S Foods (TSE:2292) Profit Surges on One-Off Gain, Raising Earnings Quality Questions

Reviewed by Simply Wall St

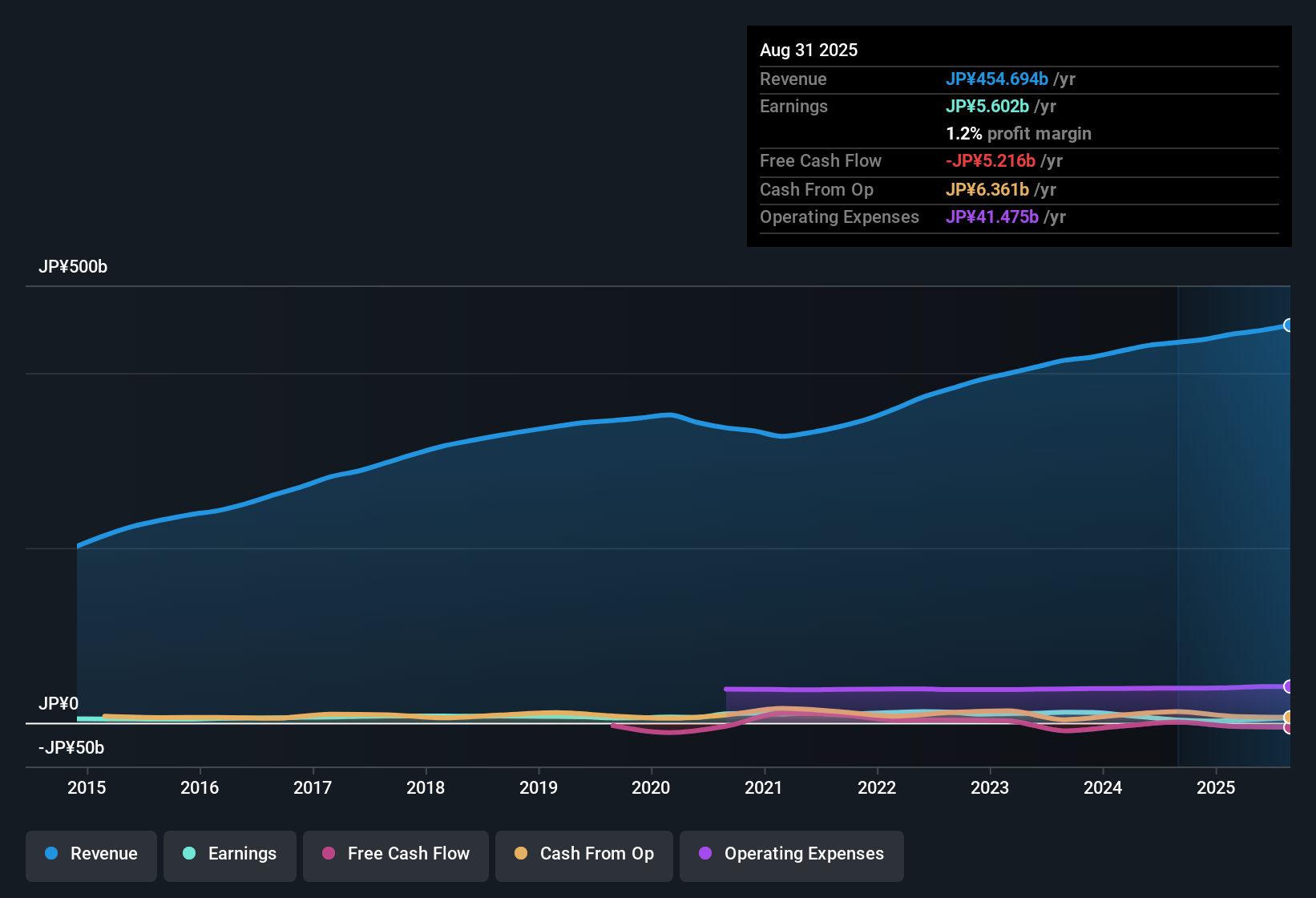

S Foods (TSE:2292) delivered a net profit margin of 1.2%, improving from last year’s 0.7%. Earnings surged 79.4% over the past year, far outpacing the company’s five-year average decline of 17.8% annually. This jump was mainly driven by a one-off gain of ¥3.8 billion. The stock is trading at ¥2,549, which is above its estimated fair value of ¥2,476.19 and at a price-to-earnings ratio of 14.4x. This ratio is below the Japanese food industry average but higher than its peer group.

See our full analysis for S Foods.Now, let’s see how these results match up against the market’s widely held narratives and what the latest earnings really mean for the longer-term story.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Drives 79% Boost

- S Foods’ net profit margin rose to 1.2% compared to last year’s 0.7%, but nearly all of this increase was due to a one-off gain of ¥3.8 billion. When recurring business is isolated, the underlying improvement appears much less significant.

- Bulls hope the recent profit surge signals a real turnaround. However, since earnings growth depends largely on a single non-recurring event, it is difficult to identify this as a definitive trend change.

- With earnings averaging a 17.8% annual decline over the last five years, most years have not recorded growth on this scale.

- Even with the temporary boost, the underlying business will require sustained profit improvement to meet bullish expectations in the future.

Profitability Still Trails Sector Peers

- The company’s price-to-earnings ratio of 14.4x is below the broader Japanese food industry average of 16.1x, but above its peer group’s 11.9x. This presents mixed signals when compared to competitors.

- The key issue is balancing value with mediocre profitability. Investors observing the sector may be attracted to the discount relative to the industry but deterred by the premium over peer companies that have more consistent performance.

- The sector context is important: food processing is considered defensive, but S Foods’ inconsistent record (a five-year average earnings decline of 17.8% annually) invites added scrutiny around its valuation.

- There is a risk that the current P/E ratio does not fully reflect ongoing earnings quality concerns, especially with the latest results enhanced by a single large gain.

Trading Above DCF Fair Value

- Shares currently trade at ¥2,549, which is above the DCF fair value of ¥2,476.19. This means the latest rally has pushed the stock to a slight premium compared with what a cash flow model would indicate as fair.

- While the valuation gap is not large, the challenge for long-term investors is to assess whether the premium is warranted by future profit growth or instead reflects short-term momentum from the recent profit increase.

- The DCF approach already incorporates expected future cash flows, so paying above that level allows less margin for error, especially given the uncertainty surrounding the sustainability of profit margins after the one-off gain.

- Investors may seek several periods of stronger recurring profitability before becoming comfortable with the current share price exceeding DCF-based estimates.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on S Foods's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

S Foods’ heavy reliance on a one-off gain and years of inconsistent profitability raise concerns about the sustainability of its recent performance.

If you’re searching for companies with a record of dependable earnings and revenue growth, check out stable growth stocks screener (2096 results) that showcase steady performance across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2292

S Foods

A meat company, engages in manufacture, wholesaling, retailing, and food servicing of meat-related food products in Japan.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives