Entrust Inc. (TSE:7191) will increase its dividend from last year's comparable payment on the 4th of December to ¥12.50. This will take the annual payment to 3.9% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for Entrust

Entrust's Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Entrust was paying only paying out a fraction of earnings, but the payment was a massive 378% of cash flows. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

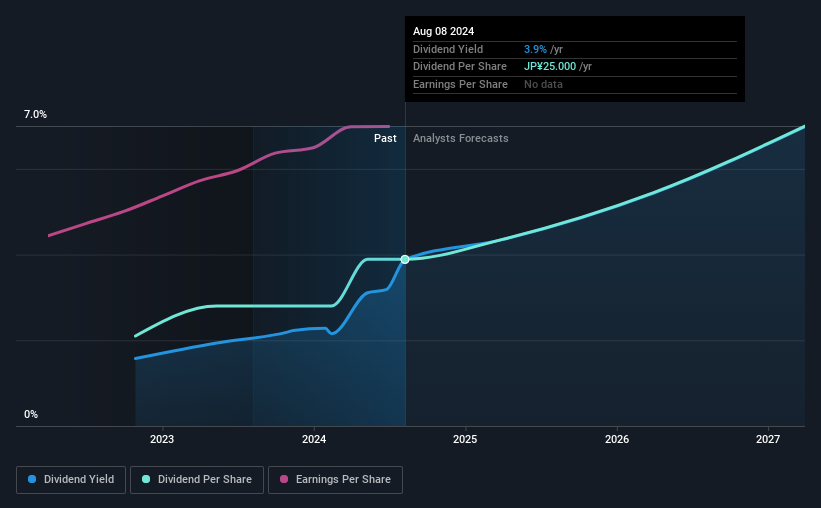

The next year is set to see EPS grow by 11.5%. If the dividend continues along recent trends, we estimate the payout ratio will be 35%, which is in the range that makes us comfortable with the sustainability of the dividend.

Entrust Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 2 years, which isn't that long in the grand scheme of things. Since 2022, the dividend has gone from ¥13.50 total annually to ¥25.00. This means that it has been growing its distributions at 36% per annum over that time. Entrust has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Entrust Could Grow Its Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Entrust has seen EPS rising for the last five years, at 9.5% per annum. Entrust definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Entrust that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Entrust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7191

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)