- South Korea

- /

- Insurance

- /

- KOSE:A005830

3 Reliable Dividend Stocks Yielding Up To 9.5%

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable fluctuations, with U.S. stocks seeing broad-based declines despite some recovery efforts. Amid these volatile conditions, investors often turn to dividend stocks as a potential source of steady income and stability. A good dividend stock typically offers consistent payouts and resilience in uncertain economic climates, making them appealing in today's market environment where interest rate paths remain unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

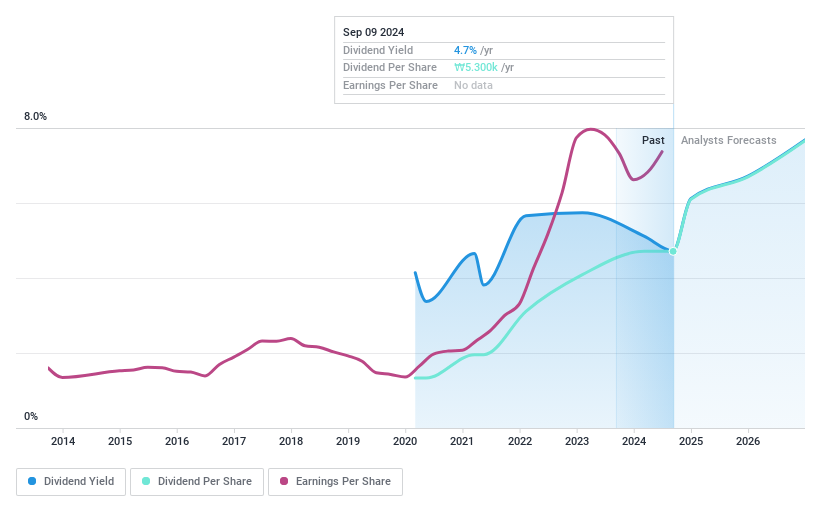

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market cap of approximately ₩6.29 billion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily derived from its Non-Life Insurance Sector at ₩19.44 billion, followed by the Life Insurance Sector at ₩1.49 billion and the Installment Finance Sector at ₩39.43 million.

Dividend Yield: 5.1%

DB Insurance offers a compelling dividend profile with stable and growing payouts, despite a short history of less than 10 years. The dividends are well-covered by earnings and cash flows, boasting low payout ratios of 15.9% and 7.9%, respectively. Trading at an estimated 85.2% below fair value, the stock presents good relative value compared to peers. Its dividend yield is in the top quartile of the KR market, enhancing its appeal for income-focused investors.

- Click here to discover the nuances of DB Insurance with our detailed analytical dividend report.

- According our valuation report, there's an indication that DB Insurance's share price might be on the cheaper side.

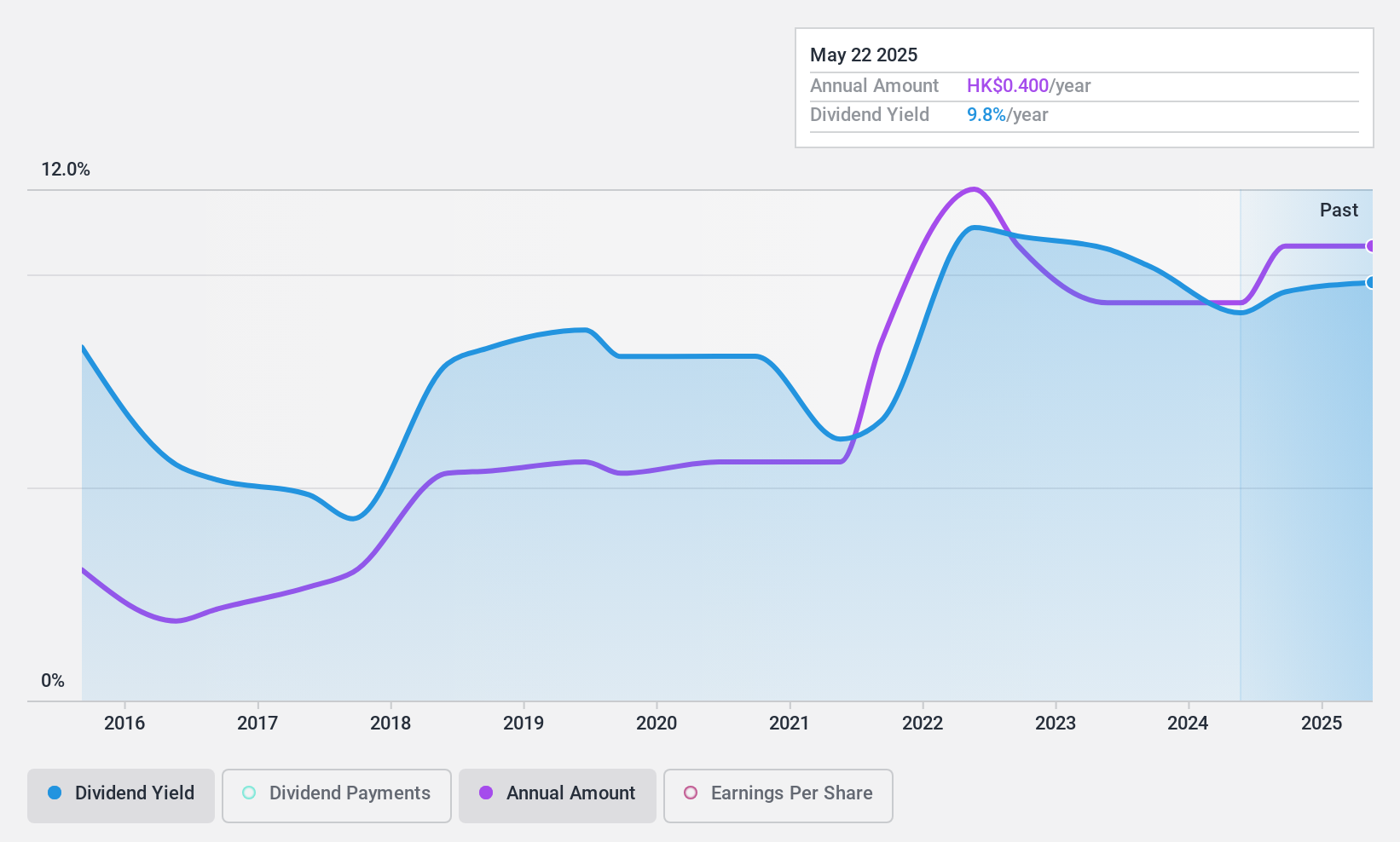

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S.A.S. Dragon Holdings Limited is an investment holding company that distributes electronic components and semiconductor products across Hong Kong, Mainland China, Taiwan, the United States of America, Vietnam, Singapore, Macao, and internationally with a market cap of HK$2.63 billion.

Operations: S.A.S. Dragon Holdings Limited generates revenue of HK$26.73 billion from its distribution of electronic components and semiconductor products across various regions worldwide.

Dividend Yield: 9.5%

S.A.S. Dragon Holdings' dividend yield of 9.52% is among the top in Hong Kong, but its sustainability is questionable as dividends aren't covered by free cash flows and have been volatile over the past decade. Despite a reasonable payout ratio of 54.1%, earnings growth of 24.7% hasn't stabilized payouts, making them unreliable. The stock trades at a significant discount to estimated fair value, presenting potential value amidst these concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of S.A.S. Dragon Holdings.

- Our valuation report unveils the possibility S.A.S. Dragon Holdings' shares may be trading at a discount.

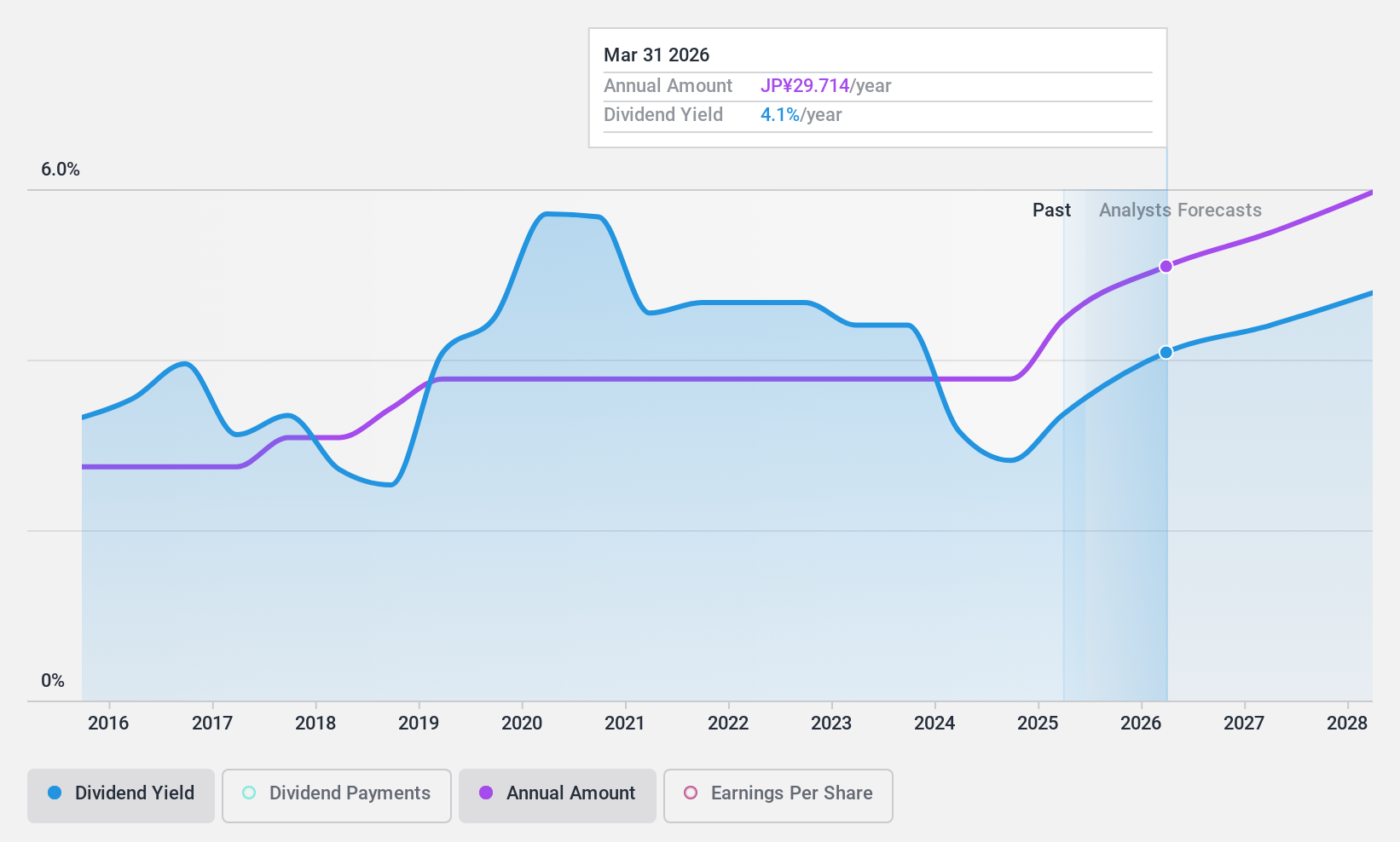

ENEOS Holdings (TSE:5020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ENEOS Holdings, Inc. operates in the energy, oil and natural gas exploration and production, and metals sectors across Japan, China, Asia, and internationally with a market cap of ¥2.26 trillion.

Operations: ENEOS Holdings generates revenue through its energy, oil and natural gas exploration and production, and metals businesses across various regions including Japan, China, Asia, and other international markets.

Dividend Yield: 3.2%

ENEOS Holdings has a stable dividend history with consistent increases over the past decade, recently raising its year-end dividend forecast to JPY 26 per share. The dividends are well-covered by earnings and cash flows, with payout ratios of 17.6% and 25.7%, respectively. Despite a lower yield of 3.17% compared to top-tier Japanese payers, ENEOS offers reliable payouts supported by strong financial performance and strategic buybacks totaling ¥118 billion this year.

- Dive into the specifics of ENEOS Holdings here with our thorough dividend report.

- Upon reviewing our latest valuation report, ENEOS Holdings' share price might be too optimistic.

Where To Now?

- Gain an insight into the universe of 1956 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005830

DB Insurance

Provides various insurance products and services in South Korea.

Very undervalued with proven track record and pays a dividend.