- Japan

- /

- Capital Markets

- /

- TSE:3454

First Brothers (TSE:3454) Margin Gains Challenge Narrative of Persistent Profit Decline

Reviewed by Simply Wall St

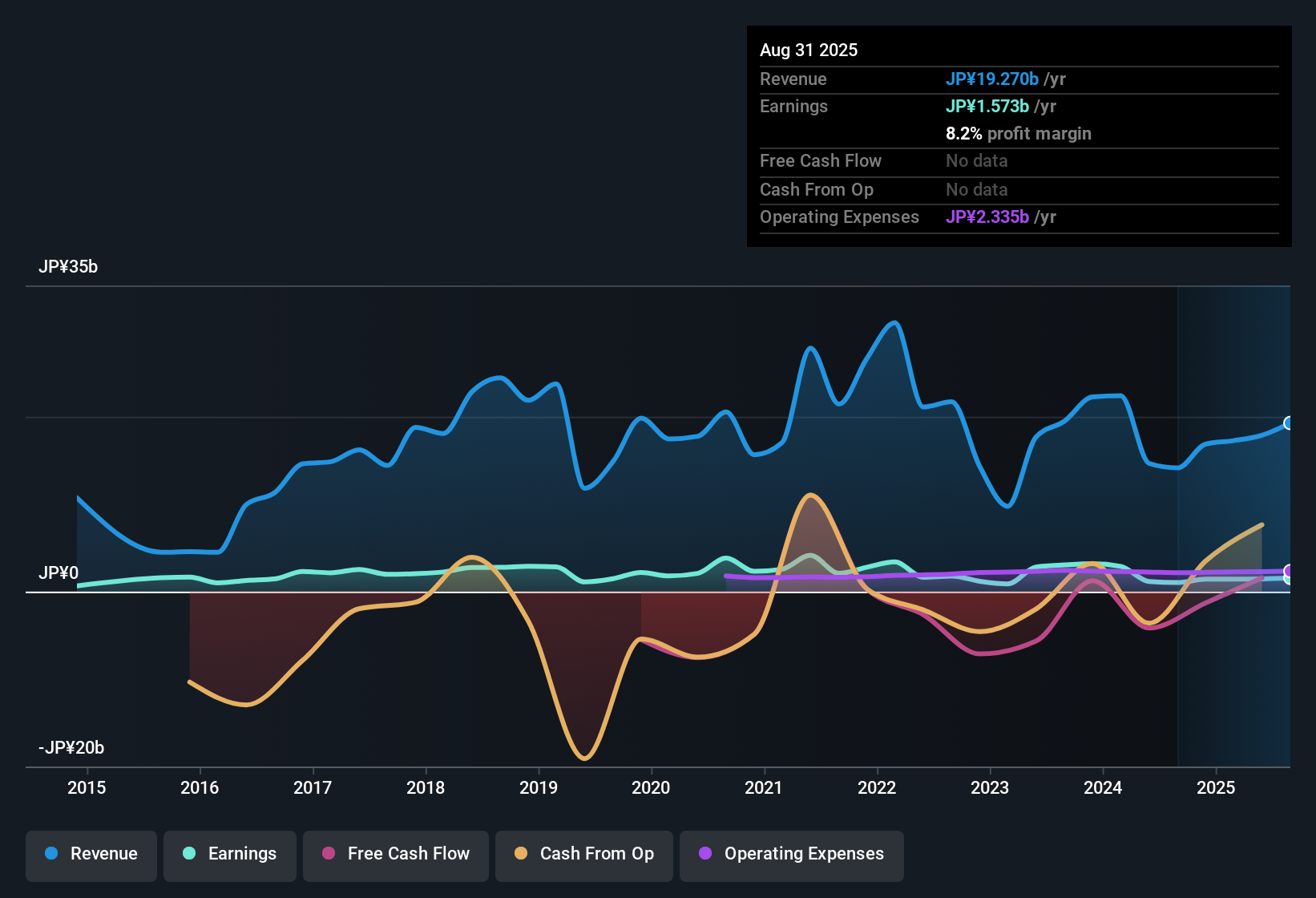

First Brothers Ltd. (TSE:3454) posted annual earnings growth of 52.6%, as net profit margins improved to 8.2% from last year’s 7.3%. The company’s Price-to-Earnings Ratio is 10.6x, notably below the peer average of 29.4x and the broader Japanese capital markets industry average of 16.5x. This suggests relative value even as the share price sits at ¥1,190, which is above the estimated fair value of ¥904.69. With profitability metrics trending upward but questions lingering about financial strength, future growth, and dividend sustainability, investors find both promising gains and reasons for caution in the latest results.

See our full analysis for First BrothersLtd.With the headline numbers in hand, the next step is to see how these results stack up against the prevailing narratives, identifying where the consensus is confirmed and where it is challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Five-Year Trend

- Net profit margins increased to 8.2% this year, representing a reversal from the five-year average annual earnings decline of 15.6%. This highlights a sharp turnaround compared with longer-term softness.

- The recent profit margin rebound heavily supports the argument that underlying business quality has improved. However:

- Bears argue that one strong year does not erase the multi-year record of declining profits and warn that the gains may not prove durable unless supported by ongoing operational discipline.

- The uptick in margin provides evidence that efficiency initiatives or market shifts may be taking hold, setting up a genuine test of whether First Brothers Ltd. can sustain higher profitability through future cycles.

No Clear Signs on Financial Strength

- Despite the positive earnings shift, there is no confirmation in the latest data regarding improved financial position or assurance of future growth. This raises doubts about the sustainability of these gains.

- Prevailing market analysis points out that while headline profitability advances grab attention,

- the absence of clear signals about balance sheet health and dividend reliability injects caution into the outlook, and

- investors may hesitate to fully back the turnaround narrative until there is concrete evidence of strengthened financial foundations or renewed growth prospects.

Market Value Still Trails Peers, Overlooks Fair Value Gap

- The current share price of ¥1,190 remains at a sizable discount to both the peer Price-to-Earnings average of 29.4x and the industry average of 16.5x. However, it trades at a premium to its own DCF fair value of ¥904.69, which spotlights a persistent valuation debate.

- What stands out is the tension between the positive perception created by lower-than-average valuation multiples and the cautious approach analysts take due to the premium to DCF fair value.

- This suggests the market may be pricing in some optimism about continued improving profitability,

- but remains hesitant to fully close the gap until further stability in growth or financial strength becomes visible.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First BrothersLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While First Brothers Ltd. has shown a promising profit margin rebound, persistent uncertainty around its financial strength and sustainability leaves room for concern.

If you want investments with a stronger financial foundation, check out solid balance sheet and fundamentals stocks screener to find companies better equipped for stability and long-term resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3454

First BrothersLtd

Engages in the investment management and investment banking businesses in Japan.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026