As we approach the end of 2024, global markets have experienced a mixed bag of economic indicators, with U.S. consumer confidence taking a hit and manufacturing orders declining, yet major stock indexes still managed to finish the holiday-shortened week on a positive note. While large-cap growth stocks initially led the charge in gains, small-cap indices like the Russell 2000 recorded more modest increases amidst fluctuating market sentiment. In this context of shifting dynamics and cautious optimism, identifying promising stocks often involves looking for companies that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

UIE (CPSE:UIE)

Simply Wall St Value Rating: ★★★★★★

Overview: UIE Plc is an investment company involved in the agro-industrial, industrial, and technology sectors across Malaysia, Indonesia, the United States, Europe, and other international markets with a market capitalization of DKK9.29 billion.

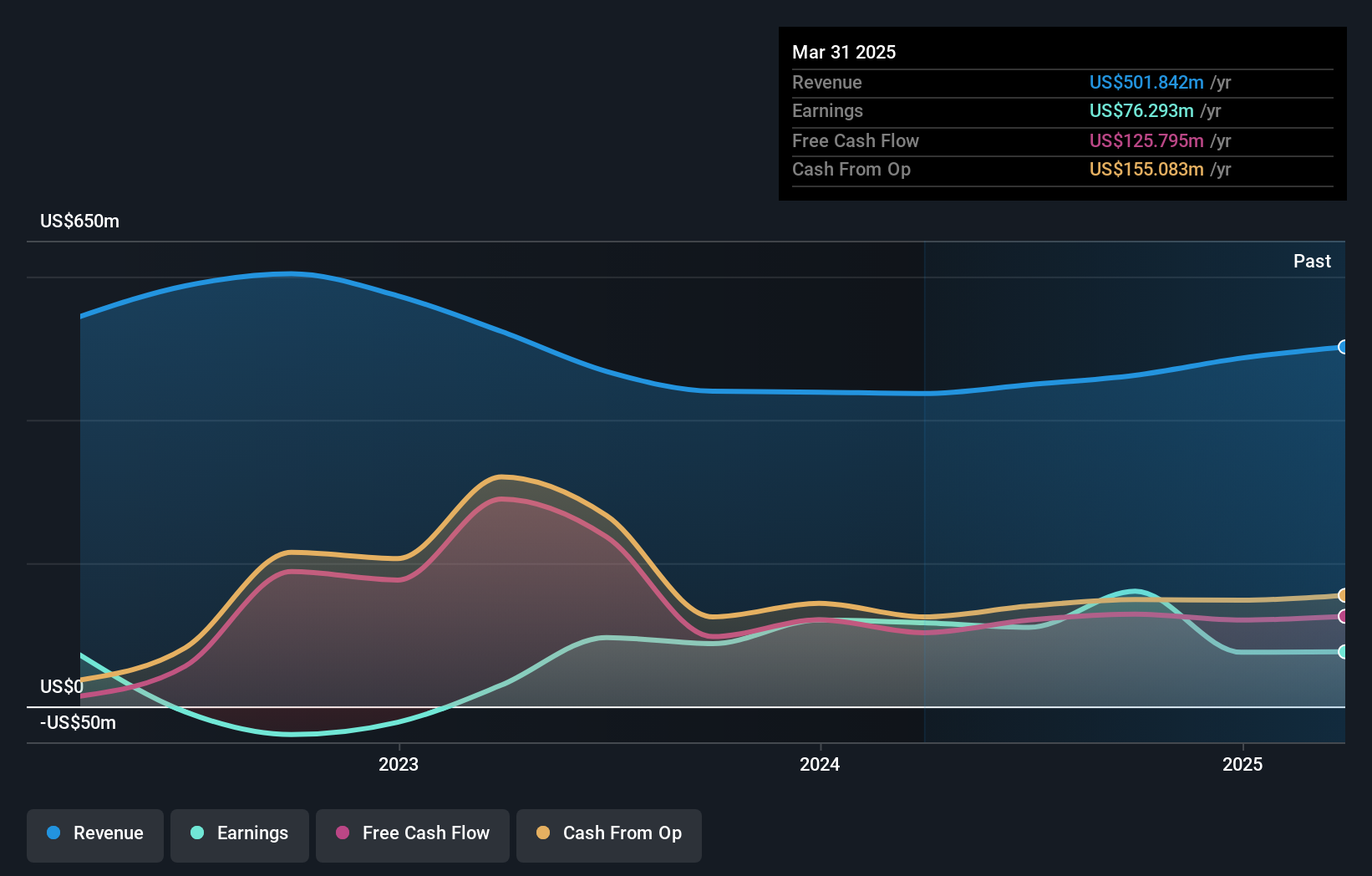

Operations: UIE generates revenue primarily through its investment in United Plantations Berhad, which contributed $462.25 million. The company's financial performance is influenced by its diverse sector investments across multiple geographic regions.

UIE, a small yet promising player, has demonstrated remarkable growth with earnings surging by 83.7% over the past year, outpacing the Food industry’s 18.4%. The company is debt-free and reported a significant one-off gain of US$70.2M impacting its recent financials as of September 2024. Trading at nearly 30% below estimated fair value, UIE seems undervalued in the market. Recent results show a turnaround with Q3 sales at US$128.52 million and net income hitting US$32.2 million compared to last year's loss, reflecting strong operational recovery and potential for future growth in this sector.

Alkhorayef Water and Power Technologies (SASE:2081)

Simply Wall St Value Rating: ★★★★☆☆

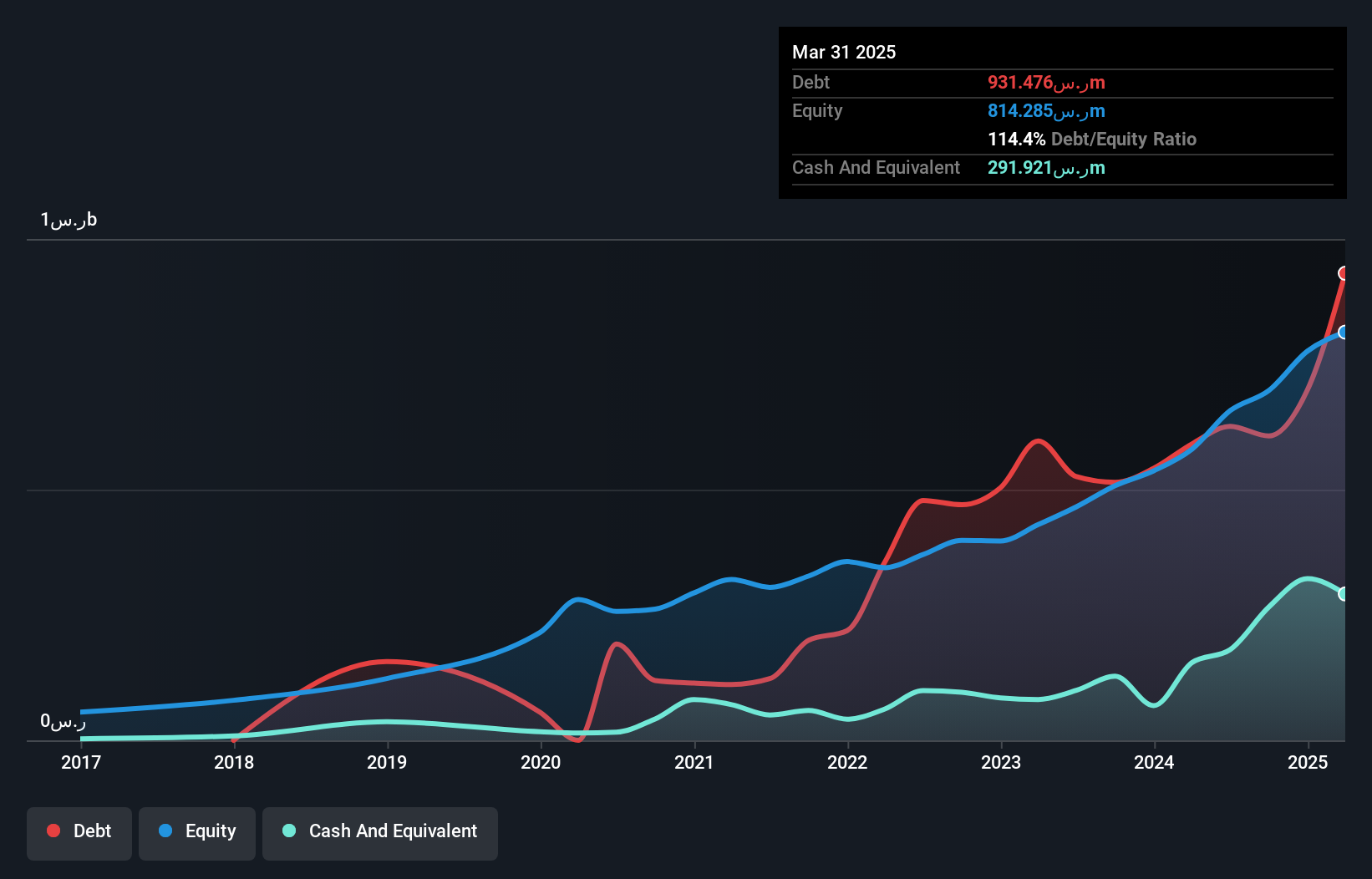

Overview: Alkhorayef Water and Power Technologies Company specializes in designing, constructing, operating, maintaining, and managing water and wastewater projects in Saudi Arabia with a market capitalization of SAR5.24 billion.

Operations: The company's revenue streams are primarily derived from three segments: Water (SAR377 million), Wastewater (SAR352.36 million), and Integrated Water Solutions (SAR1.12 billion).

Alkhorayef Water and Power Technologies, a smaller player in the utilities sector, posted a notable earnings growth of 37.5% over the past year, outpacing its industry peers. Despite this growth, the company's debt to equity ratio rose from 42% to 87% over five years, indicating increased leverage. However, interest payments are well covered by EBIT at 6.2 times coverage. Trading significantly below its estimated fair value by 67.6%, Alkhorayef seems undervalued with high-quality earnings supporting its financial health. Recent results showed nine-month sales reaching SAR1.34 billion and net income climbing to SAR160 million from SAR110 million last year.

Kanro (TSE:2216)

Simply Wall St Value Rating: ★★★★★★

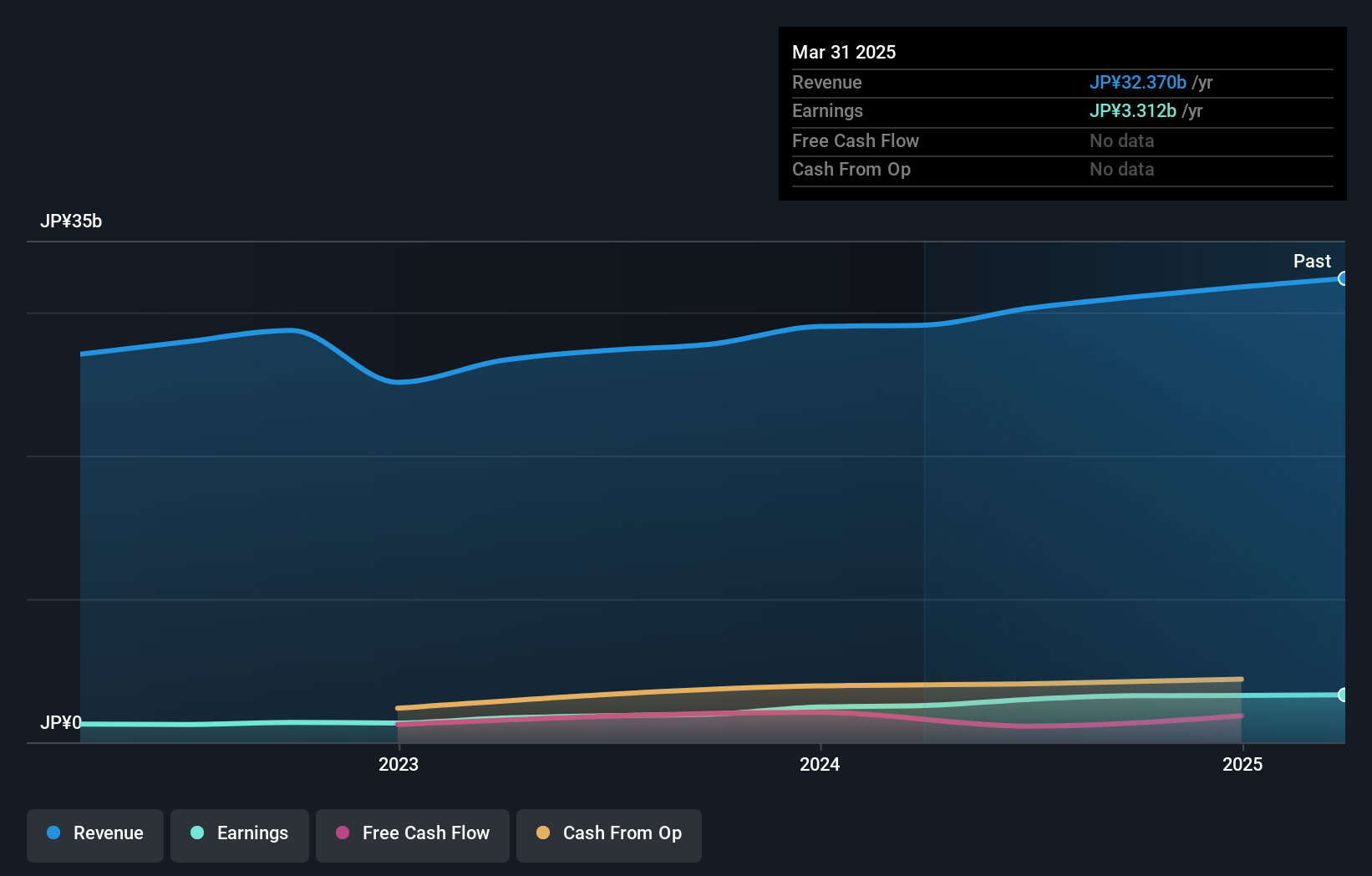

Overview: Kanro Inc. is a company that focuses on the manufacturing and sale of confectionery and food products, with a market capitalization of approximately ¥50.01 billion.

Operations: Kanro's primary revenue stream is from its Confectionery and Food Business, generating approximately ¥31.09 billion.

Kanro, a smaller player in the food industry, has shown impressive performance with earnings growth of 65% over the past year, outpacing the industry's average of 19.5%. The company is currently trading at 14% below its estimated fair value, suggesting potential undervaluation. With no debt on its balance sheet now compared to a debt-to-equity ratio of 10.5% five years ago, Kanro's financial health seems robust. Furthermore, its high-quality earnings and positive free cash flow indicate strong operational efficiency and stability within an increasingly competitive market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Kanro.

Evaluate Kanro's historical performance by accessing our past performance report.

Seize The Opportunity

- Get an in-depth perspective on all 4626 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2216

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives