- Japan

- /

- Oil and Gas

- /

- TSE:8088

Is Iwatani a Bargain After Its 20% Drop and Dividend Growth Slowdown?

Reviewed by Bailey Pemberton

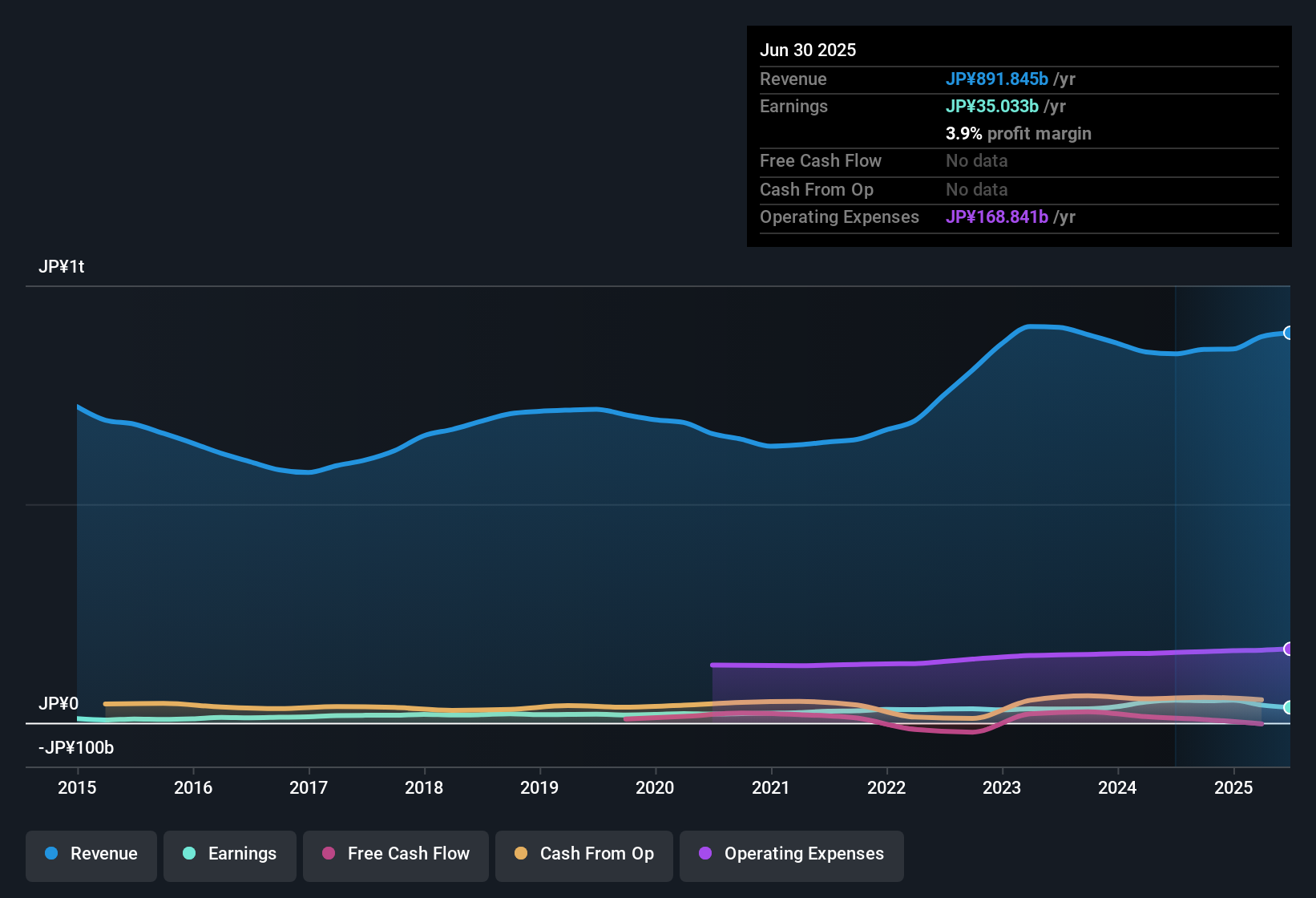

If you are considering what to do with your Iwatani shares right now, you are not alone. Investors all over are weighing their next steps amid a year that has seen the stock struggle to find momentum. After closing at 1625.0, Iwatani is down 2.0% over the last week, a mild slip that fits a longer-term slide, with the stock off 8.3% for the year to date and 19.7% over the past twelve months. At first glance, that could raise concerns about whether the company's growth prospects are fading or if the market's risk appetite has simply shifted.

However, taking a step back highlights a fascinating contrast. Over the past three and five years, Iwatani is still up 26.5% and 74.7% respectively. This shows that anyone who invested with a longer horizon is likely sitting on solid gains. The recent pullback has not been purely company-specific either, as broader market developments have played a significant role, with changes in sector trends and investor sentiment influencing risk perception.

This raises the question: where does Iwatani stand in terms of valuation? Based on six different checks, the company's value score currently sits at 2, indicating it is undervalued in two of those areas. Is that enough to make the stock a bargain, or just a starting point for a deeper dive? In the next section, we will break down these valuation methods and explore what truly drives Iwatani's value before wrapping up with some perspective on how to make your best decision.

Iwatani scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Iwatani Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation approach that aims to determine a stock's intrinsic value by forecasting its future dividend payments and discounting them back to their present value. This method is most effective for companies with consistent dividend payments and predictable growth.

For Iwatani, the latest data shows a dividend per share of ¥49.18, combined with a return on equity of 11.86%. The dividend payout ratio sits at a conservative 15.26%, indicating plenty of room to maintain and potentially grow future dividends. However, analysts project only a modest dividend growth rate going forward, at just 0.52% annually. This figure remains well below the historical level of over 10%.

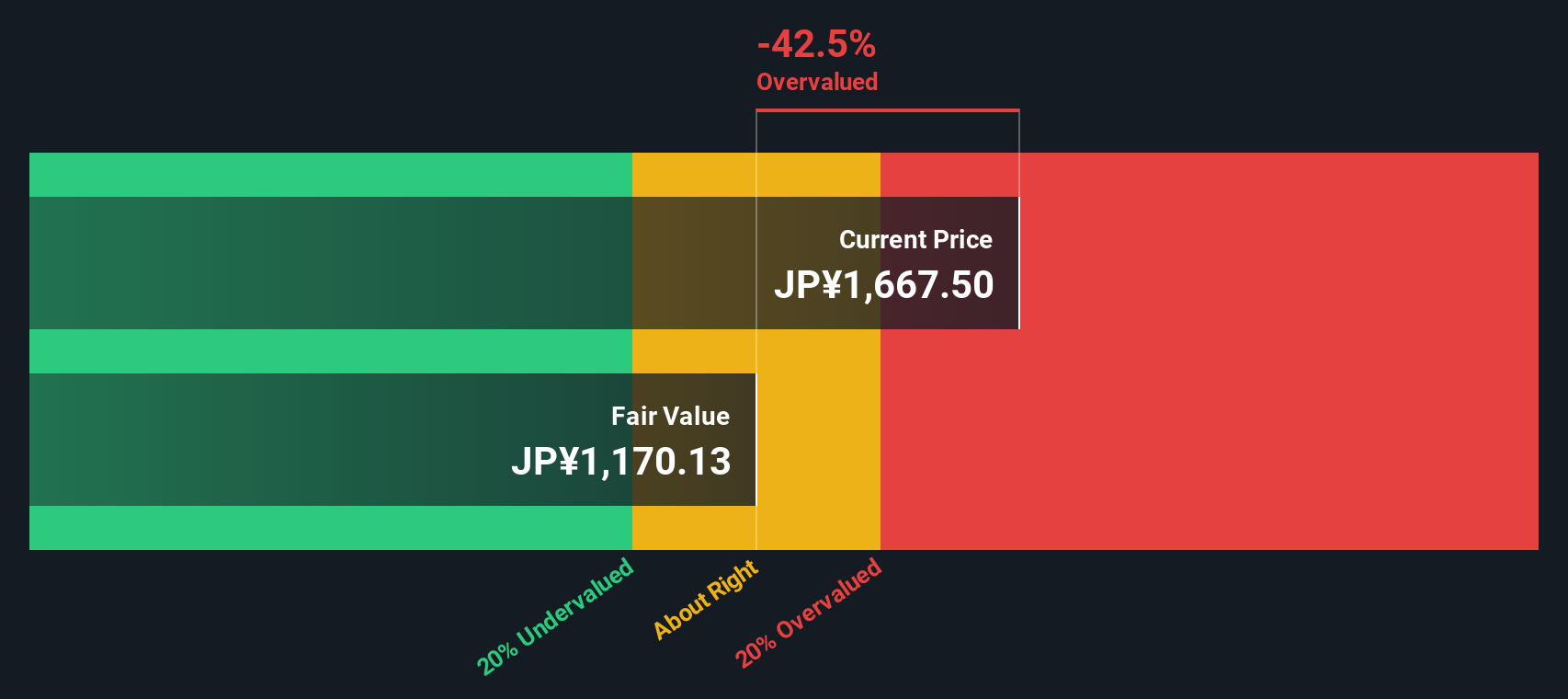

Taking these inputs into account, the DDM estimates Iwatani's intrinsic value at ¥1,171 per share. This is notably below the current share price of ¥1,625, which implies the stock is trading about 38.8% above its estimated fair value. In other words, based on expected future dividends, Iwatani currently appears overvalued according to this model.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Iwatani may be overvalued by 38.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Iwatani Price vs Earnings (PE) Analysis

The price-to-earnings (PE) ratio is a popular metric for valuing established, profitable companies like Iwatani. It offers a way to compare how much investors are willing to pay today for each yen of current earnings. This makes it especially relevant where earnings are consistently positive and stable.

What is considered a “normal” PE ratio can vary. Higher growth expectations or lower risk typically justify a higher PE, while slower growth or greater uncertainty might warrant a lower multiple. For this reason, context is crucial.

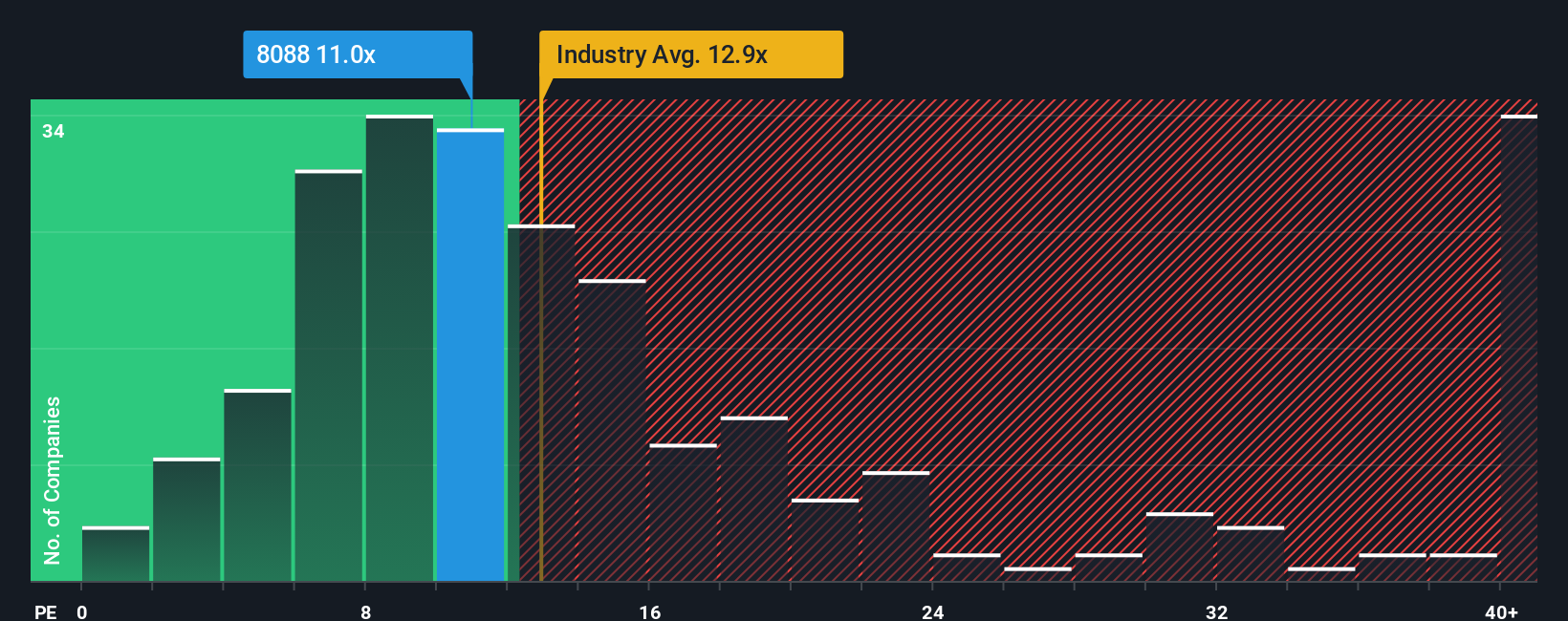

Iwatani currently trades at a PE ratio of 10.68x. This is just above the average among its peers, which is 10.32x, but remains below the broader oil and gas industry average of 12.96x. To further refine this analysis, Simply Wall St calculates a proprietary “Fair Ratio” which, for Iwatani, is 15.29x. This Fair Ratio incorporates not only the company’s sector and profit margin, but also considers its growth potential, specific risks, and market capitalization. As a result, it provides a more holistic benchmark than peer or sector averages alone.

Comparing Iwatani’s PE of 10.68x to its Fair Ratio of 15.29x suggests the stock is trading at a noticeable discount and may be undervalued, which could offer potential upside for investors seeking value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Iwatani Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you build a story about a company, integrating your personal view on its business prospects with financial forecasts and fair value estimates. By linking Iwatani’s unique story to specific projections for revenue, earnings, and margins, Narratives turn raw data into actionable insight.

On Simply Wall St’s Community page, Narratives make this process intuitive and accessible, giving millions of investors a platform to set out and compare different viewpoints. With Narratives, you can more clearly see the relationship between your calculated Fair Value and the current Price. As new information arrives, these forecasts update automatically, keeping your investment outlook fresh and relevant.

For example, two investors in the Community might see Iwatani very differently. One could predict robust hydrogen growth and set a fair value well above ¥2,000, while another expects industry headwinds and estimates the fair value below ¥1,200. Narratives help you translate your story and conviction into better investment decisions.

Do you think there's more to the story for Iwatani? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8088

Iwatani

Engages in supplying gases and energy in Japan, China, Taiwan, South Korea, Singapore, Thailand, Malaysia, Indonesia, Vietnam, the United States, and Australia.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives