- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600865

Three Undiscovered Gems in Global Markets with Promising Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major stock indices, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 stood out with gains despite broader market challenges, including trade tensions and policy uncertainties. As investors navigate these volatile conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering hidden opportunities in the global markets.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Decora | 22.54% | 13.65% | 13.80% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Baida GroupLtd (SHSE:600865)

Simply Wall St Value Rating: ★★★★★★

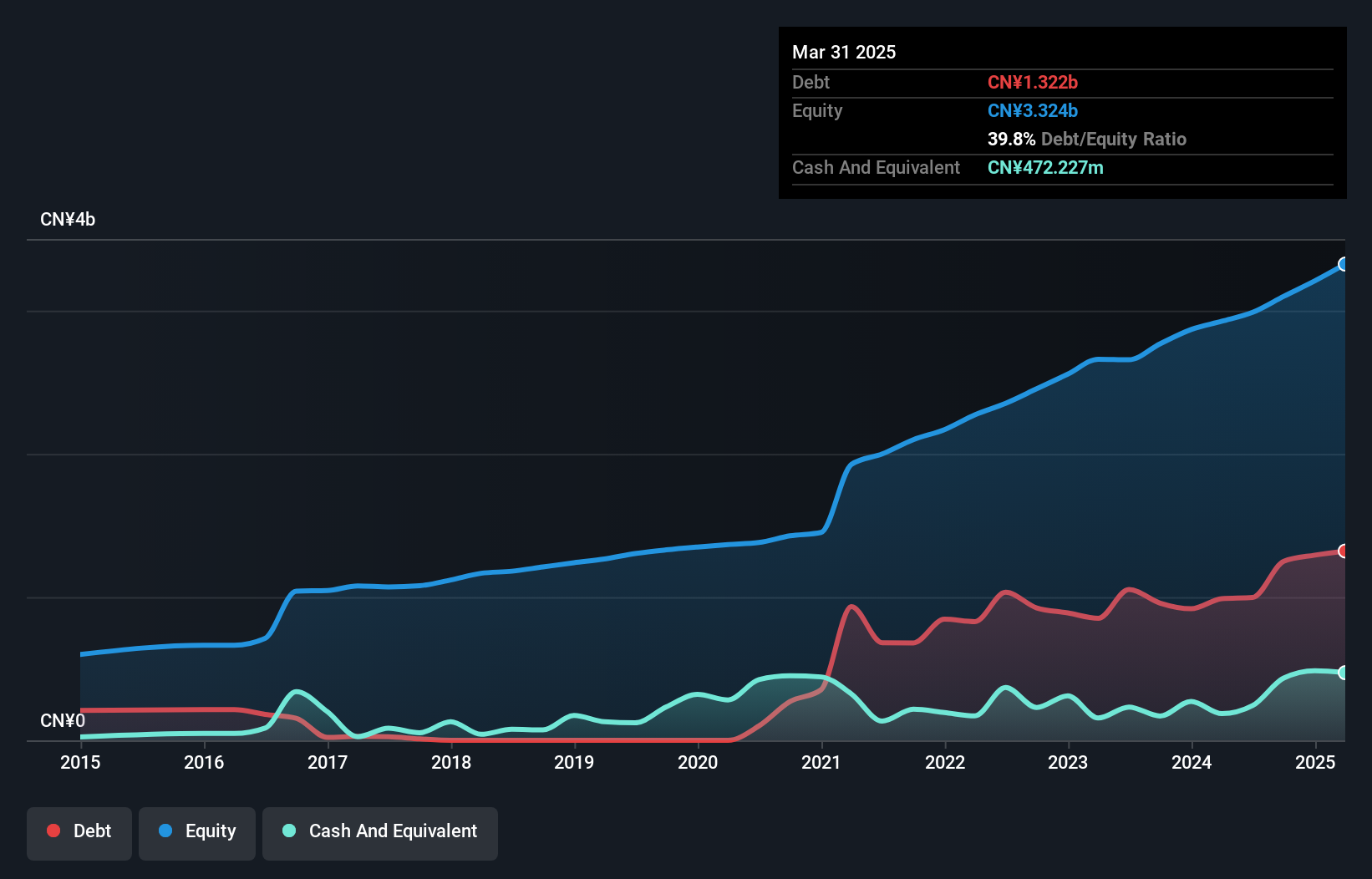

Overview: Baida Group Co., Ltd focuses on operating department stores under the Hangzhou Department Store brand in China, with a market capitalization of CN¥4.25 billion.

Operations: Baida Group's revenue is primarily derived from its department store operations under the Hangzhou Department Store brand in China. The company has a market capitalization of CN¥4.25 billion.

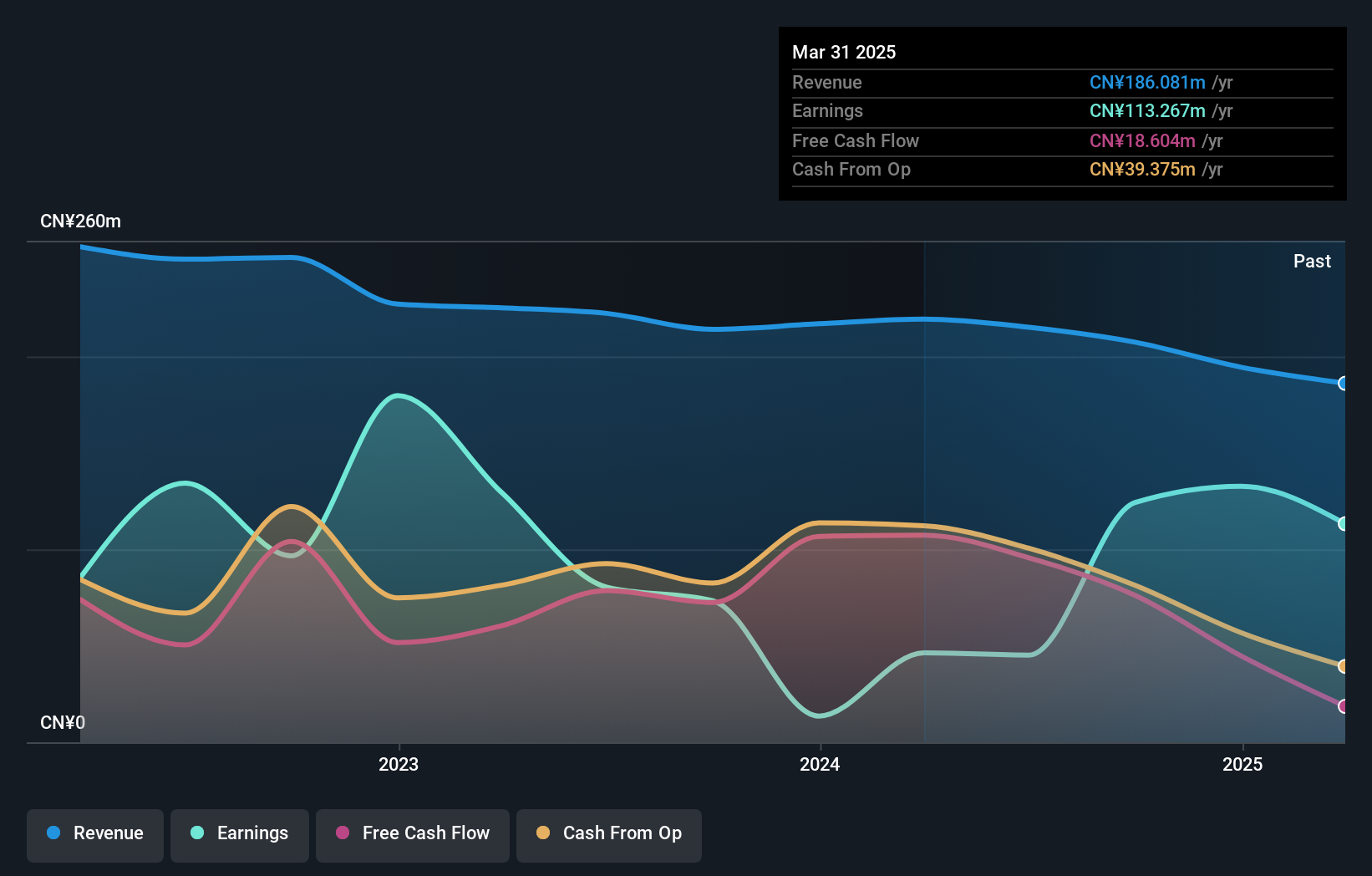

Baida Group Ltd., a small cap player in the retail sector, has shown impressive earnings growth of 878.2% over the past year, outpacing the industry average of -2.9%. Despite a revenue dip to CNY 194.43 million from CNY 216.95 million last year, net income surged to CNY 132.76 million from CNY 13.57 million, highlighting strong operational performance with basic earnings per share rising to CNY 0.35 from CNY 0.04 previously. The company is debt-free and boasts high-quality earnings with a price-to-earnings ratio of 35x, slightly undercutting the Chinese market's average of 36x.

- Navigate through the intricacies of Baida GroupLtd with our comprehensive health report here.

Explore historical data to track Baida GroupLtd's performance over time in our Past section.

Hubei Zhenhua ChemicalLtd (SHSE:603067)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hubei Zhenhua Chemical Co., Ltd. focuses on the research, development, manufacture, and sale of chromium salt and related products mainly in China, with a market cap of CN¥8.89 billion.

Operations: The company generates revenue primarily from the sale of chromium salt products in China. Its financial performance is highlighted by a notable net profit margin trend, reflecting its efficiency in managing costs relative to its revenue.

Hubei Zhenhua Chemical Ltd. seems to be carving out a promising niche with its earnings growing 15% over the past year, surpassing the chemicals industry's -4%. The company’s net debt to equity ratio stands at a satisfactory 26.3%, suggesting prudent financial management. Additionally, interest payments are well covered by EBIT at 17.5x, indicating strong operational efficiency. With a price-to-earnings ratio of 21.9x below the CN market average of 36.4x, it appears attractively valued for potential investors seeking growth opportunities in this sector. Recent buybacks completed in February reflect confidence in its long-term prospects and shareholder value enhancement strategy.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

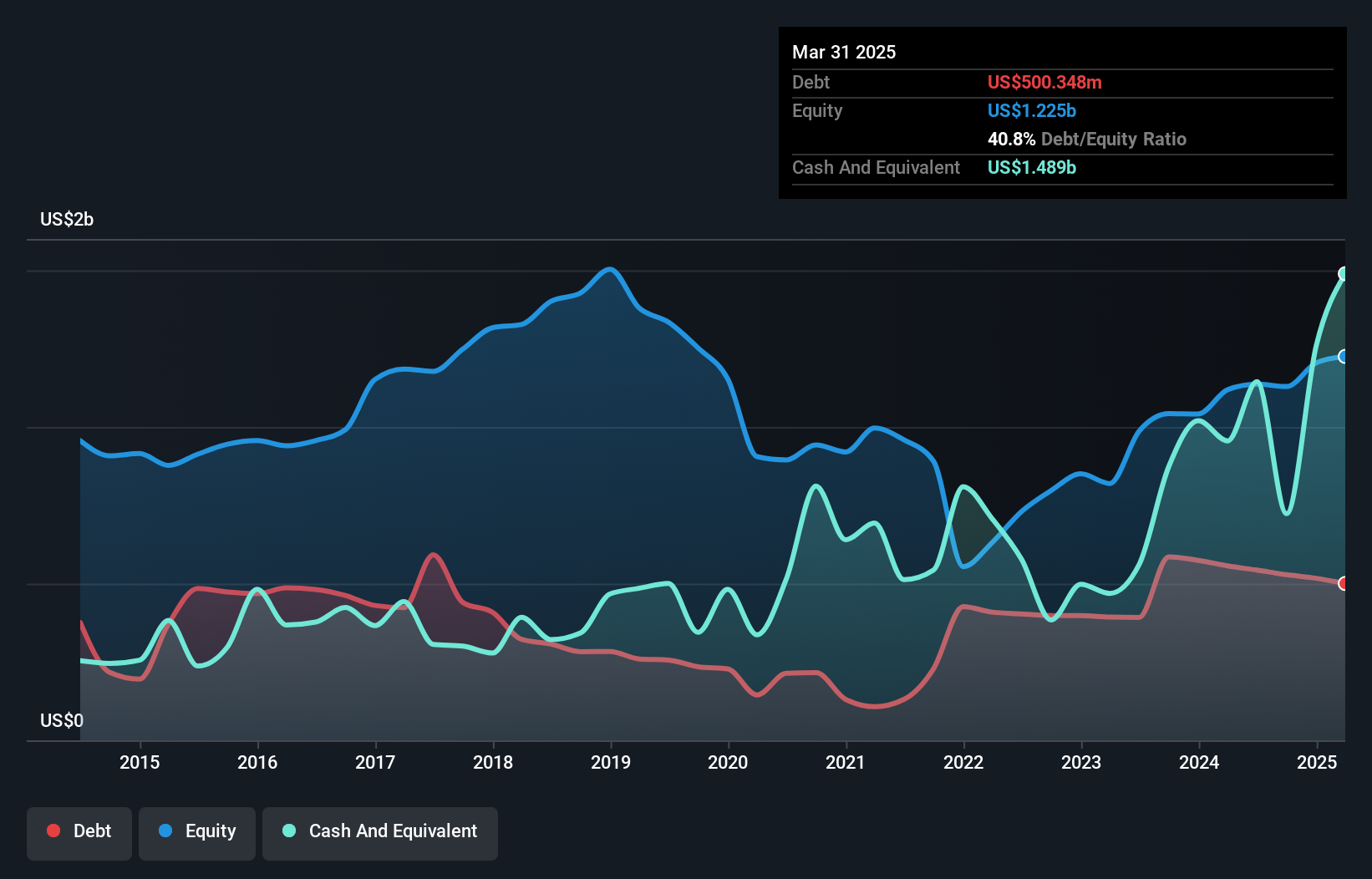

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems for the offshore oil and gas industries across various international locations, with a market cap of ¥246.93 billion.

Operations: Revenue streams for MODEC primarily stem from its engineering, procurement, construction, and installation services within the offshore oil and gas sector. The company operates in multiple international locations including Brazil, Guyana, Senegal, Ghana, Ivory Coast, and Mexico.

MODEC's recent announcement of a 20-year contract with Shell for the FPSO Gato do Mato highlights its strategic position in Brazil's oil sector. The company's earnings surged by 155% last year, outpacing the energy services industry. Despite a volatile share price, MODEC trades at 53% below its estimated fair value, suggesting potential upside. With interest payments well covered by EBIT and cash exceeding total debt, financial stability seems solid. However, the debt-to-equity ratio has risen from 20% to 43% over five years. Looking ahead, earnings are expected to decline slightly by an average of 1.4% annually over three years.

Turning Ideas Into Actions

- Access the full spectrum of 3269 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Baida GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600865

Baida GroupLtd

Primarily operates department stores under the Hangzhou Department Store name in China.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)