- Japan

- /

- Oil and Gas

- /

- TSE:5019

Idemitsu KosanLtd (TSE:5019) Board Meeting To Consider Fuji Oil Share Acquisition

Reviewed by Simply Wall St

Idemitsu Kosan Ltd (TSE:5019) recently announced a significant corporate event, with the board approving the acquisition of shares in Fuji Oil Company through a tender offer. Over the past quarter, the company's share price increased by 13%, aligning with broader market trends marked by U.S. stock indexes reaching record highs amid optimism over potential Federal Reserve rate cuts. While Idemitsu’s acquisition decision may align with strategic growth, its stock performance is consistent with overall market movement, suggesting the increase is broadly influenced by favorable market conditions rather than company-specific news alone.

Idemitsu KosanLtd has 4 possible red flags we think you should know about.

Idemitsu Kosan Ltd's shares delivered a substantial total return of very large over the past five years, illustrating significant growth. However, when compared to the past year's performance against the JP market and the JP Oil and Gas industry, the company's recent performance is less impressive, having underperformed both, which recorded returns of 23.3% and 20.9% respectively.

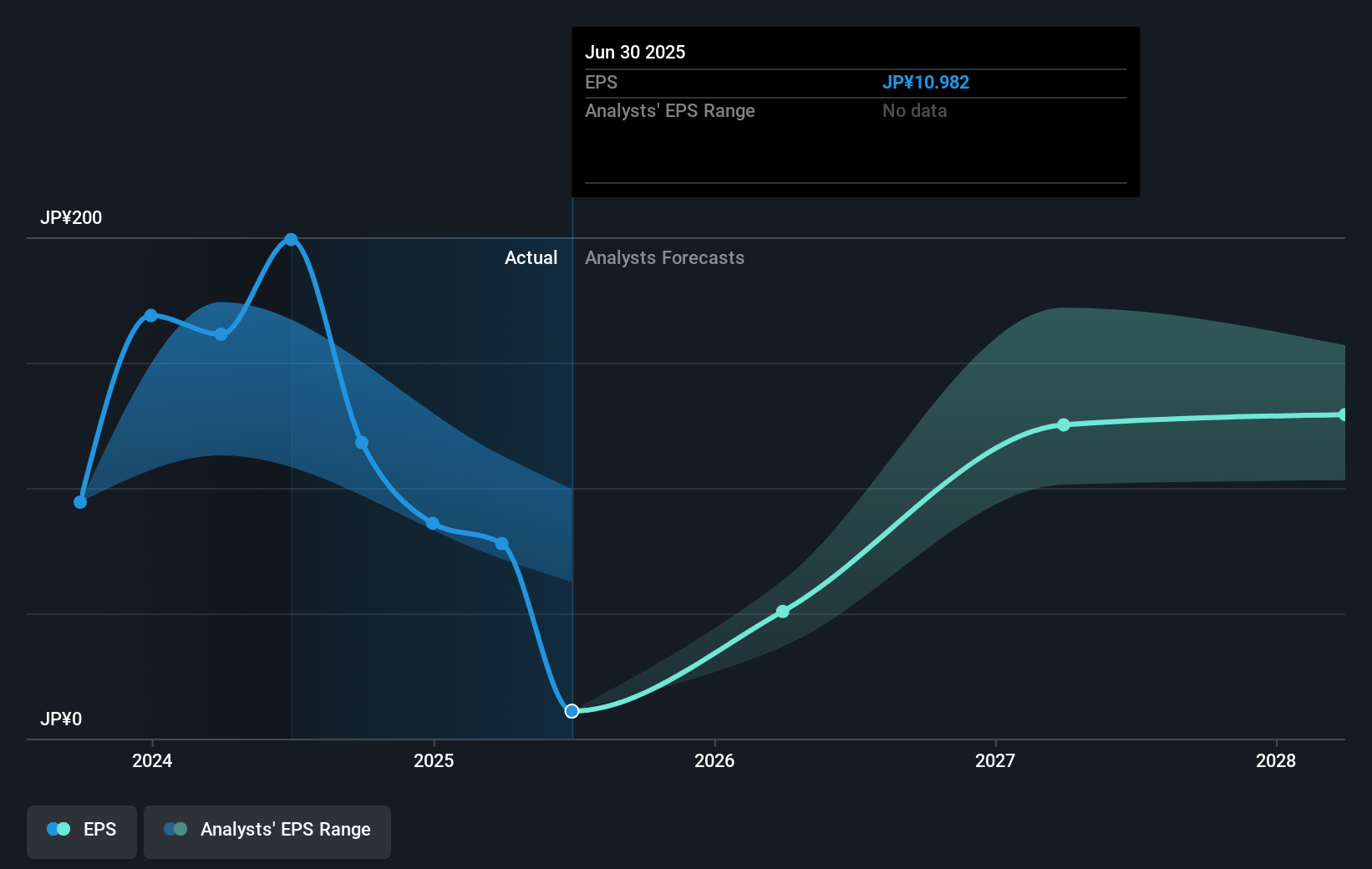

The recent acquisition announcement and resulting short-term share price movement could potentially influence the company's revenue and future earnings forecasts. These strategic decisions may bolster growth, yet the expected decline in revenue by 2.2% annually over the next three years and earnings growth expectations show mixed projections. Additionally, the current share price of ¥1001.00, which is slightly below the consensus price target of ¥1027.14, indicates a minor discount, highlighting restrained market optimism compared to analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5019

Idemitsu KosanLtd

Engages in the petroleum, basic chemicals, functional materials, power and renewable energy, and resources businesses in Japan, rest of Asia, Oceania, North America, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives