Discovering None And 2 Other Promising Small Cap Gems With Strong Metrics

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility, driven by concerns over AI competition and shifting economic indicators, small-cap stocks have been navigating a complex landscape. The S&P 600 Index, which tracks these smaller companies, has seen mixed results as investors weigh the impact of stable interest rates and geopolitical uncertainties on growth prospects. In such an environment, identifying promising small-cap gems requires a keen eye for strong financial metrics and resilience in the face of broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

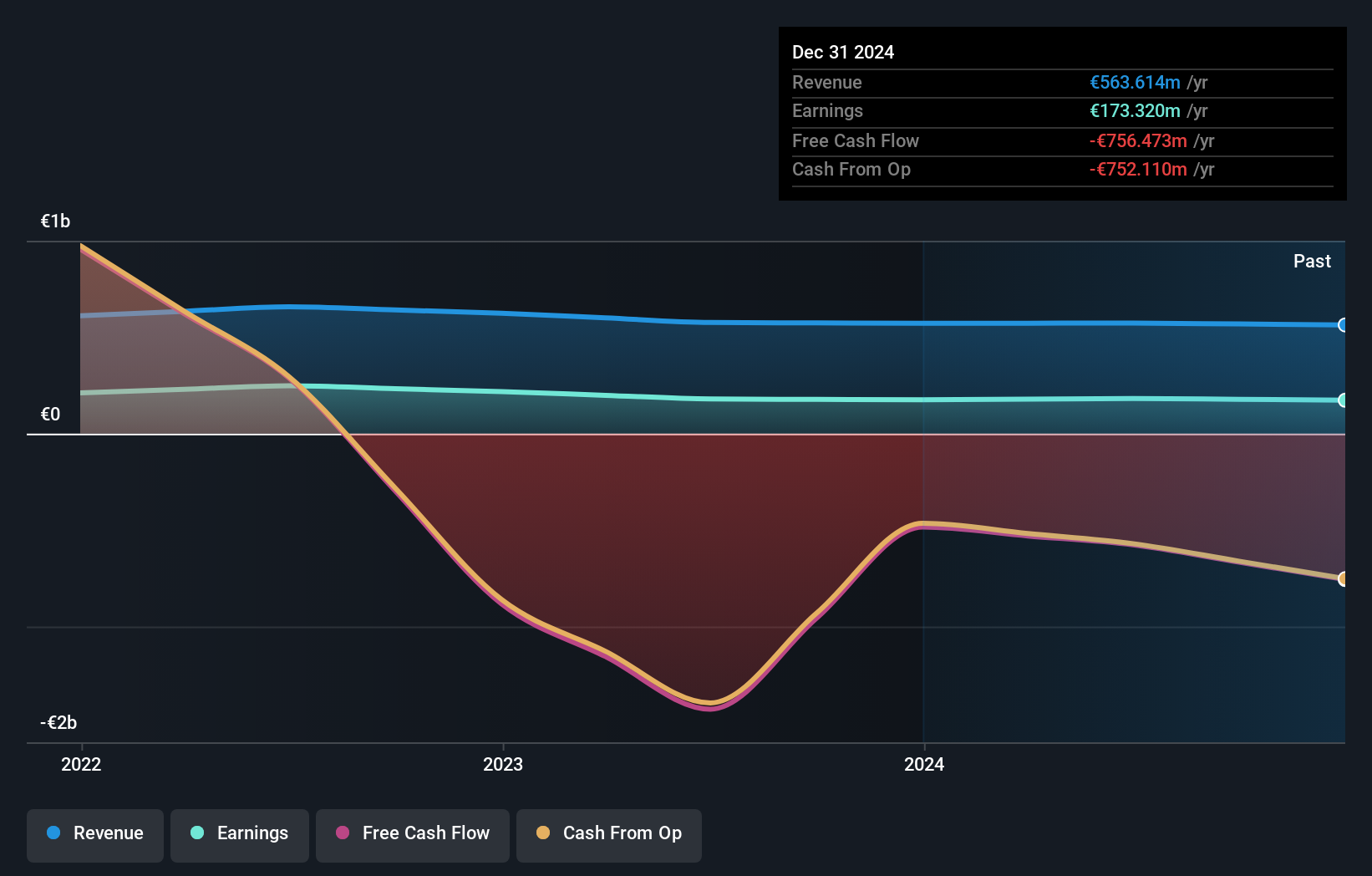

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse clientele in France, with a market cap of approximately €1.12 billion.

Operations: The company generates revenue through a diverse portfolio of banking products and services catering to various customer segments in France. With a market cap of approximately €1.12 billion, it focuses on serving individuals, professionals, businesses, and community clients.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc, with total assets of €35.3B and equity of €5.2B, appears undervalued at 59.1% below its estimated fair value. The bank's earnings growth over the past five years has been steady at 4.2% annually, although recent growth was just 1.3%, lagging behind the industry average of 5.3%. It maintains a healthy balance with a sufficient allowance for bad loans at 133%, covering its non-performing loans ratio of just 1.4%. With customer deposits making up 94% of its liabilities, it relies on low-risk funding sources for stability.

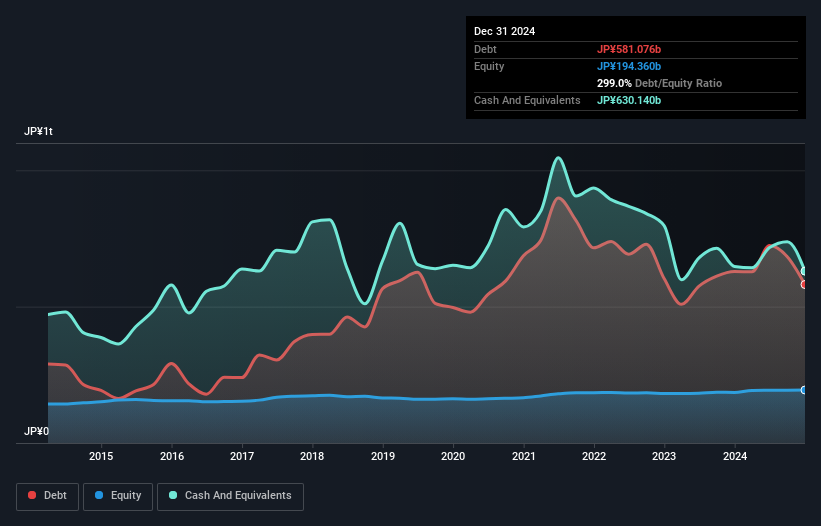

Tokai Tokyo Financial Holdings (TSE:8616)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tokai Tokyo Financial Holdings, Inc. is a securities company operating in Japan with a market cap of ¥127.57 billion.

Operations: Tokai Tokyo Financial Holdings generates revenue primarily through its securities operations in Japan. The company's net profit margin is a key financial metric to consider when evaluating its performance.

Tokai Tokyo Financial Holdings, a dynamic player in the financial sector, has demonstrated substantial earnings growth of 64% over the past year, outpacing its industry peers. The company seems to have reduced its debt to equity ratio from 307% to 299% over five years, indicating improved financial stability. With a price-to-earnings ratio of 10x, it trades at an appealing value compared to Japan's market average of 13.5x. Tokai Tokyo's high-quality earnings and positive free cash flow further strengthen its investment appeal as it navigates through competitive capital markets with promising prospects for continued growth.

- Click to explore a detailed breakdown of our findings in Tokai Tokyo Financial Holdings' health report.

Gain insights into Tokai Tokyo Financial Holdings' past trends and performance with our Past report.

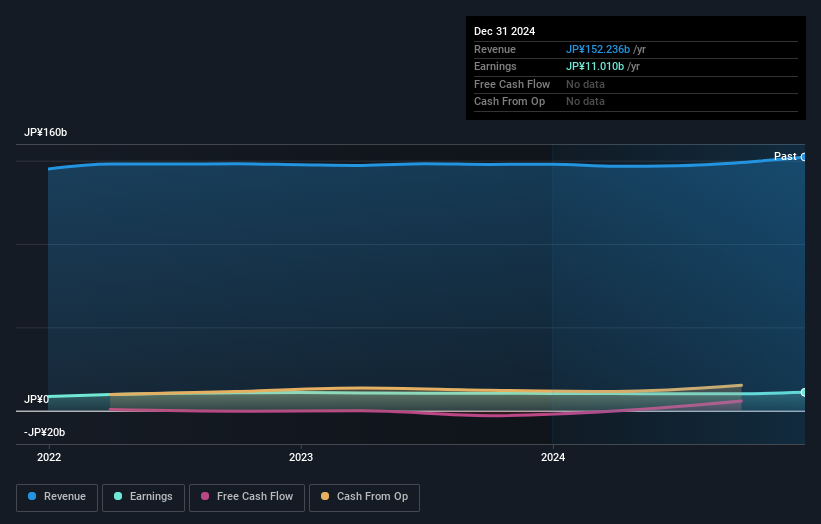

Yellow Hat (TSE:9882)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yellow Hat Ltd. operates a store network specializing in the sale and installation of car goods and parts, with a market cap of ¥123.45 billion.

Operations: The company generates revenue primarily from the sale and installation of car goods and parts. It has a market cap of ¥123.45 billion.

Yellow Hat, a niche player in the specialty retail sector, has demonstrated solid financial performance with a price-to-earnings ratio of 11.2x, which is favorable compared to the JP market's 13.5x. The company boasts high-quality earnings and has seen its earnings grow by 6.6% over the past year, outpacing industry growth. Despite an increase in its debt-to-equity ratio from 0% to 15.8% over five years, Yellow Hat maintains more cash than total debt and covers interest payments comfortably. Recently, it completed a share buyback program repurchasing about 3.12% of shares for ¥3,665 million (US$).

- Delve into the full analysis health report here for a deeper understanding of Yellow Hat.

Assess Yellow Hat's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 4688 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRLA

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Provides various banking products and services to individuals, professionals and associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives