- Japan

- /

- Healthcare Services

- /

- TSE:2374

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainties, global markets have experienced volatility, with U.S. stocks seeing declines despite a late-week rally. As investors navigate these turbulent times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to bolster their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Saint-Care Holding (TSE:2374)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saint-Care Holding Corporation offers healthcare services in Japan and has a market cap of ¥18.23 billion.

Operations: Saint-Care Holding Corporation generates revenue primarily from its Nursing Care Service Business, which accounts for ¥53.99 billion.

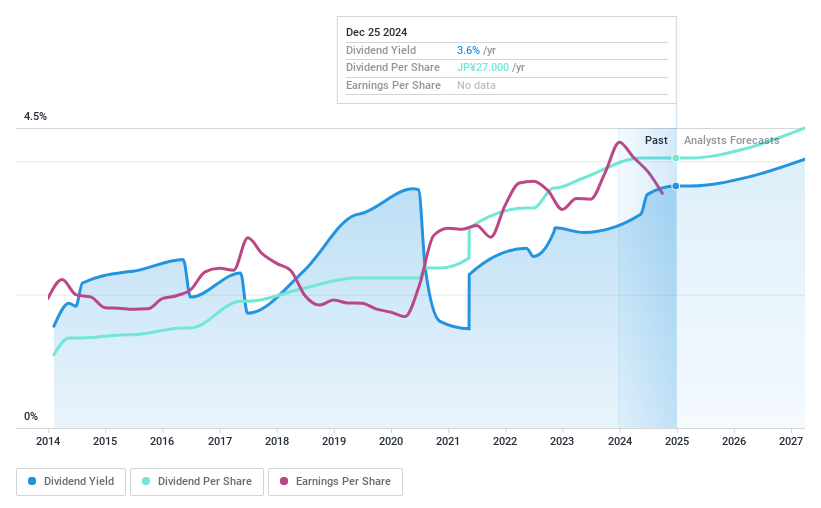

Dividend Yield: 3.6%

Saint-Care Holding's dividend yield of 3.65% is below the top 25% of dividend payers in Japan, but its dividends have been stable and growing over the past decade. The company's payout ratio is a manageable 35.5%, indicating dividends are well covered by earnings, though not by cash flows due to a high cash payout ratio of 117.3%. With a price-to-earnings ratio of 10.5x, it trades at good value compared to peers.

- Unlock comprehensive insights into our analysis of Saint-Care Holding stock in this dividend report.

- In light of our recent valuation report, it seems possible that Saint-Care Holding is trading behind its estimated value.

Universal Cement (TWSE:1104)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Universal Cement Corporation operates in Taiwan, producing and selling cement, ready-mixed concrete, gypsum board panels, and other building materials, with a market cap of NT$19.40 billion.

Operations: Universal Cement Corporation's revenue from construction materials, including concrete, amounts to NT$8.04 billion.

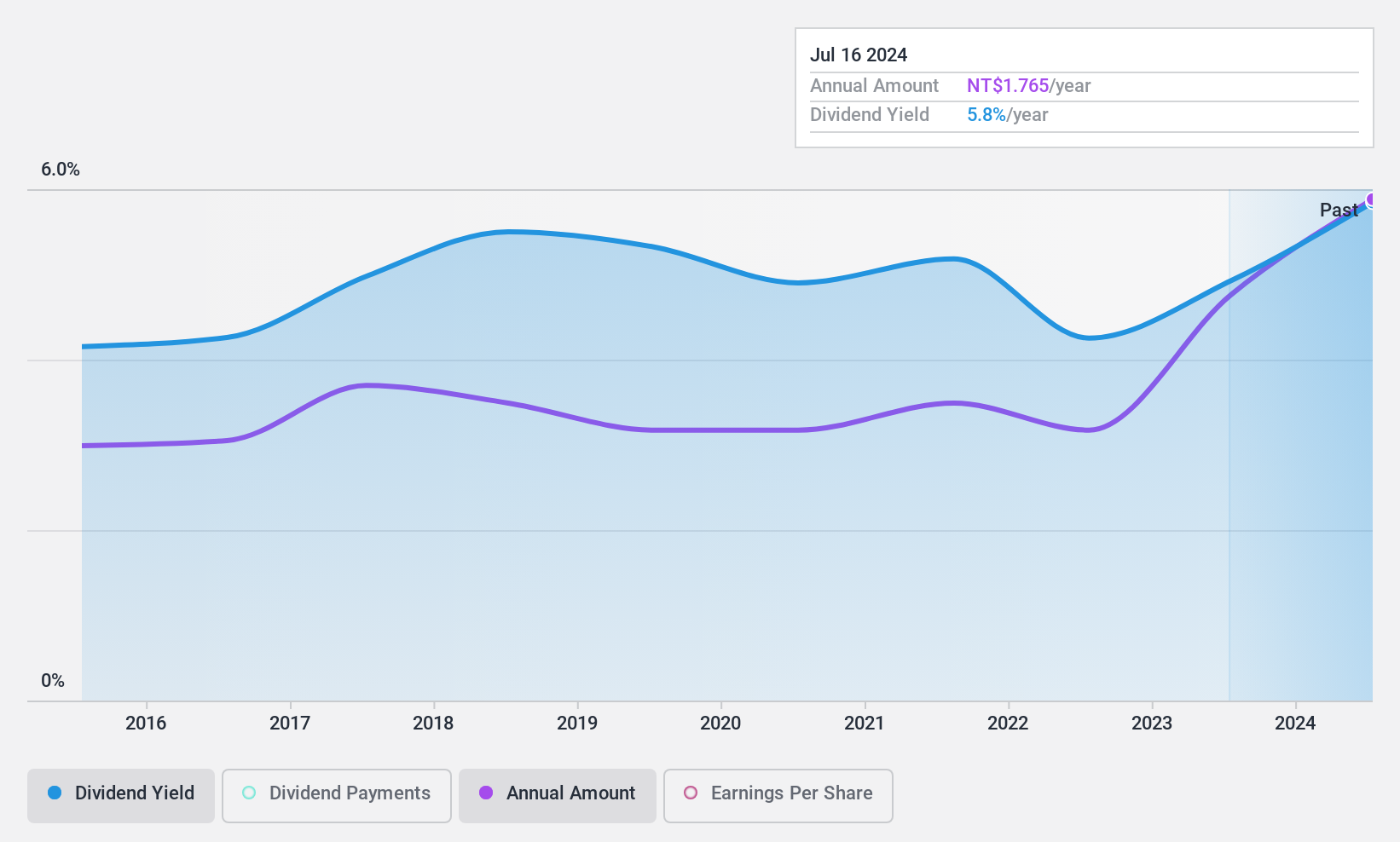

Dividend Yield: 6.2%

Universal Cement offers a high dividend yield of 6.25%, ranking in the top 25% of Taiwan's market, with stable and growing dividends over the past decade. Despite a decline in net income from TWD 956.31 million to TWD 474.48 million year-over-year, its payout ratios are sustainable at 77.4% for earnings and 78.2% for cash flows, ensuring dividend coverage. Trading at a significant discount to its estimated fair value enhances its appeal to investors seeking value and income stability.

- Delve into the full analysis dividend report here for a deeper understanding of Universal Cement.

- The analysis detailed in our Universal Cement valuation report hints at an deflated share price compared to its estimated value.

Chang Wah Electromaterials (TWSE:8070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chang Wah Electromaterials Inc. is involved in the trading of electrical, telecommunication, and semiconductor materials and parts across Taiwan, Asia, and internationally, with a market cap of NT$31.74 billion.

Operations: Chang Wah Electromaterials Inc. generates revenue primarily from its operations through Chang Wah Electromaterials Inc. (NT$7.12 billion) and Chang Wah Technology Co., Ltd. and its subsidiary (NT$11.74 billion).

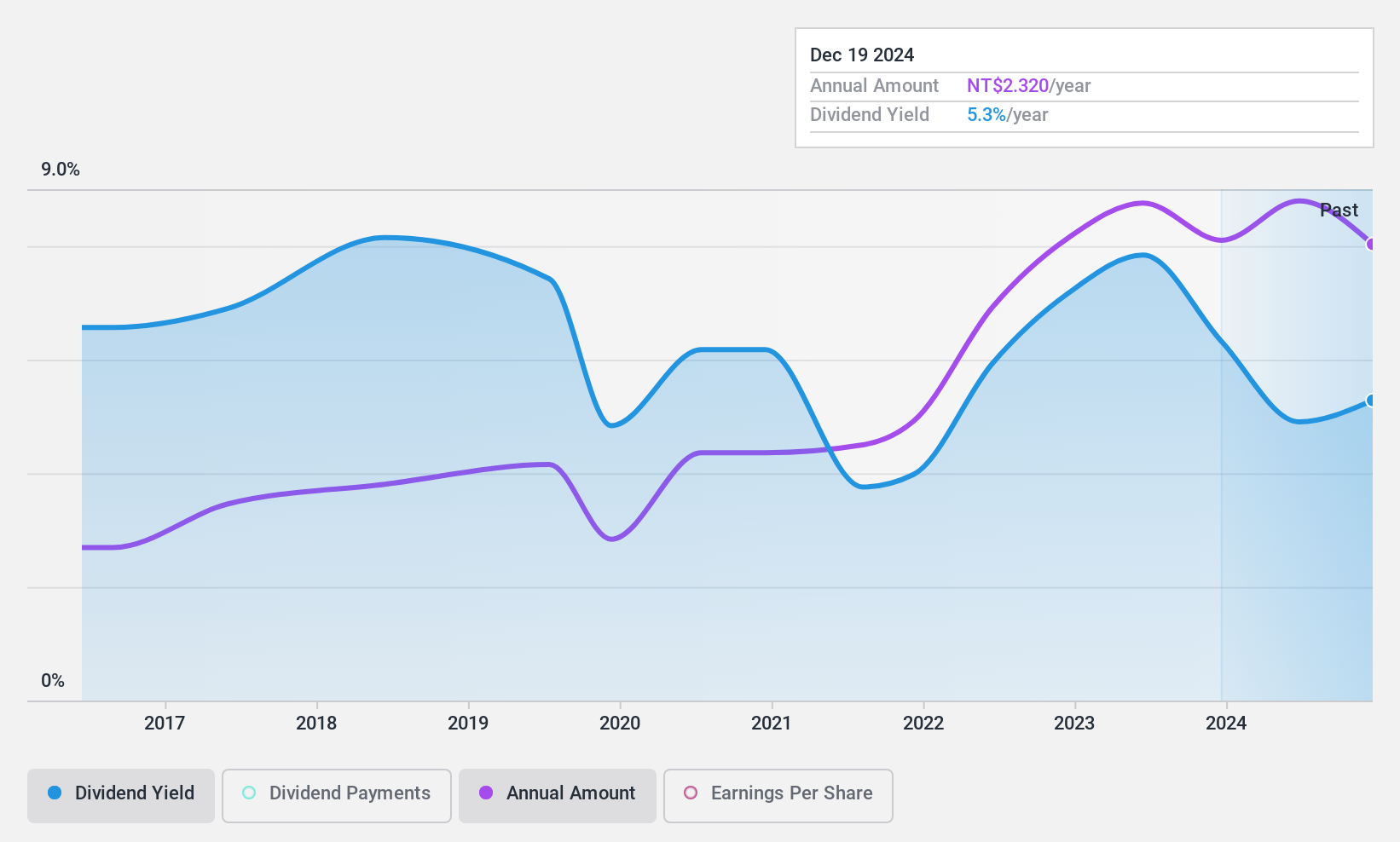

Dividend Yield: 5%

Chang Wah Electromaterials announced a cash dividend of TWD 0.70 per share, with an ex-dividend date of December 19, 2024. Despite a high payout ratio of 114.7%, dividends are covered by cash flows at a payout ratio of 79.9%. However, past dividend payments have been volatile and unreliable over the last decade, despite recent increases. The company's net income decreased year-over-year in Q3 to TWD 439.19 million from TWD 554.82 million previously reported.

- Click here and access our complete dividend analysis report to understand the dynamics of Chang Wah Electromaterials.

- Our valuation report unveils the possibility Chang Wah Electromaterials' shares may be trading at a premium.

Summing It All Up

- Unlock our comprehensive list of 1957 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2374

Excellent balance sheet average dividend payer.