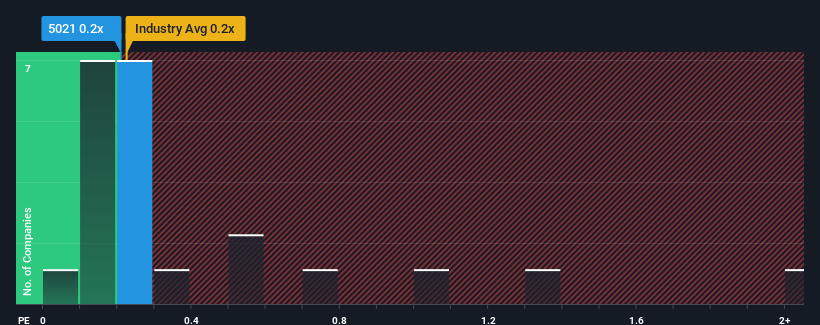

With a median price-to-sales (or "P/S") ratio of close to 0.2x in the Oil and Gas industry in Japan, you could be forgiven for feeling indifferent about Cosmo Energy Holdings Co., Ltd.'s (TSE:5021) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Cosmo Energy Holdings

What Does Cosmo Energy Holdings' P/S Mean For Shareholders?

There hasn't been much to differentiate Cosmo Energy Holdings' and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Cosmo Energy Holdings will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Cosmo Energy Holdings will help you uncover what's on the horizon.How Is Cosmo Energy Holdings' Revenue Growth Trending?

Cosmo Energy Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 16% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should demonstrate some strength in company's business, generating growth of 0.8% each year as estimated by the six analysts watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 2.3% per annum, that would be a solid result.

Despite the marginal growth, we find it odd that Cosmo Energy Holdings is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cosmo Energy Holdings currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Cosmo Energy Holdings is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5021

Cosmo Energy Holdings

Through its subsidiaries, engages in the oil business in Japan and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives