- Japan

- /

- Oil and Gas

- /

- TSE:5010

Some Nippon Seiro Co., Ltd. (TSE:5010) Shareholders Look For Exit As Shares Take 34% Pounding

Nippon Seiro Co., Ltd. (TSE:5010) shares have had a horrible month, losing 34% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 34% in the last year.

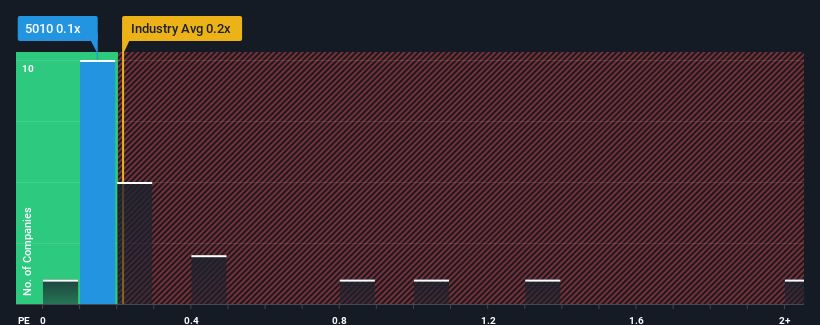

Even after such a large drop in price, there still wouldn't be many who think Nippon Seiro's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Japan's Oil and Gas industry is similar at about 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Nippon Seiro

How Nippon Seiro Has Been Performing

For example, consider that Nippon Seiro's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nippon Seiro's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nippon Seiro's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's top line. As a result, revenue from three years ago have also fallen 7.5% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 5.7% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's somewhat alarming that Nippon Seiro's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Nippon Seiro looks to be in line with the rest of the Oil and Gas industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We find it unexpected that Nippon Seiro trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Nippon Seiro (2 don't sit too well with us) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Seiro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5010

Nippon Seiro

Manufactures, processes, and sells petroleum waxes, physically and chemically converted wax products, and fuel oil in Japan, North America, rest of Asia, and internationally.

Good value with proven track record.

Market Insights

Community Narratives