- Japan

- /

- Hospitality

- /

- TSE:9376

Market Might Still Lack Some Conviction On Eurasia Travel Co., Ltd. (TSE:9376) Even After 33% Share Price Boost

Eurasia Travel Co., Ltd. (TSE:9376) shareholders have had their patience rewarded with a 33% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

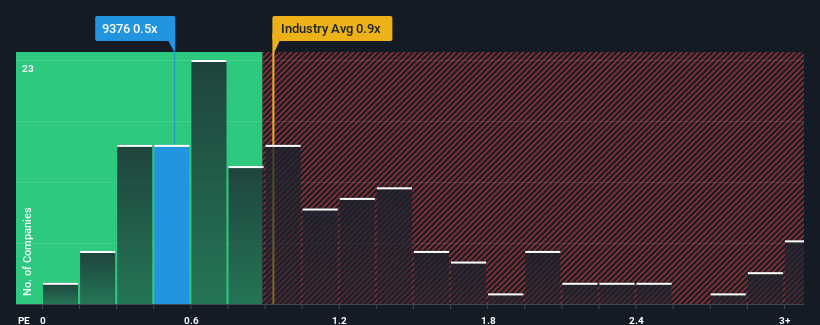

Even after such a large jump in price, there still wouldn't be many who think Eurasia Travel's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Japan's Hospitality industry is similar at about 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Eurasia Travel

What Does Eurasia Travel's P/S Mean For Shareholders?

Eurasia Travel certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eurasia Travel's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Eurasia Travel would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 56%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 10% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Eurasia Travel's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Eurasia Travel appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To our surprise, Eurasia Travel revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Eurasia Travel (1 makes us a bit uncomfortable!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eurasia Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9376

Eurasia Travel

Provides travel agency services in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives