- Japan

- /

- Interactive Media and Services

- /

- TSE:4449

3 Growth Companies With High Insider Ownership And Up To 59% Earnings Growth

Reviewed by Simply Wall St

In a week marked by cautious Fed commentary and political uncertainty, global markets have experienced notable volatility, with U.S. stocks declining broadly despite a late-week rally. The Federal Reserve's recent rate cut and tempered expectations for future reductions have added to investor concerns, highlighting the importance of identifying robust growth companies with strong insider ownership as potential resilient investments in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Here's a peek at a few of the choices from the screener.

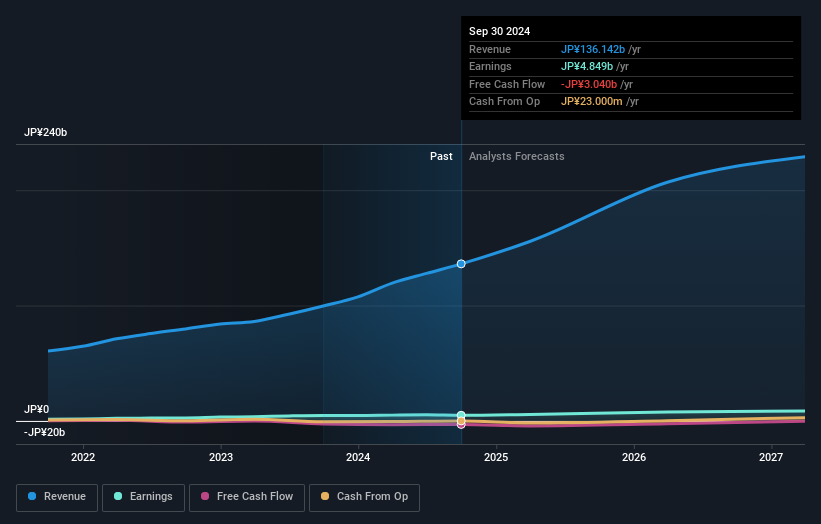

Komehyo HoldingsLtd (TSE:2780)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Komehyo Holdings Co., Ltd. operates in Japan, focusing on the purchase and sale of used and new products through its stores, with a market cap of ¥42.25 billion.

Operations: Revenue Segments (in millions of ¥): Retail sales: ¥52,000; Wholesale sales: ¥15,000; Online sales: ¥8,500. Komehyo Holdings Co., Ltd. generates revenue through retail sales of ¥52 billion, wholesale transactions amounting to ¥15 billion, and online sales totaling ¥8.5 billion.

Insider Ownership: 34.6%

Earnings Growth Forecast: 23.4% p.a.

Komehyo Holdings Ltd. exhibits significant growth potential, with earnings expected to grow 23.4% annually, outpacing the Japanese market's 7.9%. The company's revenue is forecast to increase by 21.2% per year, surpassing the market's average growth rate of 4.2%. Trading at a price-to-earnings ratio of 8.7x, it offers good value compared to peers and industry averages. However, its share price has been highly volatile recently and debt coverage by operating cash flow remains inadequate.

- Get an in-depth perspective on Komehyo HoldingsLtd's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Komehyo HoldingsLtd is trading behind its estimated value.

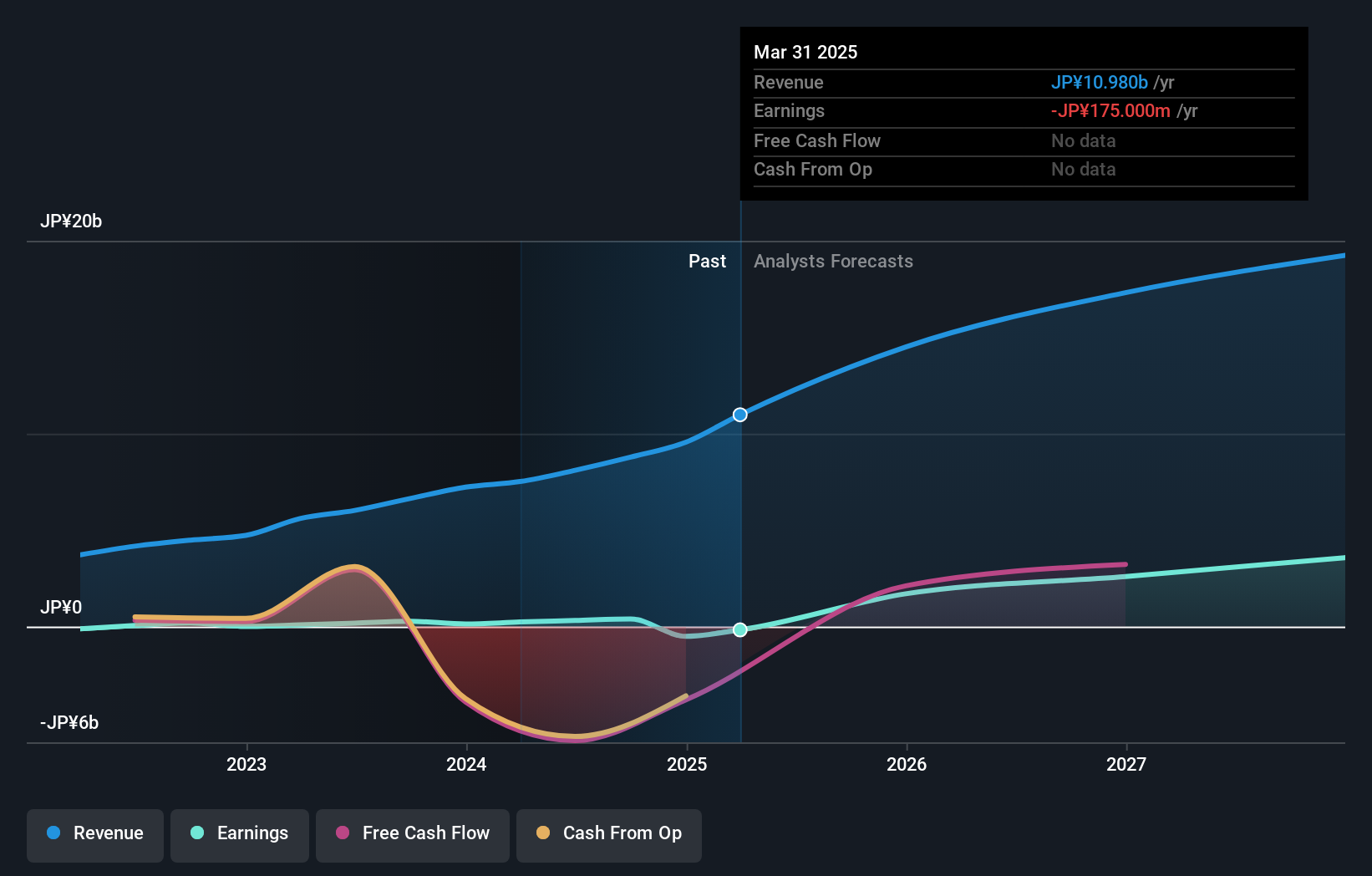

giftee (TSE:4449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: giftee Inc. operates in the Internet service sector in Japan with a market capitalization of ¥39.73 billion.

Operations: The company generates revenue from its E-Gift Platform Business, amounting to ¥8.78 billion.

Insider Ownership: 34.5%

Earnings Growth Forecast: 59.8% p.a.

giftee Inc. demonstrates strong growth potential, with earnings projected to rise significantly at 59.8% annually, far exceeding the Japanese market's 7.9%. Revenue is expected to grow at 19.2% per year, surpassing the market average of 4.2%. Recent guidance anticipates net sales of ¥9.11 billion and an operating profit of ¥1.70 billion for fiscal year-end 2024, alongside a dividend forecast of ¥10 per share. However, its share price has been highly volatile recently.

- Unlock comprehensive insights into our analysis of giftee stock in this growth report.

- Our comprehensive valuation report raises the possibility that giftee is priced higher than what may be justified by its financials.

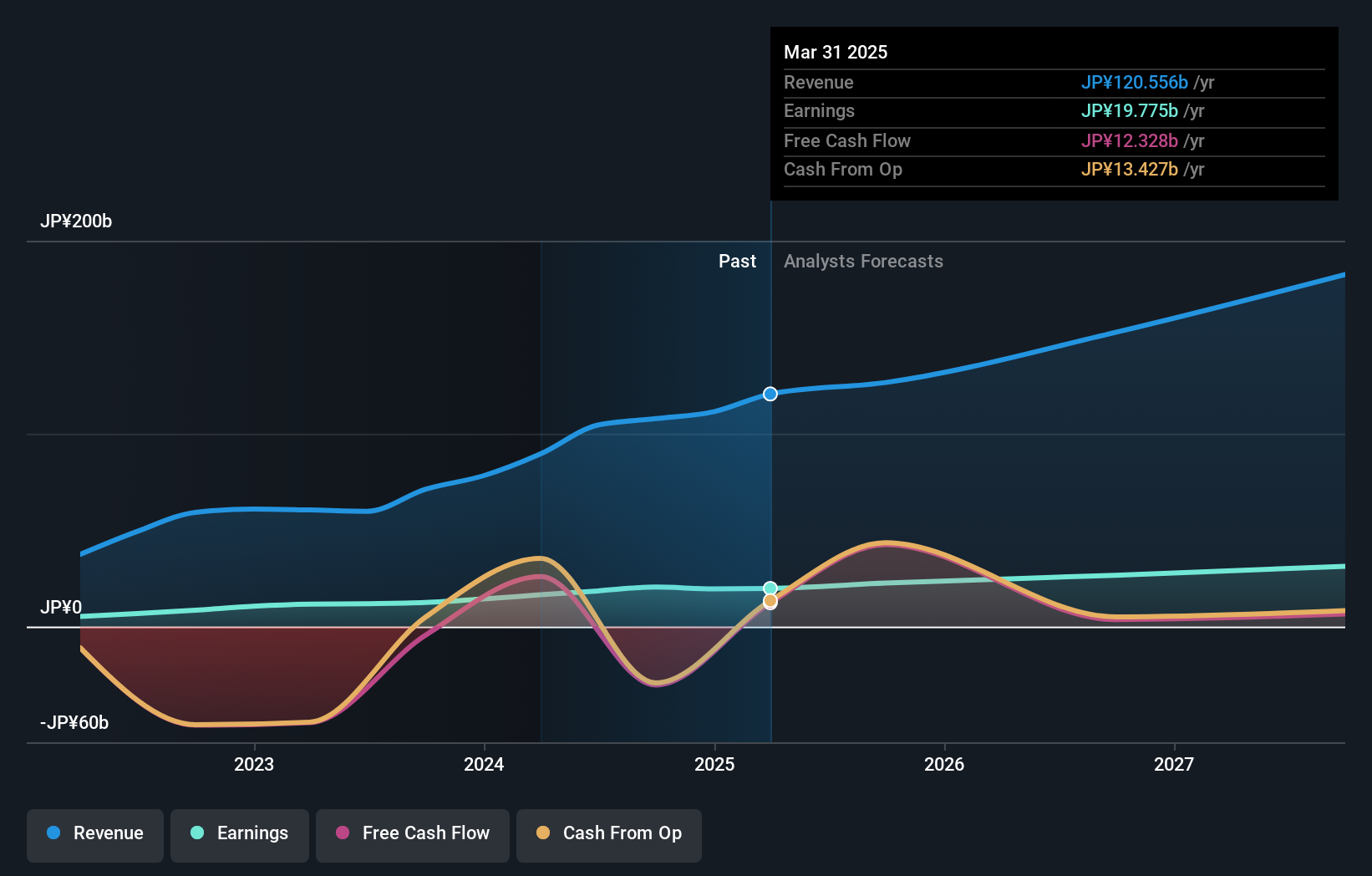

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan, with a market capitalization of ¥234.63 billion.

Operations: The company generates revenue from its Lease Fund Business with ¥22.18 billion, Domestic Real Estate Fund Business with ¥45.08 billion, and Overseas Real Estate Fund Business with ¥2.82 billion.

Insider Ownership: 31.4%

Earnings Growth Forecast: 14.4% p.a.

Financial Partners Group Ltd. is positioned for growth with forecasted revenue increases of 18.2% annually, outpacing the Japanese market's 4.2%. Despite a volatile share price, its return on equity is projected to reach a high 36.2% in three years, indicating strong potential profitability. The company has initiated a share buyback program to enhance shareholder value and announced a dividend increase to ¥81.55 per share, though dividends are not well covered by free cash flows.

- Navigate through the intricacies of Financial Partners GroupLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Financial Partners GroupLtd's share price might be on the expensive side.

Seize The Opportunity

- Click through to start exploring the rest of the 1511 Fast Growing Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4449

Reasonable growth potential with adequate balance sheet.