- Japan

- /

- Diversified Financial

- /

- TSE:8439

Market Might Still Lack Some Conviction On Tokyo Century Corporation (TSE:8439) Even After 36% Share Price Boost

Tokyo Century Corporation (TSE:8439) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

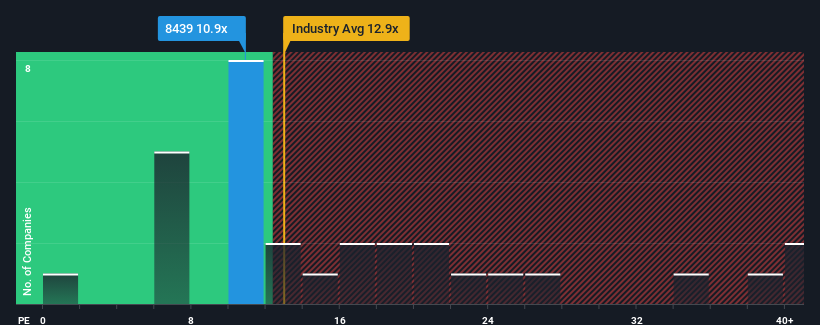

In spite of the firm bounce in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Tokyo Century as an attractive investment with its 10.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Tokyo Century as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Tokyo Century

How Is Tokyo Century's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Tokyo Century's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 81% last year. The latest three year period has also seen an excellent 46% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 9.8% each year during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 9.4% each year growth forecast for the broader market.

With this information, we find it odd that Tokyo Century is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Tokyo Century's P/E?

Tokyo Century's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Tokyo Century's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 2 warning signs for Tokyo Century (1 makes us a bit uncomfortable!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Tokyo Century, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tokyo Century might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8439

Tokyo Century

Provides equipment leasing, mobility and fleet management, specialty financing, and international businesses in Japan, the United States, Ireland, The United Kingdom, Germany, Singapore, Malaysia, Thailand, China, the Philippines, Panama, Mexico, Brazil, and internationally.

Undervalued established dividend payer.