3 Stocks Estimated To Be Trading Up To 46.6 Percent Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets have shown varied performances, with U.S. stocks ending slightly lower amid concerns about trade policies and job growth falling short of expectations. Despite these challenges, the search for undervalued stocks remains crucial as investors look for opportunities that may offer potential value in a fluctuating market environment. Identifying stocks trading below their intrinsic value can be an effective strategy to capitalize on market inefficiencies and position oneself advantageously amidst current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.71 | US$37.36 | 49.9% |

| DIP (TSE:2379) | ¥2269.00 | ¥4528.79 | 49.9% |

| Alarum Technologies (TASE:ALAR) | ₪3.356 | ₪6.68 | 49.7% |

| Celsius Holdings (NasdaqCM:CELH) | US$21.28 | US$42.43 | 49.8% |

| Solum (KOSE:A248070) | ₩17630.00 | ₩35136.90 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.19 | CN¥30.00 | 49.4% |

| S&U (LSE:SUS) | £16.25 | £32.33 | 49.7% |

| Similarweb (NYSE:SMWB) | US$11.87 | US$23.62 | 49.7% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Kyndryl Holdings (NYSE:KD) | US$41.15 | US$81.37 | 49.4% |

Underneath we present a selection of stocks filtered out by our screen.

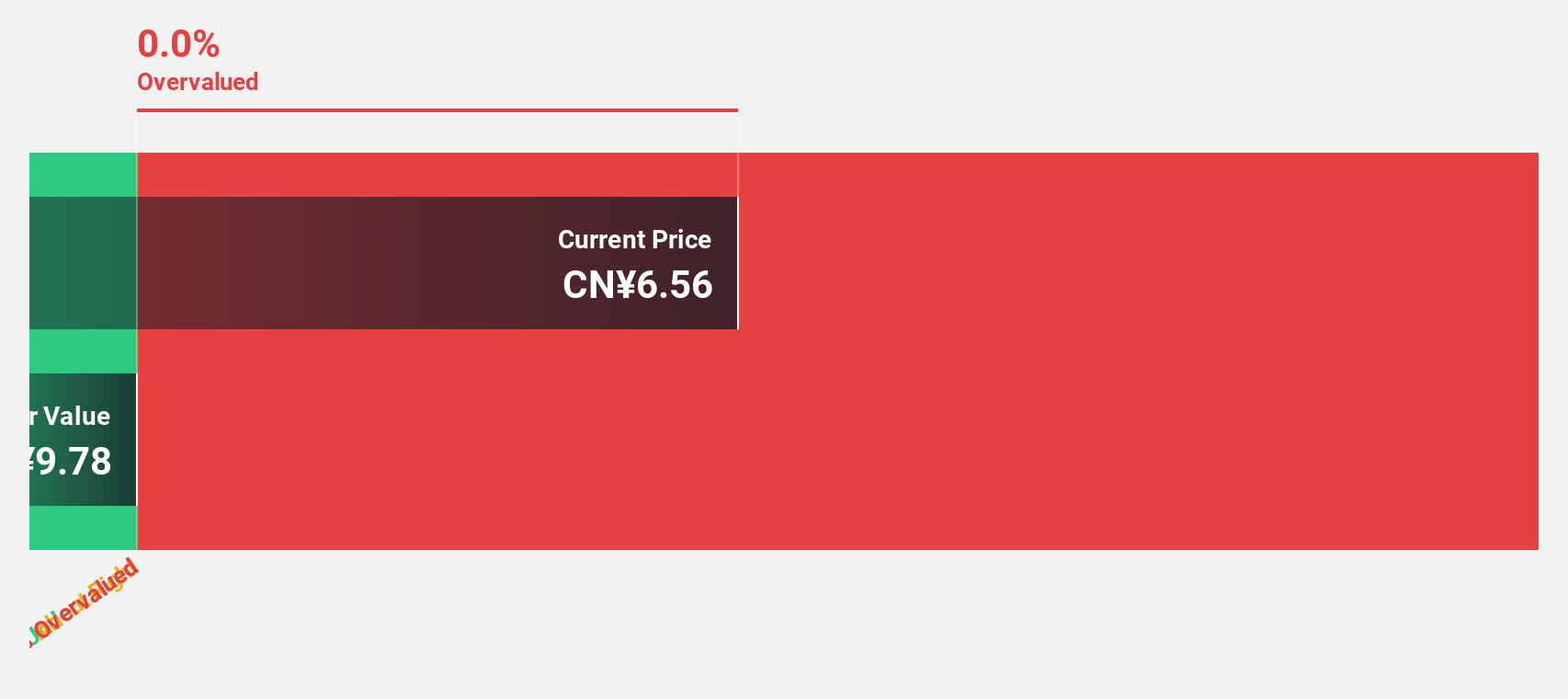

Jiangsu Chuanzhiboke Education Technology (SZSE:003032)

Overview: Jiangsu Chuanzhiboke Education Technology Co., LTD. operates in the education technology sector and has a market cap of CN¥3.68 billion.

Operations: The company's revenue is primarily generated from Training Services, amounting to CN¥269.45 million.

Estimated Discount To Fair Value: 46.6%

Jiangsu Chuanzhiboke Education Technology is trading at CN¥9.2, significantly below its estimated fair value of CN¥17.24, indicating it may be undervalued based on cash flows. Despite recent volatility and being dropped from the S&P Global BMI Index, the company is expected to achieve high revenue growth of 25.4% annually and become profitable in three years, surpassing market averages. However, its forecasted return on equity remains low at 3.3%.

- In light of our recent growth report, it seems possible that Jiangsu Chuanzhiboke Education Technology's financial performance will exceed current levels.

- Get an in-depth perspective on Jiangsu Chuanzhiboke Education Technology's balance sheet by reading our health report here.

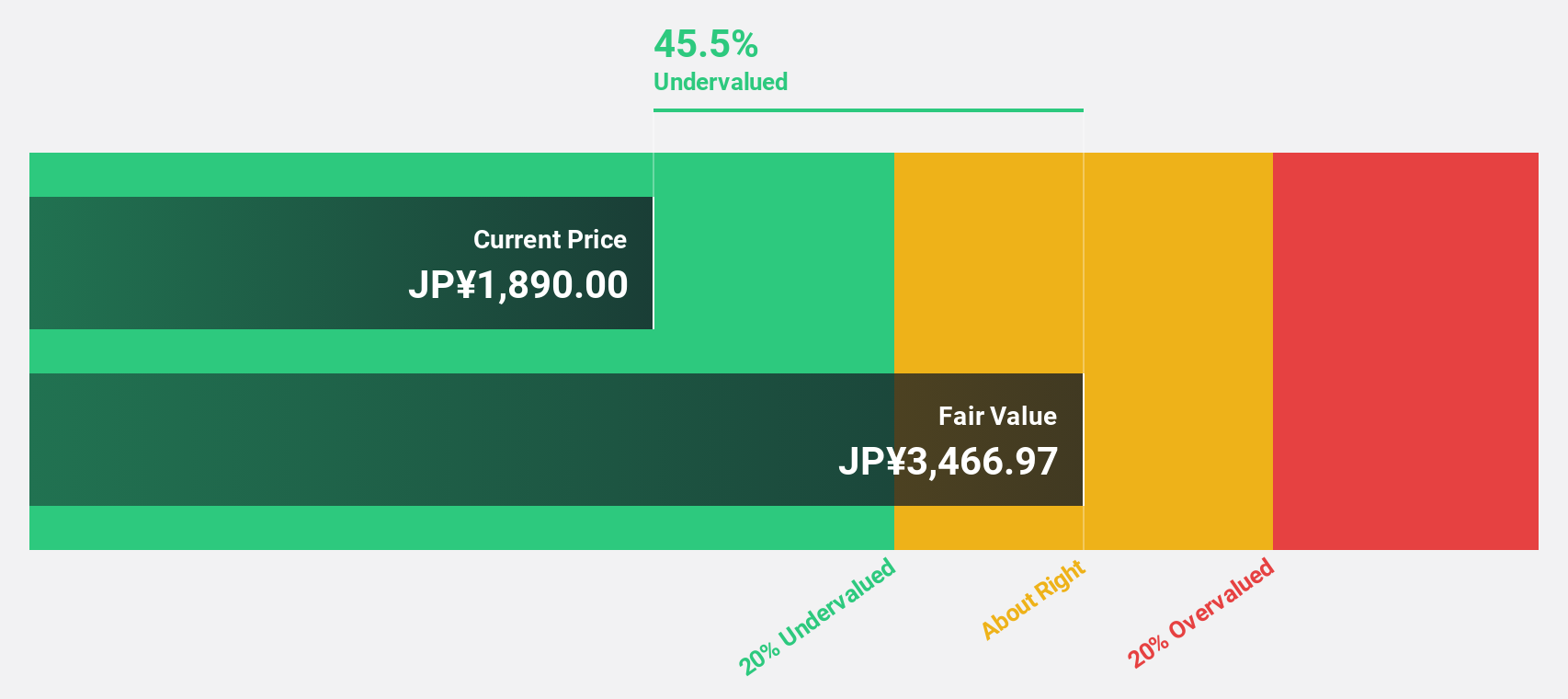

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. operates in Japan, focusing on the production and sale of sweets, with a market capitalization of ¥382.65 billion.

Operations: Kotobuki Spirits Co., Ltd.'s revenue is primarily derived from the production and sale of sweets in Japan.

Estimated Discount To Fair Value: 32.5%

Kotobuki Spirits is trading at ¥2,515, considerably below its estimated fair value of ¥3,723.37, suggesting undervaluation based on cash flows. Earnings are projected to grow 15.35% annually, outpacing the JP market's 7.7%. The company announced a share buyback program worth ¥3 billion to enhance shareholder returns and address supply-demand concerns due to a follow-on equity offering of 2,584,800 shares. Revenue growth is forecasted at 12.5% per year but remains slower than significant benchmarks.

- Our comprehensive growth report raises the possibility that Kotobuki Spirits is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Kotobuki Spirits' balance sheet health report.

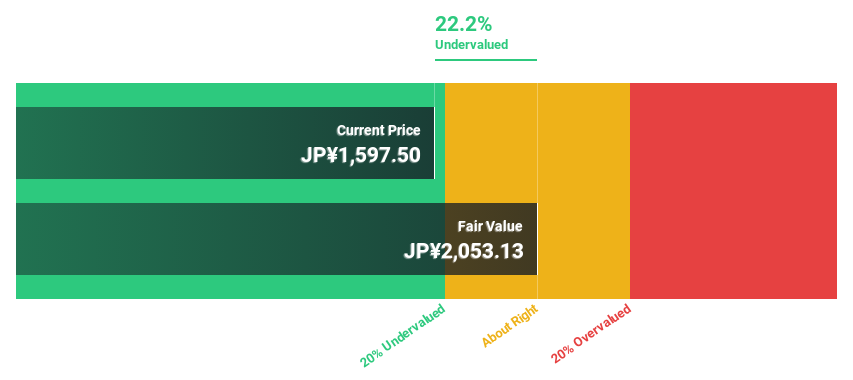

Chugin Financial GroupInc (TSE:5832)

Overview: Chugin Financial Group, Inc., with a market cap of ¥283.93 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual customers in Japan.

Operations: The company generates revenue through its subsidiary, The Chugoku Bank, Limited, which provides a variety of financial services to corporate and individual clients in Japan.

Estimated Discount To Fair Value: 22.6%

Chugin Financial Group is trading at ¥1,588.5, significantly below its estimated fair value of ¥2,053, indicating potential undervaluation based on cash flows. Earnings are expected to grow 21.65% annually with revenue growth forecasted at 22.6%, both surpassing the JP market averages. The company maintains a reliable dividend yield of 3.53%. Recent guidance projects ordinary revenues of ¥212 billion and profit attributable to owners at ¥25 billion for fiscal year-end March 2025.

- Our growth report here indicates Chugin Financial GroupInc may be poised for an improving outlook.

- Take a closer look at Chugin Financial GroupInc's balance sheet health here in our report.

Make It Happen

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 911 more companies for you to explore.Click here to unveil our expertly curated list of 914 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5832

Chugin Financial GroupInc

Through its subsidiary The Chugoku Bank, Limited, provides various financial services to corporate and individual customers in Japan.

High growth potential with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.