It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Integral (TSE:5842). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Integral

How Fast Is Integral Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Integral's EPS skyrocketed from JP¥168 to JP¥265, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 58%.

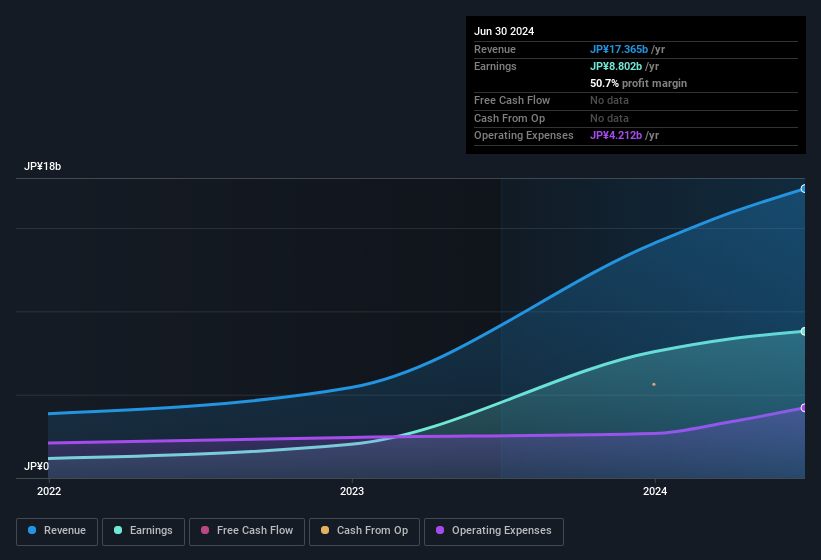

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Integral's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Integral shareholders can take confidence from the fact that EBIT margins are up from 55% to 73%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Integral's balance sheet strength, before getting too excited.

Are Integral Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Integral insiders own a meaningful share of the business. Indeed, with a collective holding of 74%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. at the current share price. That means they have plenty of their own capital riding on the performance of the business!

Should You Add Integral To Your Watchlist?

You can't deny that Integral has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Integral's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. You should always think about risks though. Case in point, we've spotted 2 warning signs for Integral you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in JP with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5842

Integral

A private equity firm which specializes in management buyouts, turnaround, leveraged buyouts, mezzanine, and other minority investments.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives