- China

- /

- Renewable Energy

- /

- SHSE:601619

3 Dividend Stocks Offering Yields Up To 3.9%

Reviewed by Simply Wall St

As global markets react to recent political developments and economic indicators, U.S. stocks have been climbing towards record highs, buoyed by optimism surrounding trade policies and advancements in artificial intelligence. Amidst this backdrop of market enthusiasm, investors are increasingly considering dividend stocks as a means to secure steady income streams while participating in potential market gains. In the current environment where growth stocks have outperformed value shares and large-cap indexes lead their smaller peers, selecting dividend stocks with solid yields can be a strategic approach for balancing portfolio stability with income generation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

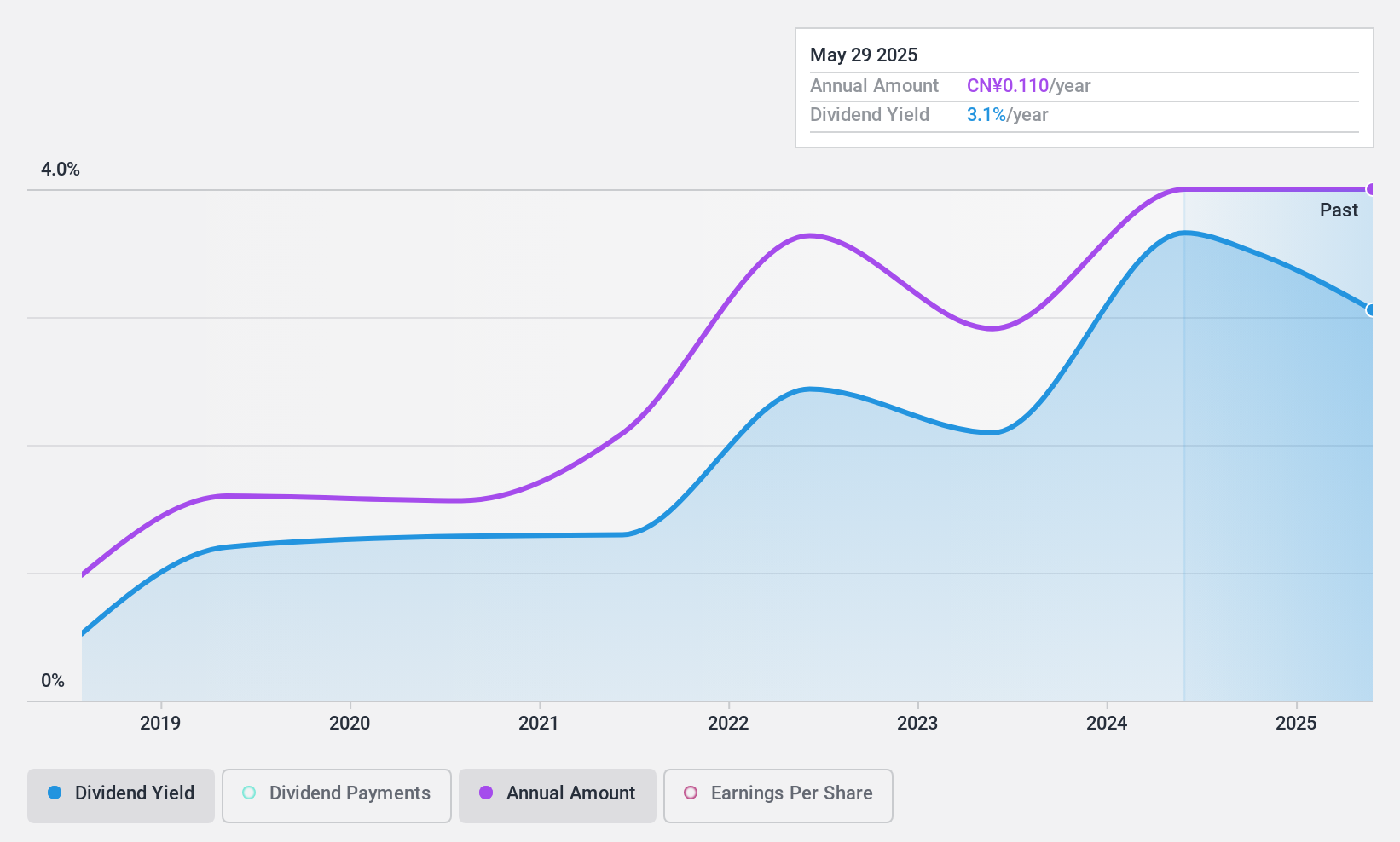

Jiaze Renewables (SHSE:601619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited is involved in the development, construction, sale, operation, and maintenance of new energy projects with a market cap of CN¥8.16 billion.

Operations: Jiaze Renewables Corporation Limited generates revenue through its activities in the new energy sector, including project development, construction, sales, operations, and maintenance.

Dividend Yield: 3.3%

Jiaze Renewables offers a mixed picture for dividend investors. While its price-to-earnings ratio of 11.6x suggests good value compared to the CN market average, its dividend payments have been volatile and unreliable over the past seven years, despite being covered by earnings (41.3% payout ratio) and cash flows (57%). The recent private placement raising CNY 1.2 billion could impact future dividends, but it remains in the top tier with a 3.28% yield in China.

- Click to explore a detailed breakdown of our findings in Jiaze Renewables' dividend report.

- Our valuation report here indicates Jiaze Renewables may be overvalued.

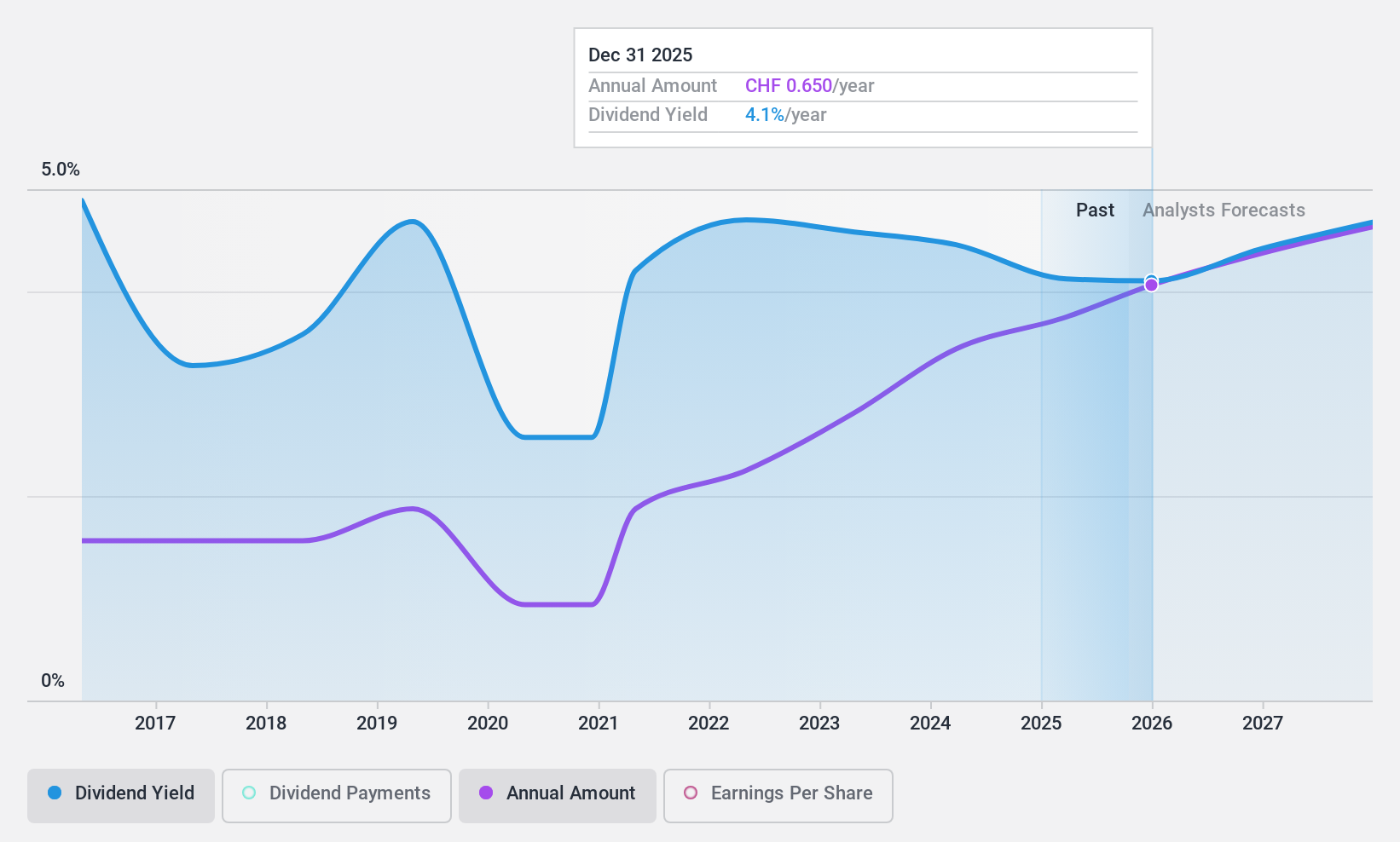

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG, along with its subsidiaries, offers private banking, wealth management, and asset management services and has a market capitalization of CHF4.24 billion.

Operations: EFG International's revenue segments include CHF128.80 million from the Americas, CHF176.70 million from Asia Pacific, CHF193.30 million from the United Kingdom, CHF449.70 million from Switzerland & Italy, CHF55.30 million from Global Markets & Treasury, CHF122.90 million from Investment and Wealth Solutions, and CHF257.30 million from Continental Europe & Middle East.

Dividend Yield: 3.9%

EFG International's dividend history has been unreliable and volatile over the past decade, though dividends have increased overall. The current payout ratio of 55.2% suggests dividends are covered by earnings, with future coverage expected at 60.6%. Despite a low dividend yield compared to top Swiss payers, its price-to-earnings ratio of 14.1x indicates value relative to the Swiss market average. High bad loans (2.4%) remain a concern amidst acquisition plans for growth.

- Dive into the specifics of EFG International here with our thorough dividend report.

- Upon reviewing our latest valuation report, EFG International's share price might be too optimistic.

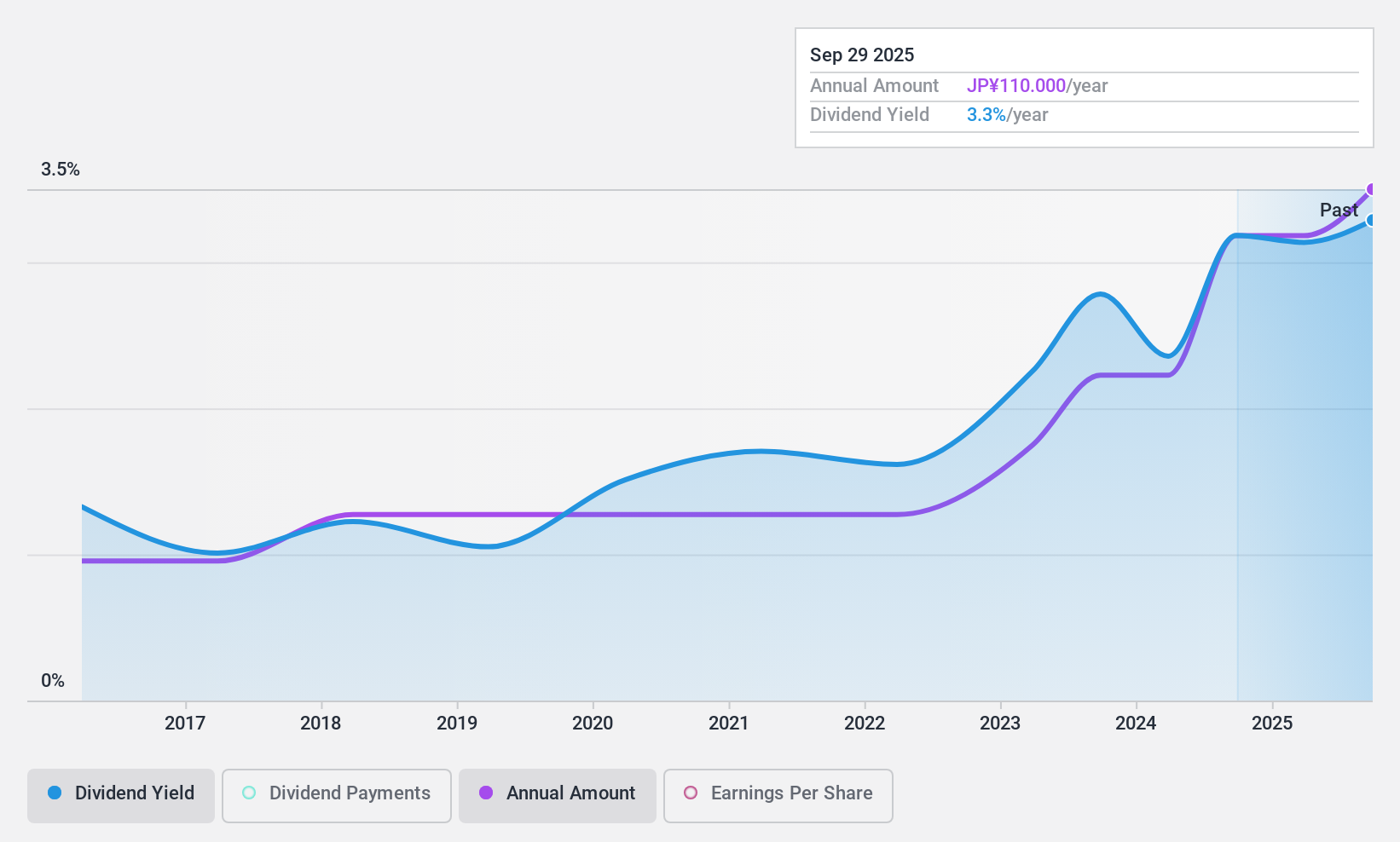

Maruha Nichiro (TSE:1333)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Maruha Nichiro Corporation operates in fishing, fish farming, food processing, trading, meat products, and distribution both in Japan and internationally, with a market cap of ¥149.14 billion.

Operations: Maruha Nichiro Corporation's revenue is derived from its operations in fishing, fish farming, food processing, trading, and meat products distribution.

Dividend Yield: 3.4%

Maruha Nichiro's dividend payments have been stable and growing over the past decade, with a current yield of 3.38%, slightly below Japan's top quartile. The dividends are well covered by both earnings (payout ratio: 28.6%) and cash flows (cash payout ratio: 15.3%). Despite large one-off items affecting financial results, the stock trades at a significant discount to its estimated fair value, though debt coverage by operating cash flow remains a concern.

- Click here and access our complete dividend analysis report to understand the dynamics of Maruha Nichiro.

- Our valuation report unveils the possibility Maruha Nichiro's shares may be trading at a discount.

Make It Happen

- Take a closer look at our Top Dividend Stocks list of 1964 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601619

Jiaze Renewables

Engages in the development, construction, sale, operation, and maintenance of new energy projects.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives