- Japan

- /

- Construction

- /

- TSE:1965

Undiscovered Gems in Japan for October 2024

Reviewed by Simply Wall St

Japan's stock markets have been on an upswing, with the Nikkei 225 Index climbing 5.6% and the TOPIX Index rising 3.7%, buoyed by China's recent stimulus measures and dovish signals from the Bank of Japan. This positive environment provides a fertile ground for uncovering potential opportunities in lesser-known Japanese stocks, as investors seek companies that can capitalize on favorable economic shifts and market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techno Ryowa Ltd. focuses on the design, construction, and maintenance of environmental control systems primarily in Japan, with a market cap of ¥43.05 billion.

Operations: Techno Ryowa Ltd. generates revenue primarily from its Air Conditioning Hygiene Equipment Construction Business, contributing ¥47.04 billion, and General Building Equipment Work, adding ¥24.41 billion. The Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment contribute smaller portions of ¥2.64 billion and ¥1.16 billion, respectively.

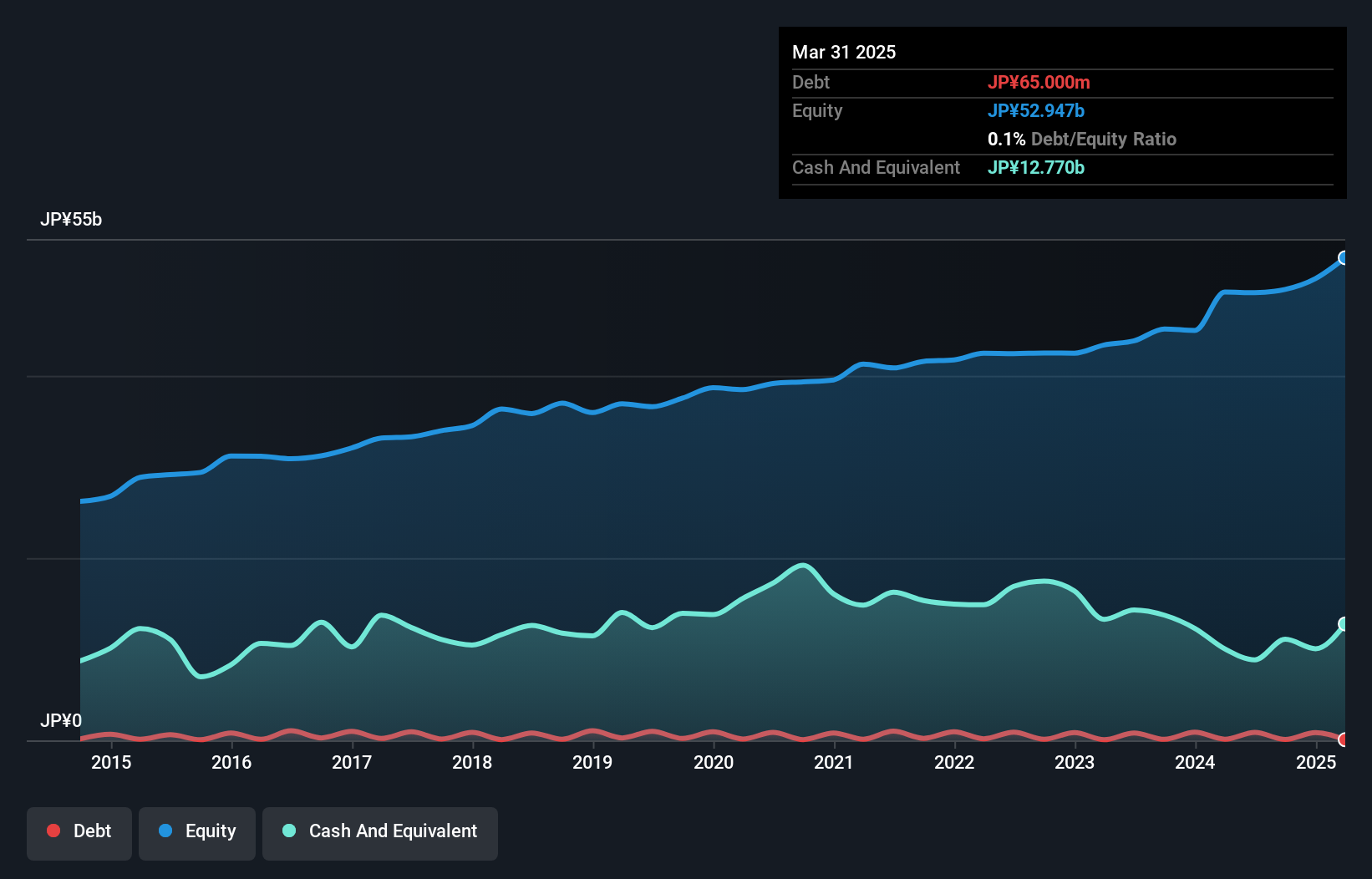

Techno Ryowa, a notable player in Japan's construction industry, has seen its debt to equity ratio improve from 2.7% to 1.8% over five years, indicating stronger financial health. With earnings growth of 99% last year, it outpaced the industry average of 26.6%, showcasing robust performance. The price-to-earnings ratio stands at a favorable 9.4x compared to the JP market's 13.5x, suggesting potential undervaluation. Recently added to the S&P Global BMI Index, Techno Ryowa continues gaining recognition.

- Click here to discover the nuances of Techno Ryowa with our detailed analytical health report.

Evaluate Techno Ryowa's historical performance by accessing our past performance report.

ISE Chemicals (TSE:4107)

Simply Wall St Value Rating: ★★★★★★

Overview: ISE Chemicals Corporation is involved in the production, processing, and trade of iodine and iodine derivatives, as well as nickel and cobalt compounds in Japan, with a market capitalization of ¥112.63 billion.

Operations: ISE Chemicals generates revenue primarily from its Iodine and Natural Gas Business, contributing ¥24.94 billion, and the Metal Compound Business, which adds ¥4.25 billion. The company's net profit margin is a key performance indicator to consider when evaluating its financial health.

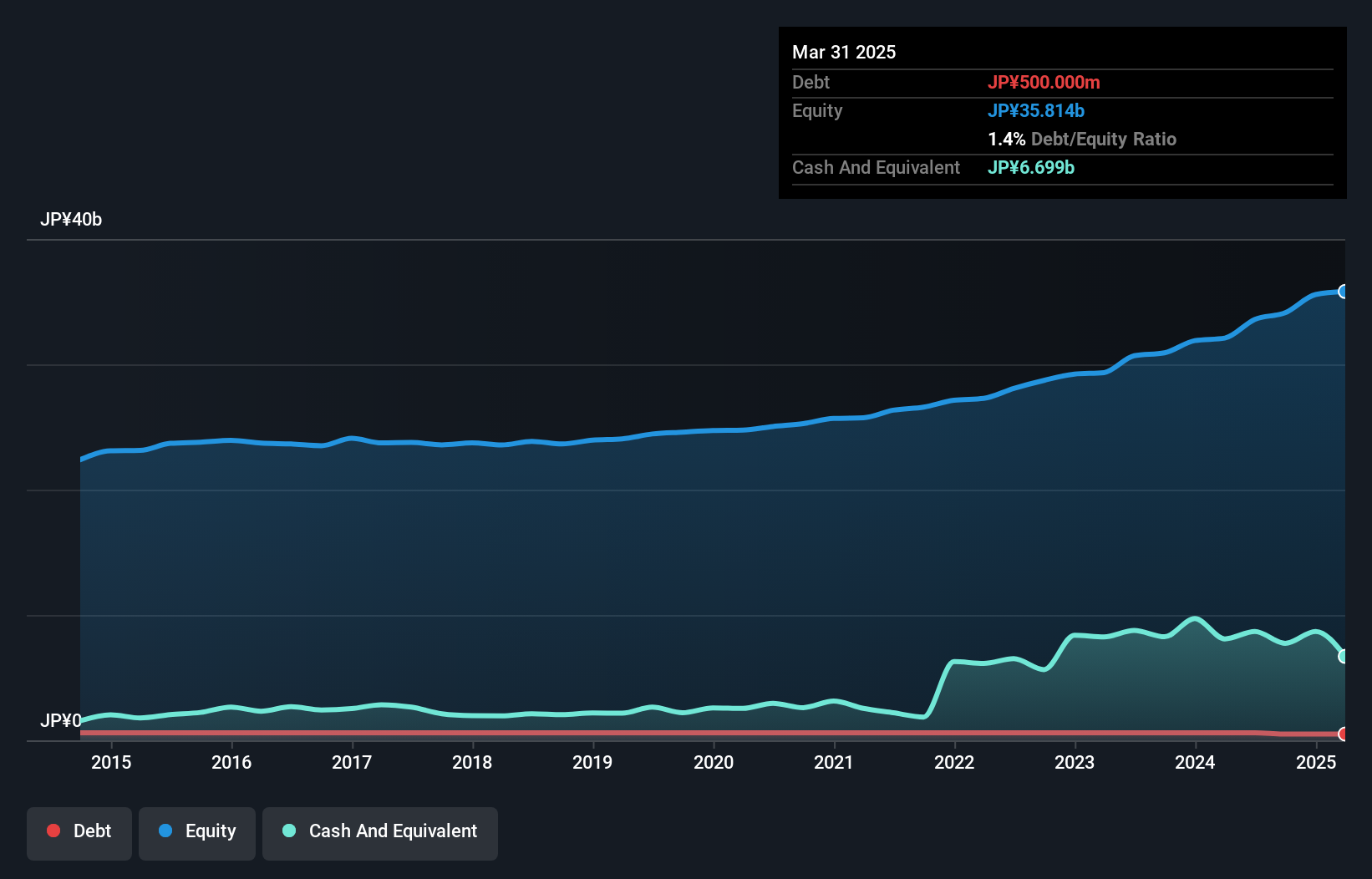

ISE Chemicals, a nimble player in Japan's chemicals sector, has shown impressive earnings growth of 20.2% over the past year, outpacing the industry average of 13%. The company’s debt to equity ratio has improved significantly from 2.5 to 1.8 over five years, indicating stronger financial health. With more cash than total debt and high-quality earnings reported, ISE recently joined the S&P Global BMI Index, suggesting increased recognition in global markets.

- Delve into the full analysis health report here for a deeper understanding of ISE Chemicals.

Explore historical data to track ISE Chemicals' performance over time in our Past section.

Ohsho Food Service (TSE:9936)

Simply Wall St Value Rating: ★★★★★★

Overview: Ohsho Food Service Corp. operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan, with a market cap of ¥165.04 billion.

Operations: Ohsho Food Service generates revenue primarily through its chain of Chinese restaurants in Japan. The company's net profit margin has shown fluctuations, reflecting changes in operational efficiency and cost management strategies.

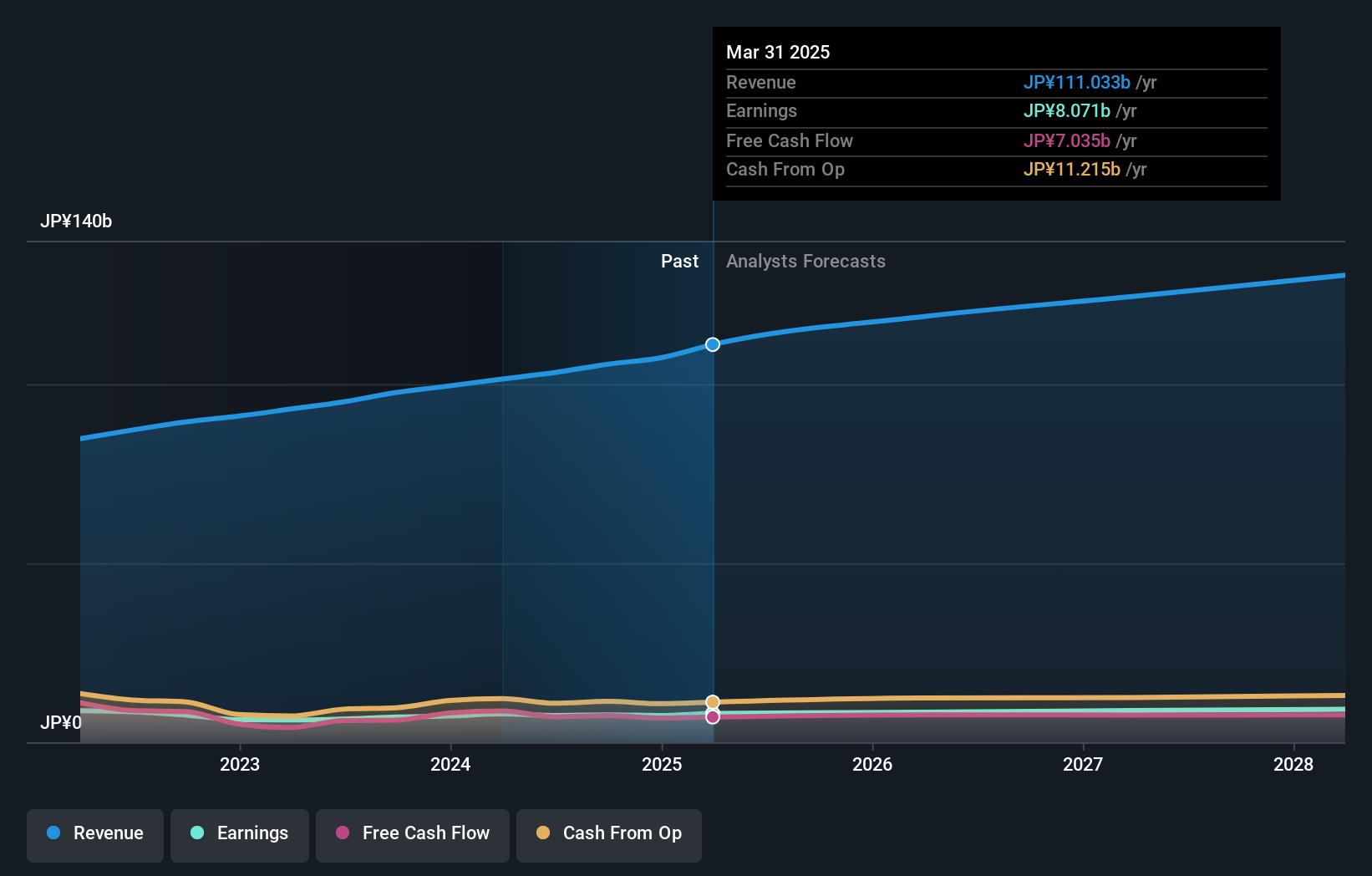

Ohsho Food Service, a notable player in the hospitality sector, has shown robust financial health with earnings growing 11.9% annually over the past five years. The company reported first-quarter sales of ¥26.42 billion and net income of ¥1.70 billion, reflecting its solid performance despite not outpacing industry growth rates. With a debt-to-equity ratio reduced to 9.4% and trading slightly below fair value estimates, Ohsho seems well-positioned for steady progress in the coming year with projected net sales of ¥109.88 billion.

Turning Ideas Into Actions

- Dive into all 736 of the Japanese Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techno Ryowa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1965

Techno Ryowa

Engages in the design, construction, and maintenance of environmental control systems primarily in Japan.

Solid track record with excellent balance sheet.