- Japan

- /

- Capital Markets

- /

- TSE:7342

3 Growth Companies Insiders Are Banking On

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are keenly observing the performance of major indices, which have shown moderate gains despite recent setbacks. In this environment, growth companies with high insider ownership can be particularly intriguing as they often signal strong internal confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

Underneath we present a selection of stocks filtered out by our screen.

Esker (ENXTPA:ALESK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esker SA operates a cloud platform catering to finance, procurement, and customer service professionals across various regions globally, with a market cap of €1.55 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated €203.05 million.

Insider Ownership: 11.1%

Revenue Growth Forecast: 11.8% p.a.

Esker reported EUR 51 million in Q3 2024 sales, a 17% increase from the previous year. Revenue growth is projected at 11.8% annually, outpacing the French market's 5.5%. Earnings are expected to grow significantly at 26.7% per year, exceeding the market's average of 12.3%. Despite these positive forecasts, Esker's return on equity is anticipated to be relatively low at 19.4%, and there has been no substantial insider trading activity recently.

- Get an in-depth perspective on Esker's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Esker's share price might be on the expensive side.

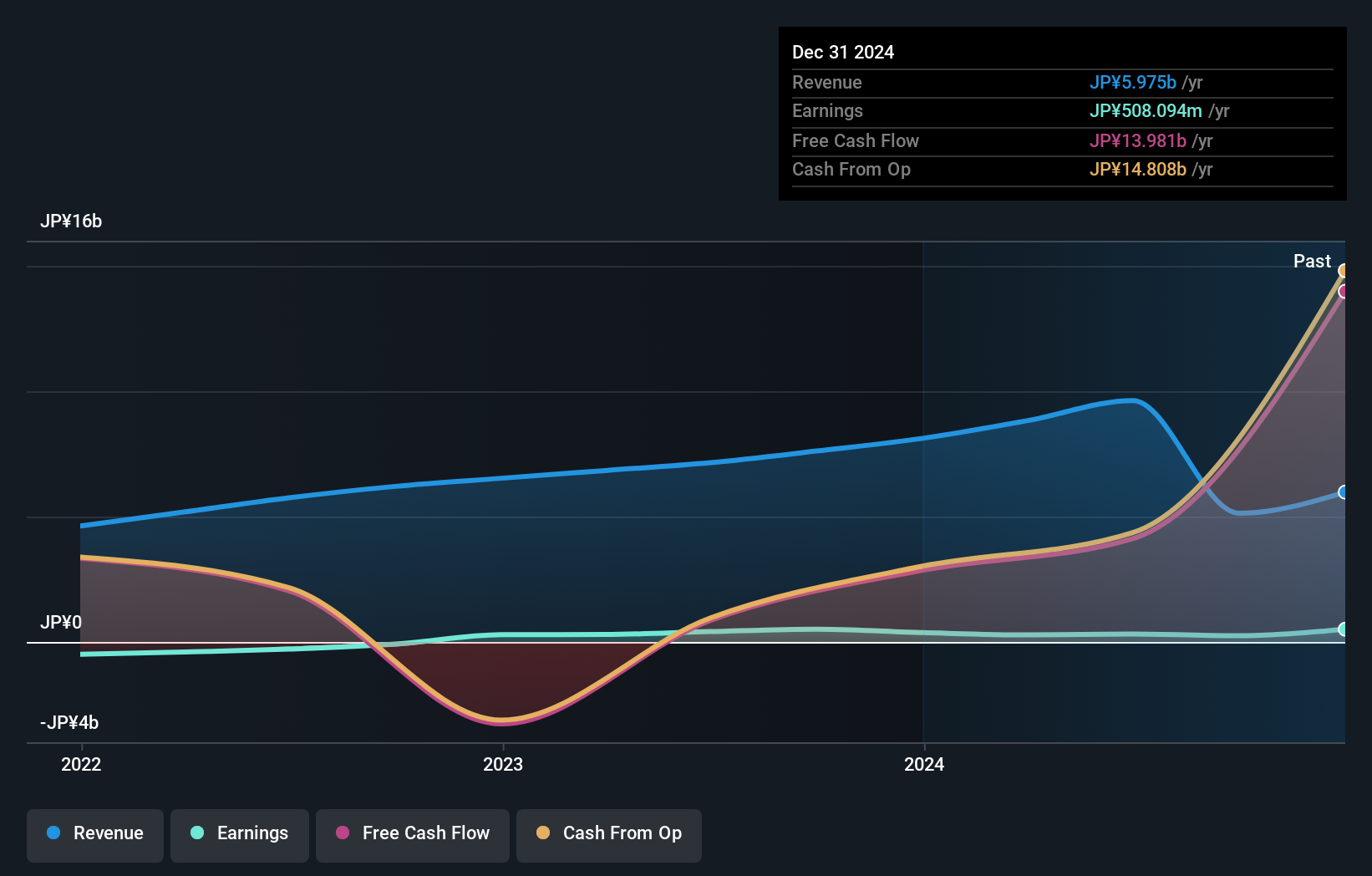

WealthNavi (TSE:7342)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WealthNavi Inc. develops and delivers an online asset management and risk management platform, with a market cap of ¥115.42 billion.

Operations: The company's revenue is primarily generated from its Robo-Advisor segment, amounting to ¥5.13 billion.

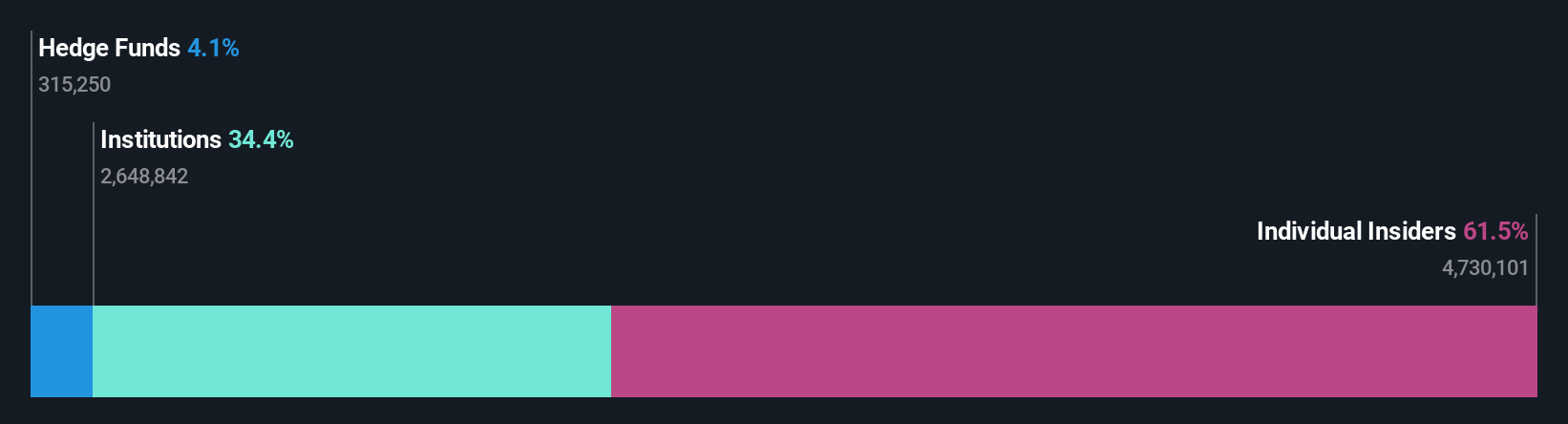

Insider Ownership: 17.4%

Revenue Growth Forecast: 27.2% p.a.

WealthNavi is poised for robust growth with earnings forecasted to increase by 85.8% annually, significantly outpacing the Japanese market's average. Revenue is also expected to grow at 27.2% per year, driven by new services like Robo-NISA and insurance advisory offerings. Despite recent shareholder dilution and a volatile share price, strategic moves such as MUFG Bank's proposed acquisition could enhance its market position and service expansion through smartphone apps.

- Delve into the full analysis future growth report here for a deeper understanding of WealthNavi.

- Insights from our recent valuation report point to the potential overvaluation of WealthNavi shares in the market.

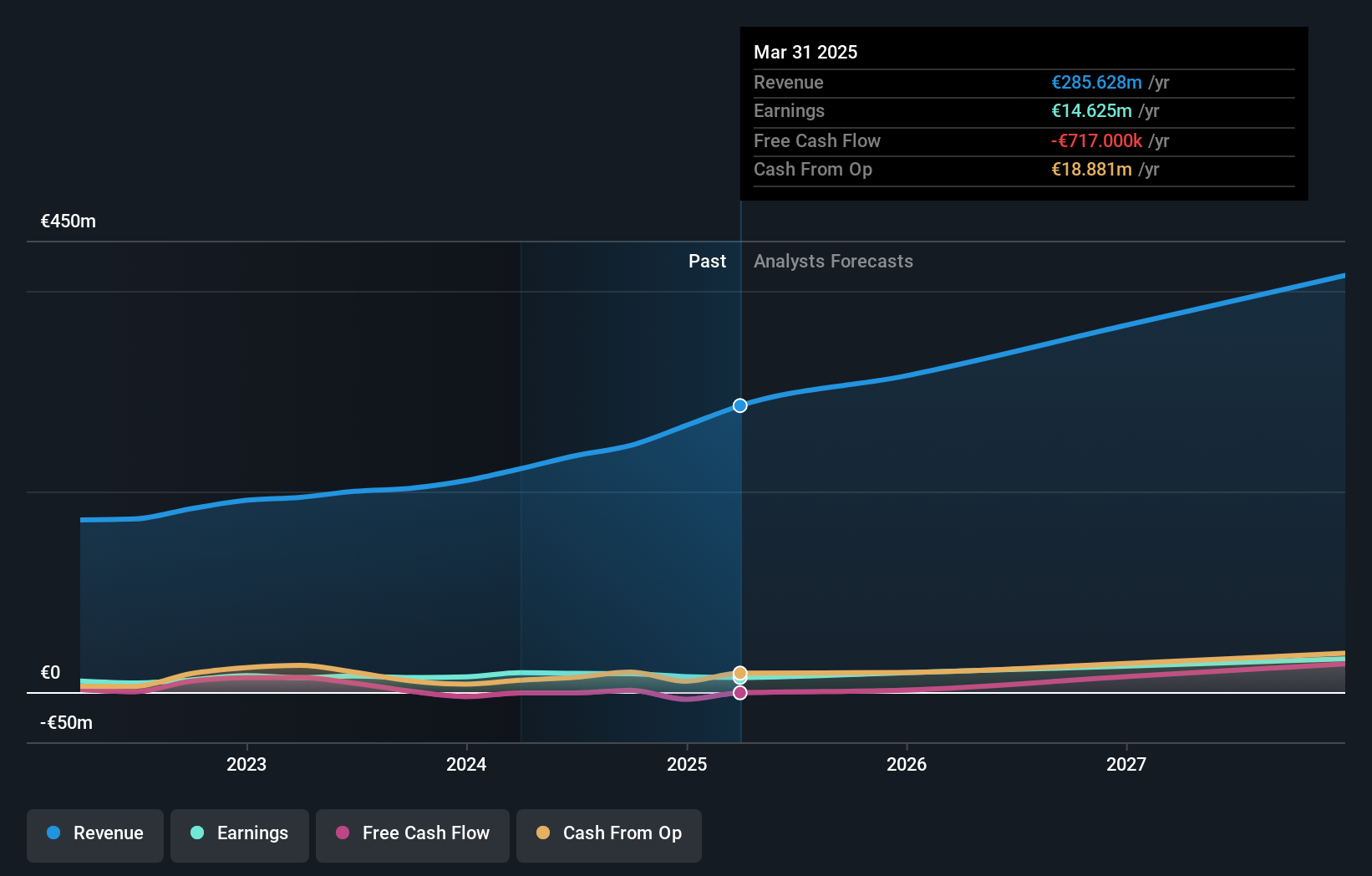

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of approximately €361.47 million.

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to €245.89 million.

Insider Ownership: 39.6%

Revenue Growth Forecast: 12.3% p.a.

init innovation in traffic systems is experiencing strong growth, with earnings forecasted to rise by 27.8% annually, outpacing the German market. Despite a decline in third-quarter net income to €3.32 million from €3.7 million the previous year, nine-month sales increased significantly to €178.12 million from €143.04 million. The stock trades at 25.5% below its estimated fair value and shows good relative value compared to peers, although its dividend is not well-covered by free cash flows.

- Click to explore a detailed breakdown of our findings in init innovation in traffic systems' earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of init innovation in traffic systems shares in the market.

Summing It All Up

- Investigate our full lineup of 1501 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WealthNavi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7342

WealthNavi

Develops and delivers an online asset management and risk management platform.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives