- China

- /

- Commercial Services

- /

- SZSE:001267

3 Growth Companies With High Insider Ownership Achieving Up To 132% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility due to geopolitical tensions and concerns over consumer spending, with major indexes like the S&P 500 seeing fluctuations amidst tariff fears and economic data releases. Amid such uncertainty, investors often look toward growth companies with high insider ownership as these firms may demonstrate strong alignment between management and shareholder interests, potentially leading to robust earnings growth even in challenging market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's uncover some gems from our specialized screener.

Oscotec (KOSDAQ:A039200)

Simply Wall St Growth Rating: ★★★★★★

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, and dental bone graft materials, with a market cap of approximately ₩989.86 billion.

Operations: The company's revenue is primarily derived from its New Drug Business Division at ₩28.19 billion, followed by the Medical Business Sector at ₩2.41 billion, Functional Materials at ₩245.91 million, and the Food Business contributing ₩1130.60 million.

Insider Ownership: 21.2%

Earnings Growth Forecast: 132.4% p.a.

Oscotec is trading at 70.4% below its estimated fair value, indicating potential undervaluation. The company is forecast to achieve profitability within three years, with earnings expected to grow annually by 132.42%. Revenue growth is projected at 52.6% per year, significantly outpacing the market average of 9.1%. Additionally, its Return on Equity is anticipated to reach a high of 23.4%, underscoring strong future financial performance prospects despite no recent substantial insider trading activity reported.

- Take a closer look at Oscotec's potential here in our earnings growth report.

- Our expertly prepared valuation report Oscotec implies its share price may be too high.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Growth Rating: ★★★★☆☆

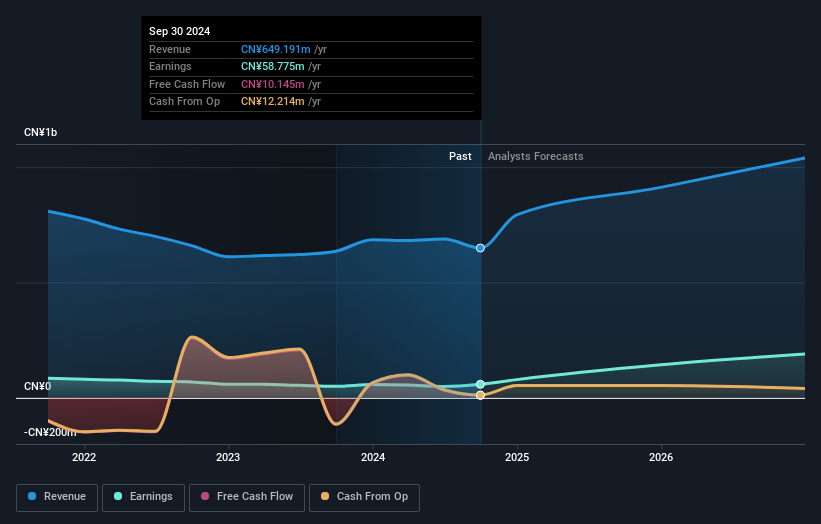

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector, focusing on sustainable solutions, with a market cap of CN¥6.96 billion.

Operations: I'm sorry, but it seems that there is no specific revenue segment information provided in the text you shared. If you have more detailed data on the company's revenue segments, I would be happy to help summarize it for you.

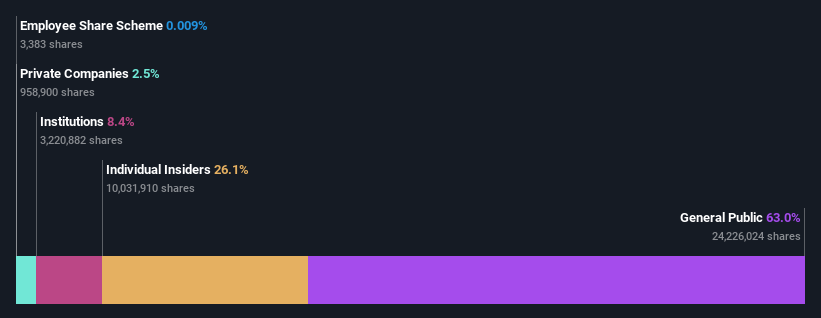

Insider Ownership: 35%

Earnings Growth Forecast: 49.5% p.a.

Hui Lyu Ecological Technology Groups Ltd. is positioned for significant earnings growth, with projections of 49.5% annually, surpassing the Chinese market average of 25.4%. Revenue is expected to grow at 18.4% per year, faster than the market's 13.4%, though below the ideal benchmark of 20%. Despite a volatile share price recently and a forecasted low return on equity of 10.1%, no substantial insider trading activity has been reported in the past three months.

- Navigate through the intricacies of Hui Lyu Ecological Technology GroupsLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Hui Lyu Ecological Technology GroupsLtd valuation report hints at an inflated share price compared to its estimated value.

S Foods (TSE:2292)

Simply Wall St Growth Rating: ★★★★☆☆

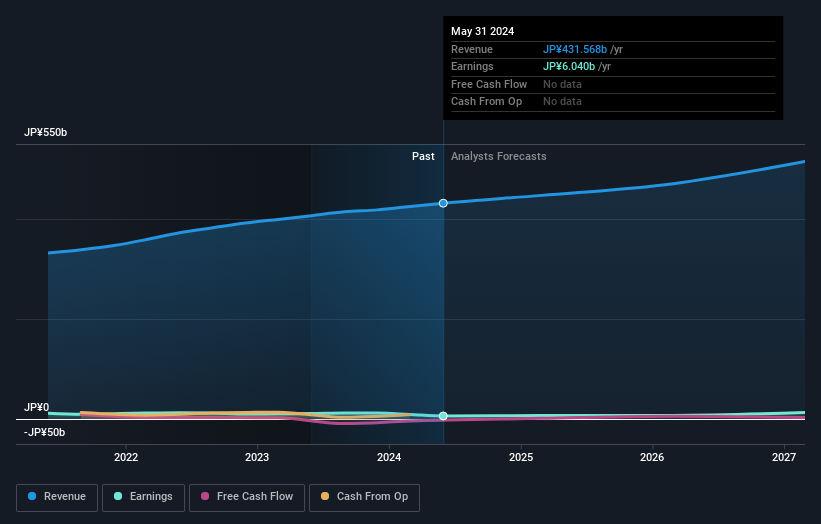

Overview: S Foods Inc. is a Japanese meat company involved in the manufacture, wholesaling, retailing, and food servicing of meat-related products, with a market cap of ¥75.07 billion.

Operations: The company's revenue is generated from its activities in manufacturing, wholesaling, retailing, and food servicing of meat-related products within Japan.

Insider Ownership: 25.4%

Earnings Growth Forecast: 36% p.a.

S Foods is trading at 53% below its estimated fair value, indicating potential undervaluation. While profit margins have decreased to 0.5% from last year's 2.9%, earnings are forecasted to grow significantly at 36% annually, outpacing the JP market's 8%. Revenue growth of 9.5% per year is expected, surpassing the market average of 4.2%. Despite a low forecasted return on equity of 10.4%, no substantial insider trading activity has been observed recently.

- Unlock comprehensive insights into our analysis of S Foods stock in this growth report.

- Our valuation report here indicates S Foods may be overvalued.

Where To Now?

- Explore the 1452 names from our Fast Growing Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hui Lyu Ecological Technology GroupsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001267

Hui Lyu Ecological Technology GroupsLtd

Hui Lyu Ecological Technology Groups Co.,Ltd.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives