- Japan

- /

- Diversified Financial

- /

- TSE:8596

It's Down 26% But Kyushu Leasing Service Co., Ltd. (TSE:8596) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Kyushu Leasing Service Co., Ltd. (TSE:8596) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop has obliterated the annual return, with the share price now down 7.8% over that longer period.

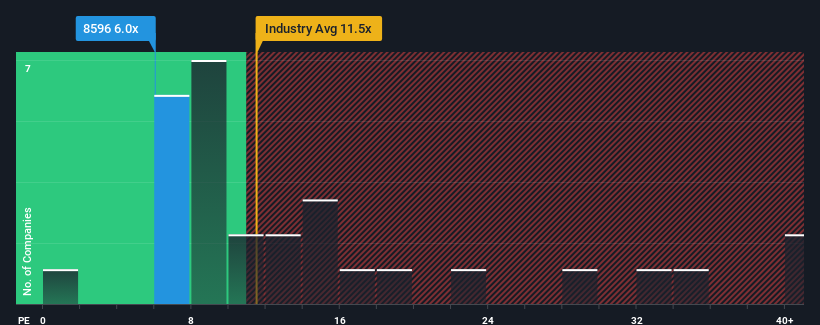

Since its price has dipped substantially, Kyushu Leasing Service's price-to-earnings (or "P/E") ratio of 6x might make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For example, consider that Kyushu Leasing Service's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Kyushu Leasing Service

Does Growth Match The Low P/E?

Kyushu Leasing Service's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 48%. Still, the latest three year period has seen an excellent 65% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 9.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Kyushu Leasing Service is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Shares in Kyushu Leasing Service have plummeted and its P/E is now low enough to touch the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kyushu Leasing Service currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Kyushu Leasing Service has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you're unsure about the strength of Kyushu Leasing Service's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Leasing Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8596

Kyushu Leasing Service

Operates as a financial services company in Japan.

Established dividend payer and good value.

Market Insights

Community Narratives