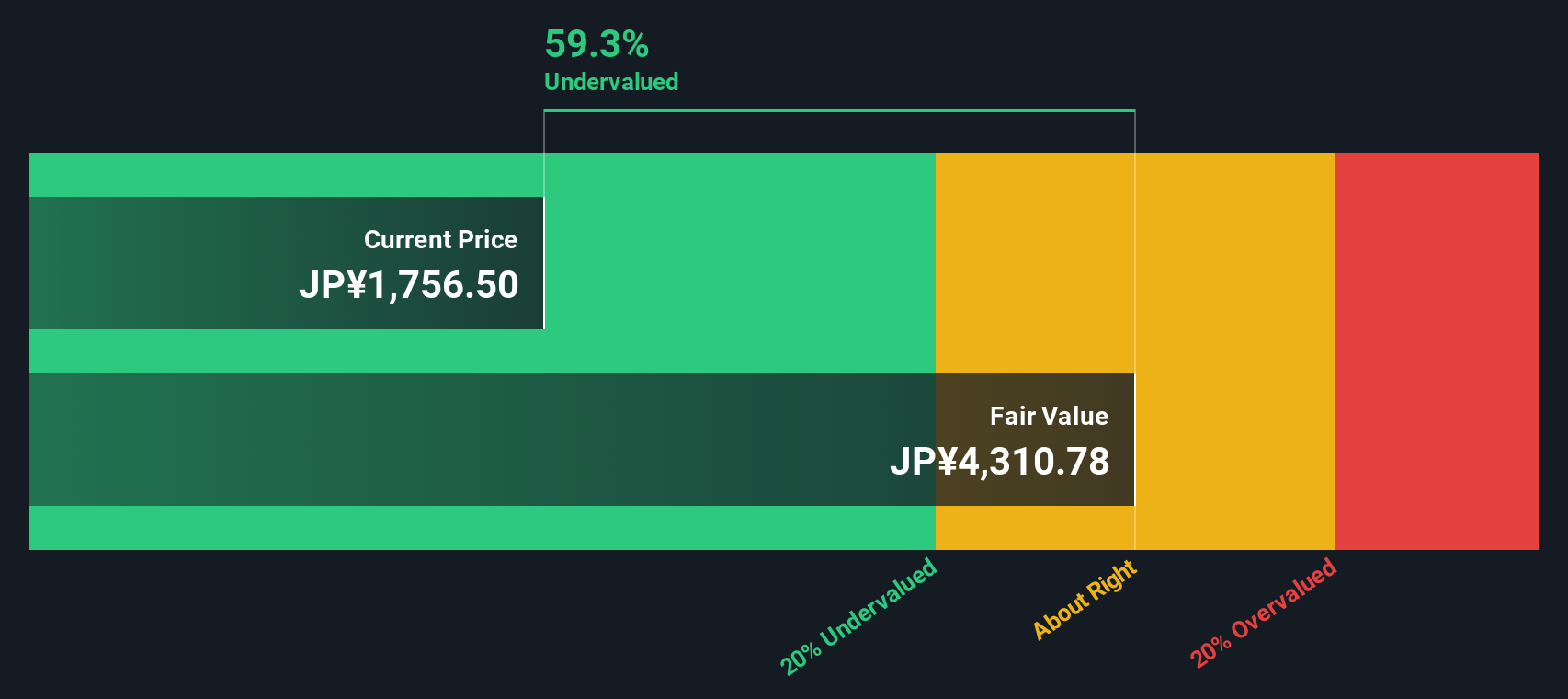

Result: Fair Value of ¥2,369 (UNDERVALUED)

See our latest analysis for Asahi Group Holdings.However, slowing revenue growth and recent leadership changes could be catalysts that challenge the current outlook and market sentiment for Asahi Group Holdings.

Find out about the key risks to this Asahi Group Holdings narrative.Another View: What Does the SWS DCF Model Suggest?

A contrasting look with our DCF model also suggests Asahi Group Holdings is undervalued. This approach weighs future cash flows instead of relying on recent earnings alone, which offers a fresh angle for investors to consider. Could fundamentals support a broader re-rating ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Asahi Group Holdings Narrative

If you see things differently or want to dive deeper into the details, you can build your own view in just a few minutes. Do it your way

A great starting point for your Asahi Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep fresh opportunities on their radar. Don’t let great stocks pass you by when curated lists can put new potential right in front of you.

- Unlock strong income streams by tapping into dividend stocks with yields > 3%, offering high yields for those who want their portfolios to work harder every quarter.

- Tap into tomorrow’s innovation leaders by searching AI penny stocks, which are making headlines with breakthroughs in artificial intelligence.

- Find value others overlook by using our tailored list of undervalued stocks based on cash flows, potentially primed for upward momentum based on healthy fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:2502

Asahi Group Holdings

Manufactures and sells beer, alcohol and non-alcohol beverages, and food products in Japan, Europe, Oceania, and Southeast Asia.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives