Nippn Corporation's (TSE:2001) Share Price Is Matching Sentiment Around Its Earnings

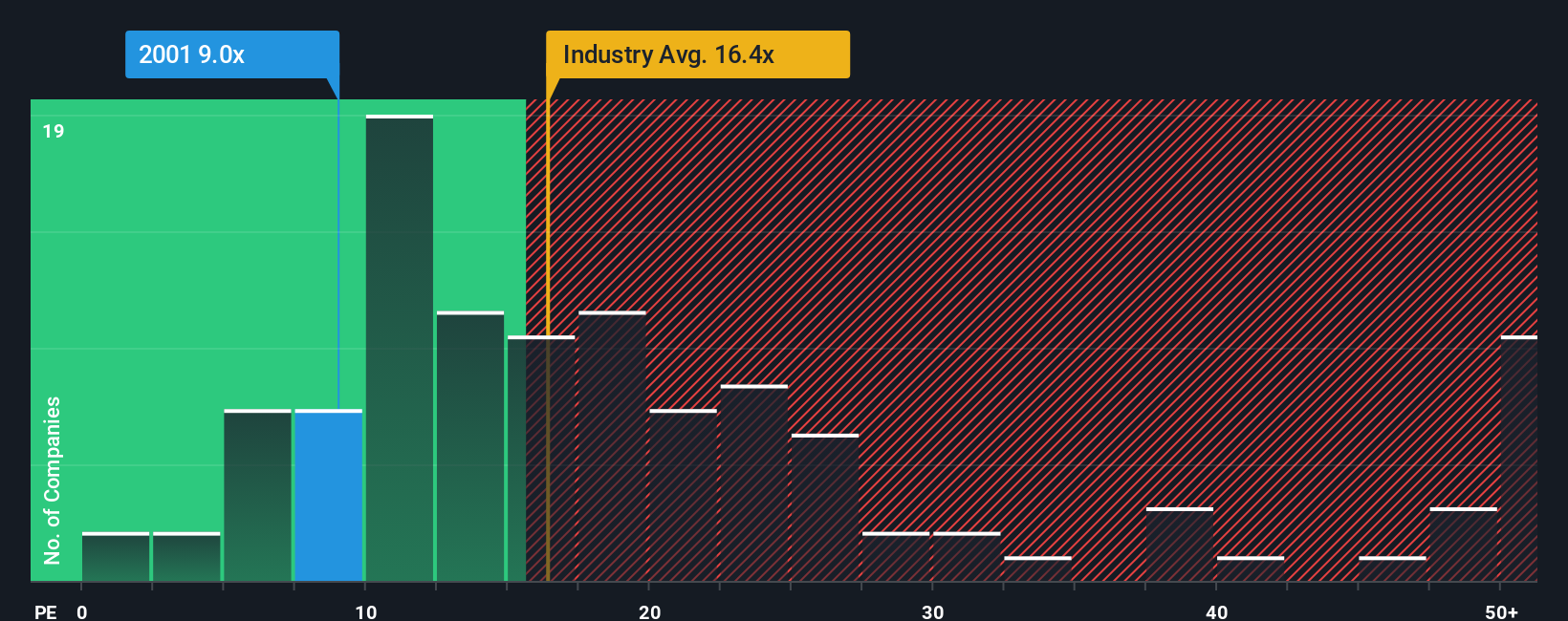

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may consider Nippn Corporation (TSE:2001) as an attractive investment with its 9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Nippn hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Nippn

Is There Any Growth For Nippn?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nippn's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 108% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 2.1% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 9.2% per year, which paints a poor picture.

With this information, we are not surprised that Nippn is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Nippn's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Nippn maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Nippn (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Nippn, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nippn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2001

Nippn

Engages in flour milling and food business in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026