- Japan

- /

- Oil and Gas

- /

- TSE:5020

Will Liquid Hydrogen Production in Australia Change ENEOS Holdings' (TSE:5020) Energy Transition Narrative?

Reviewed by Sasha Jovanovic

- ENEOS Holdings recently began testing large-scale production of liquid hydrogen in Australia, marking an important development in its renewable energy initiatives.

- This project positions ENEOS Holdings to align closely with global trends favoring hydrogen as a sustainable energy solution for the future.

- We'll look at how advancing liquid hydrogen production could strengthen ENEOS Holdings' investment narrative and shift its energy transition outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ENEOS Holdings Investment Narrative Recap

To be a shareholder in ENEOS Holdings, you need to believe that the company's energy transition strategy can offset earnings volatility tied to commodity prices and margin pressures from its traditional oil and gas business. The recent move to test liquid hydrogen production in Australia is a milestone for ENEOS’s renewable energy ambitions, but it does not immediately address the main short term catalyst, earnings stabilization amidst fluctuating resource prices, or mitigate the most pressing risk of revenue swings from these variables. Among recent announcements, the update to earnings guidance provided on 8 August 2025 stands out as particularly relevant in this context. The reaffirmed revenue and profit guidance reflects management’s current expectations, but with persistent risks from shifting resource prices and currency movements, the near-term impact of the hydrogen project may be limited in shaping financial performance. Yet, investors should also be aware that despite green energy developments, the company’s earnings still remain exposed to...

Read the full narrative on ENEOS Holdings (it's free!)

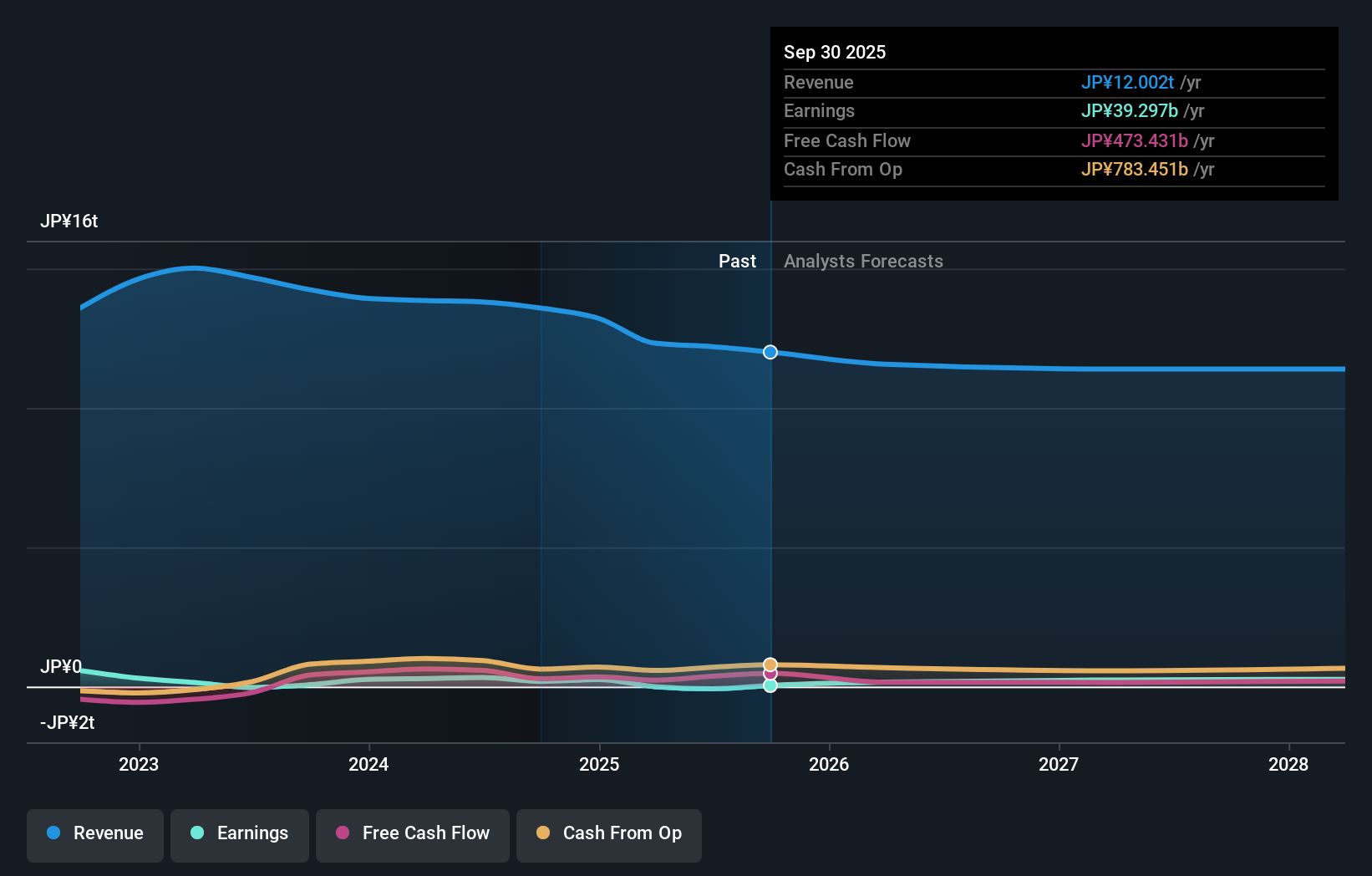

ENEOS Holdings is projected to generate ¥11,410.5 billion in revenue and ¥262.7 billion in earnings by 2028. This outlook is based on a forecast annual revenue decline of 2.2% and an earnings increase of ¥344.1 billion from the current earnings of ¥-81.4 billion.

Uncover how ENEOS Holdings' forecasts yield a ¥957 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community members value ENEOS Holdings between ¥905.73 and ¥1,120, with estimates spread across ten price buckets. While this diversity highlights differing views on future growth, operating profit volatility remains an area you should review as it could influence both risks and opportunities for the stock.

Explore 3 other fair value estimates on ENEOS Holdings - why the stock might be worth 6% less than the current price!

Build Your Own ENEOS Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ENEOS Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free ENEOS Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ENEOS Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENEOS Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5020

ENEOS Holdings

Through its subsidiaries, operates in the energy, oil and natural gas exploration and production, and metals businesses in Japan, China, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives