Undiscovered Gems Three Promising Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, with the S&P 500 reaching new highs and small-cap stocks trailing slightly behind their larger peers, investors are keenly observing potential shifts in trade policies and AI investments. In this environment of cautious optimism, identifying promising stocks often involves looking for companies that can capitalize on emerging trends or demonstrate resilience amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 46.58% | 6.59% | 23.75% | ★★★★★★ |

| Korea Ratings | NA | 0.84% | 0.92% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 7.52% | 53.96% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

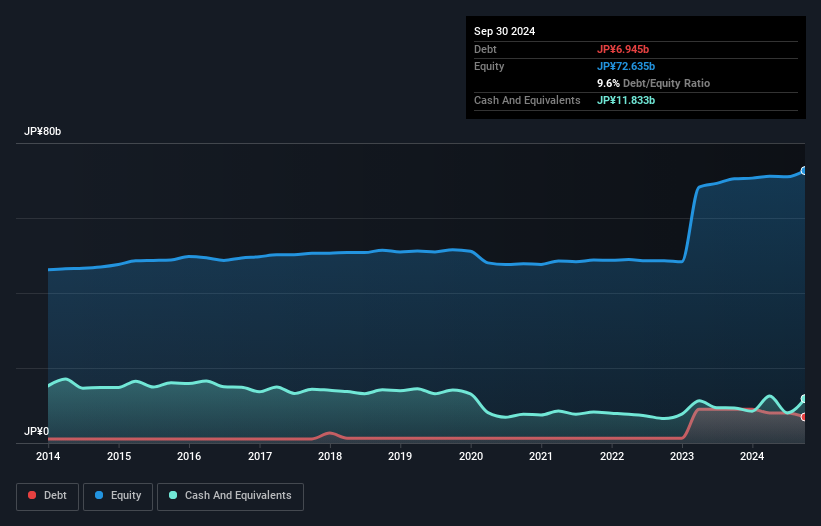

WELLNEO SUGAR (TSE:2117)

Simply Wall St Value Rating: ★★★★★☆

Overview: WELLNEO SUGAR Co., Ltd. is a Japanese company that manufactures and sells sugar and other food products, with a market capitalization of ¥74.52 billion.

Operations: WELLNEO SUGAR generates revenue primarily from its sugar segment, accounting for ¥86.61 billion, and the food & wellness segment contributing ¥8.13 billion.

WELLNEO SUGAR, a smaller player in the food industry, has shown robust earnings growth of 58.8% over the past year, outpacing the industry's 20.3%. The company appears to be trading at a significant discount, around 94.4% below its estimated fair value, suggesting potential for value investors. With high-quality earnings and interest coverage not being an issue, WELLNEO seems financially sound despite its debt-to-equity ratio increasing from 2.5 to 9.6 over five years. Recent board meetings have focused on retiring treasury shares and dividend increases to JPY 56 per share for fiscal year-end March 2025 from JPY 46 previously.

- Click here and access our complete health analysis report to understand the dynamics of WELLNEO SUGAR.

Gain insights into WELLNEO SUGAR's past trends and performance with our Past report.

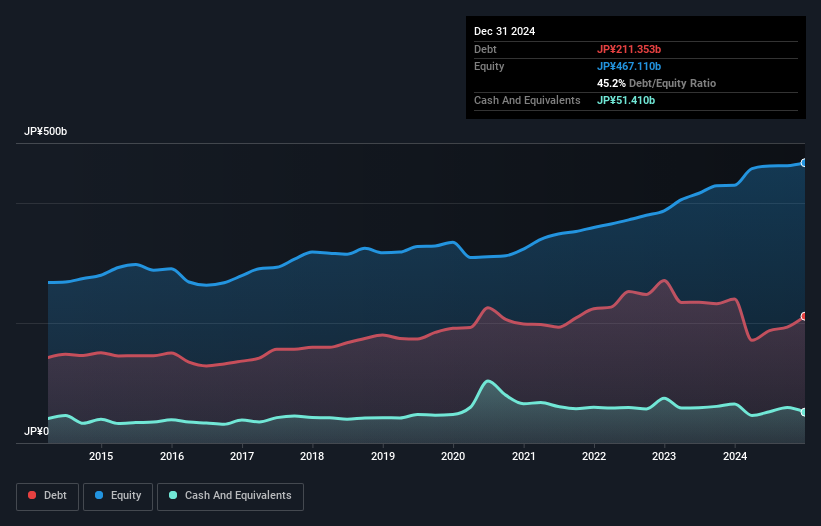

Daido Steel (TSE:5471)

Simply Wall St Value Rating: ★★★★★★

Overview: Daido Steel Co., Ltd. is a company that manufactures and sells steel products both in Japan and internationally, with a market capitalization of ¥248.44 billion.

Operations: Daido Steel generates its revenue primarily from Special Steel Products, contributing ¥283.84 billion, and Functional & Magnetic Materials, adding ¥218.14 billion. Autoparts & Industrial Machinery Parts also play a significant role in the revenue stream with ¥141.85 billion.

Daido Steel, a noteworthy player in the steel industry, has shown resilience with its earnings growth of 5.5% over the past year, outpacing the broader Metals and Mining sector's -12.9%. The company's debt to equity ratio has improved from 56.1% to 41.8% over five years, indicating effective debt management. Trading at nearly half its estimated fair value suggests potential undervaluation compared to peers. Recently, Daido Steel completed a share buyback of approximately 3.47%, spending ¥8,497 million (US$) to enhance capital efficiency and shareholder returns amidst shifting business conditions and market dynamics.

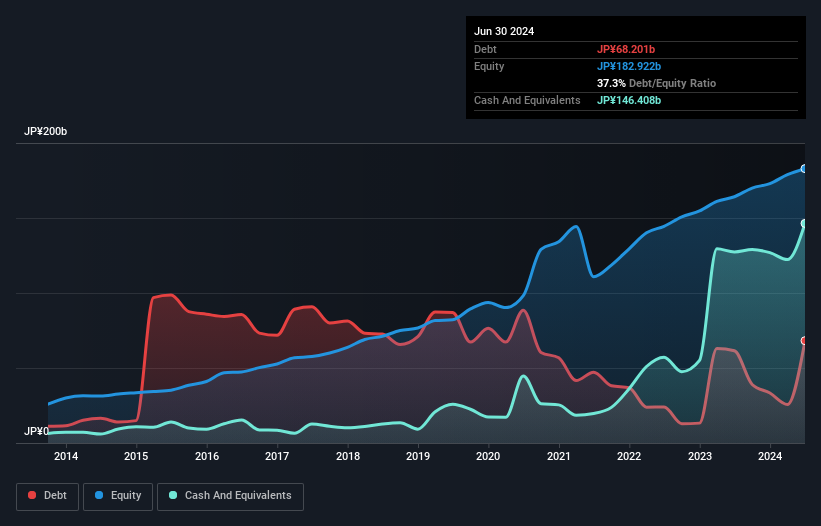

Nojima (TSE:7419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nojima Corporation operates digital home electronics retail stores both in Japan and internationally, with a market capitalization of ¥209.57 billion.

Operations: The primary revenue streams for Nojima Corporation include the operation of mobile carrier stores, generating ¥355.45 billion, and digital consumer electronics specialty shop operations, contributing ¥282.52 billion. The overseas segment and internet business also add significant revenues of ¥77.95 billion and ¥67.77 billion, respectively.

Nojima, a small player in the specialty retail sector, has been making waves with its impressive financial metrics. Over the past year, earnings surged by 26%, outpacing the industry's 6% growth. This performance is underscored by high-quality earnings and a robust interest coverage ratio of 73x EBIT over interest payments. The company trades at a significant discount of 51% to its estimated fair value, suggesting potential upside for investors. Additionally, Nojima's debt-to-equity ratio improved dramatically from 75% to 34% in five years, complemented by strategic share repurchases totaling ¥3.15 billion recently completed under their buyback program.

- Dive into the specifics of Nojima here with our thorough health report.

Gain insights into Nojima's historical performance by reviewing our past performance report.

Next Steps

- Click through to start exploring the rest of the 4664 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade WELLNEO SUGAR, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WELLNEO SUGAR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2117

WELLNEO SUGAR

Manufactures and sells sugar and other food products primarily in Japan.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives