- Japan

- /

- Diversified Financial

- /

- TSE:7148

3 Dividend Stocks To Consider With Up To 3.9% Yield

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are increasingly seeking stability in dividend stocks. In this environment, stocks that offer a reliable income stream through dividends can be particularly appealing, providing a buffer against market volatility while potentially delivering consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.20% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2042 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Yondenko (TSE:1939)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yondenko Corporation operates in Japan, focusing on the construction of electrical and electrical power transmission and distribution facilities, with a market cap of ¥60.41 billion.

Operations: Yondenko Corporation's revenue segments include the Lease Segment, contributing ¥2.91 billion.

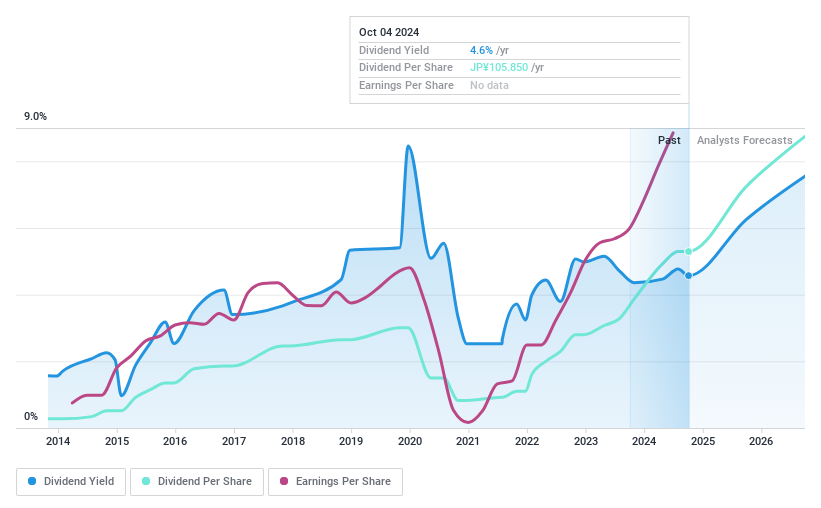

Dividend Yield: 3.7%

Yondenko's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 44.3% and a cash payout ratio of 51.1%. However, the dividends have been unstable over the past decade, experiencing volatility with drops exceeding 20% annually. Despite this inconsistency, dividends have grown over ten years. The recent board meeting on October 31 aimed to revise earnings forecasts and dividend distributions for the fiscal year ending March 2025.

- Unlock comprehensive insights into our analysis of Yondenko stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Yondenko shares in the market.

Chugoku Marine Paints (TSE:4617)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chugoku Marine Paints, Ltd. is a company that produces and sells functional coatings globally, with a market cap of ¥109.69 billion.

Operations: Chugoku Marine Paints, Ltd. generates revenue from the production and sale of functional coatings on a global scale.

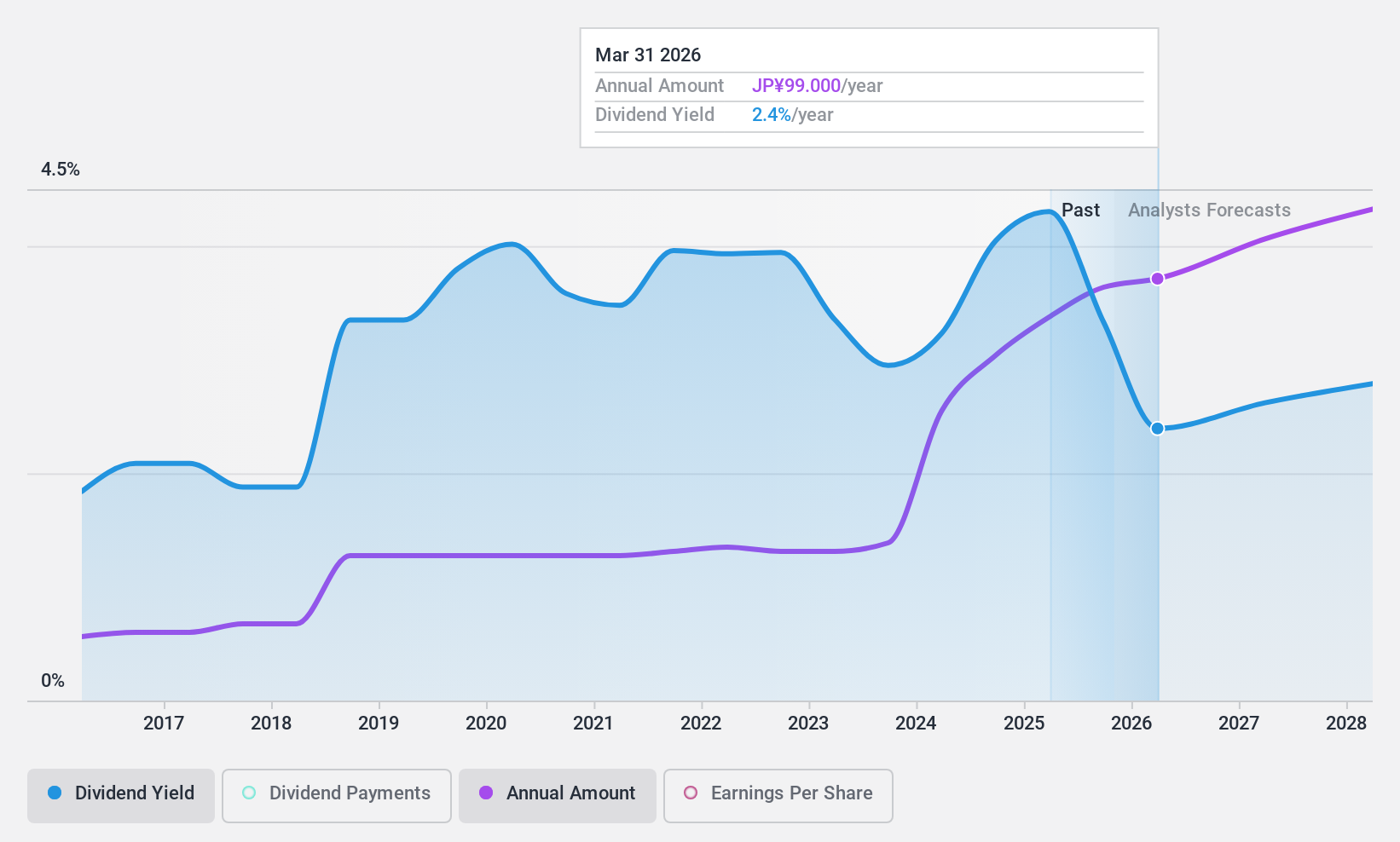

Dividend Yield: 3.4%

Chugoku Marine Paints offers a reliable dividend yield of 3.39%, supported by stable and growing payments over the past decade. With a payout ratio of 30.2% and a cash payout ratio of 37%, dividends are well-covered by earnings and cash flows, ensuring sustainability. However, its yield is lower than the top quartile in Japan's market. The stock trades at 23.8% below estimated fair value, presenting potential investment appeal despite forecasted earnings decline.

- Click here to discover the nuances of Chugoku Marine Paints with our detailed analytical dividend report.

- Our valuation report here indicates Chugoku Marine Paints may be undervalued.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market capitalization of approximately ¥200.68 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse financial products and services in Japan.

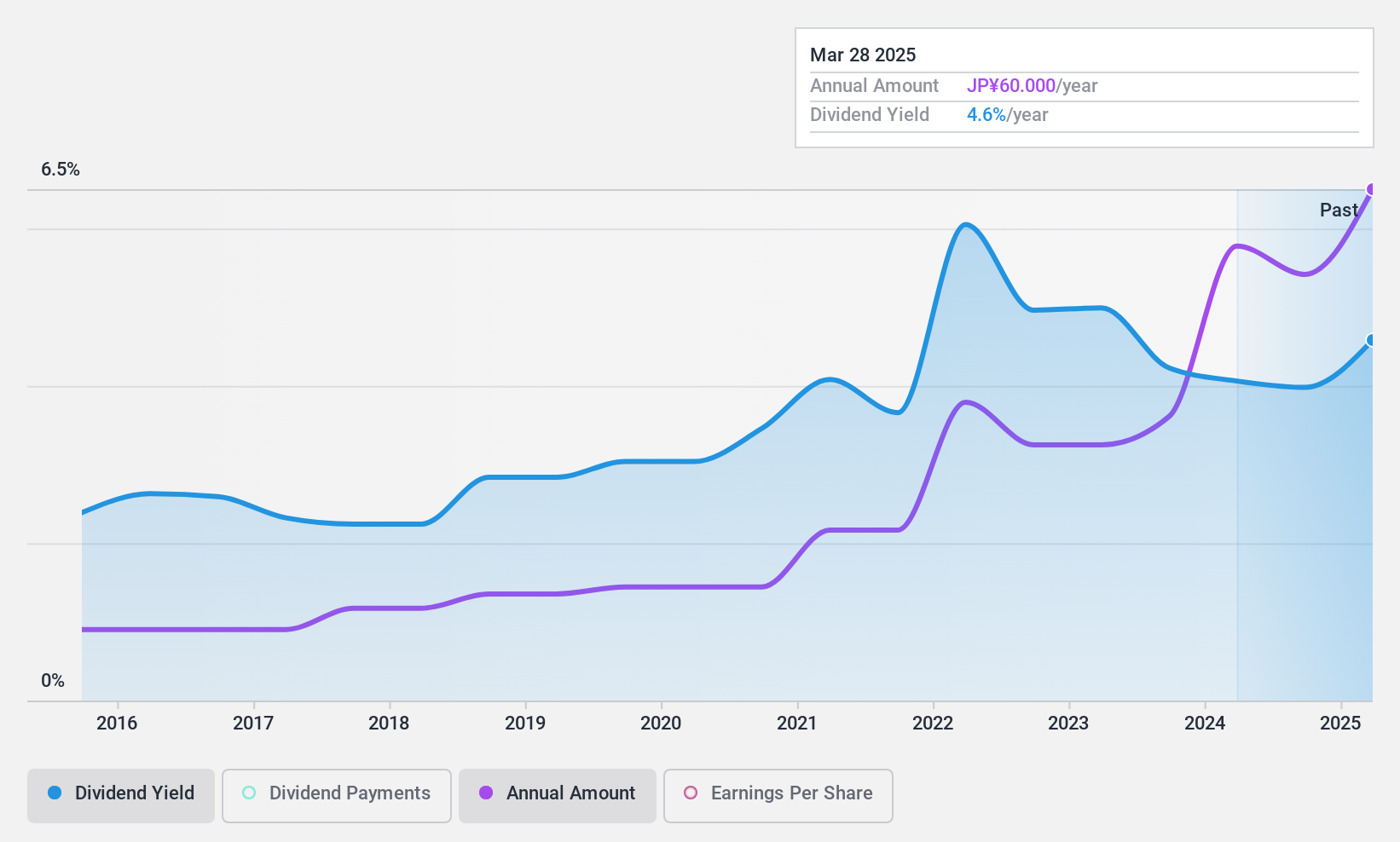

Dividend Yield: 4%

Financial Partners Group Co., Ltd. provides a dividend yield of 3.98%, ranking in the top 25% of Japanese dividend payers, with earnings and cash flows comfortably covering payouts given a payout ratio of 51.6% and cash payout ratio of 34.5%. Despite this, dividends have been volatile over the past decade, reflecting an unstable track record. Recent share buybacks totaling ¥1.99 billion may indicate management's confidence but also highlight ongoing financial volatility concerns due to high debt levels.

- Click to explore a detailed breakdown of our findings in Financial Partners GroupLtd's dividend report.

- The analysis detailed in our Financial Partners GroupLtd valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Click through to start exploring the rest of the 2039 Top Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7148

Financial Partners GroupLtd

Provides various financial products and services in Japan.

Reasonable growth potential with proven track record and pays a dividend.