- Japan

- /

- Hospitality

- /

- TSE:7611

Undiscovered Gems With Strong Fundamentals for November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are increasingly optimistic due to positive economic indicators such as the drop in U.S. initial jobless claims and rising home sales. In this climate of cautious optimism and geopolitical uncertainty, identifying stocks with strong fundamentals becomes crucial for navigating potential market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Value Rating: ★★★★☆☆

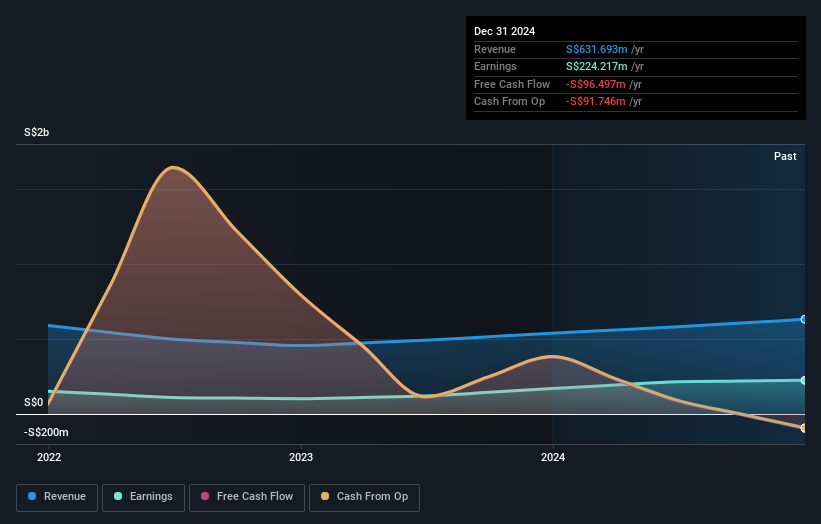

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering stockbroking, futures broking, structured lending, investment trading, margin financing, and research services across Singapore, Hong Kong, Thailand, Malaysia, and internationally with a market cap of SGD1.51 billion.

Operations: The primary revenue stream for UOB-Kay Hian Holdings comes from securities and futures broking and related services, generating SGD581.07 million. The company's net profit margin reflects its financial efficiency in managing expenses relative to its revenue.

UOB-Kay Hian Holdings, a player in the capital markets, showcases robust earnings growth of 80% over the past year, outpacing the industry average of 21.9%. The company has reduced its debt-to-equity ratio from 65.2% to 45.1% over five years and holds more cash than total debt, indicating solid financial health. Despite shareholder dilution in the last year, it trades at a value perceived to be 25.4% below fair market estimates. Recent changes in company secretaries may signal strategic shifts as UOB-Kay Hian continues navigating its competitive landscape with high-quality earnings intact.

- Delve into the full analysis health report here for a deeper understanding of UOB-Kay Hian Holdings.

Tomoe (TSE:1921)

Simply Wall St Value Rating: ★★★★★☆

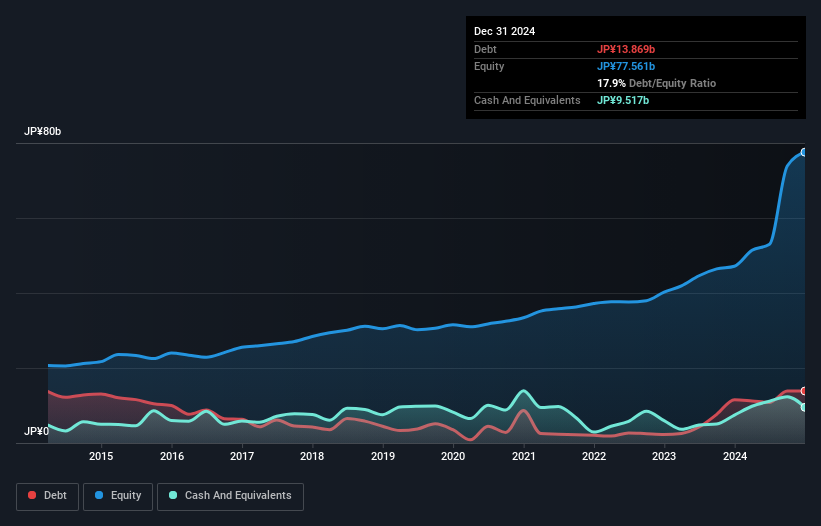

Overview: Tomoe Corporation engages in general construction, steel structures construction, and real estate businesses in Japan with a market cap of ¥40.03 billion.

Operations: Tomoe generates revenue primarily from general construction and steel structures construction. The company's net profit margin is 3.5%, reflecting its efficiency in converting revenue into actual profit.

Tomoe, a small cap player in the construction sector, offers an intriguing mix of strengths and challenges. Its price-to-earnings ratio of 13.3x is slightly below the JP market average, hinting at potential value. Despite having more cash than total debt, its debt-to-equity ratio has risen from 12.4% to 20.4% over five years, suggesting increased leverage. Earnings growth was negative at -2.8%, contrasting sharply with the industry average of 19.2%. Recently added to the S&P Global BMI Index, Tomoe's share price has been highly volatile over the past three months, reflecting market uncertainty or investor sentiment shifts.

- Click to explore a detailed breakdown of our findings in Tomoe's health report.

Gain insights into Tomoe's past trends and performance with our Past report.

Hiday Hidaka (TSE:7611)

Simply Wall St Value Rating: ★★★★★★

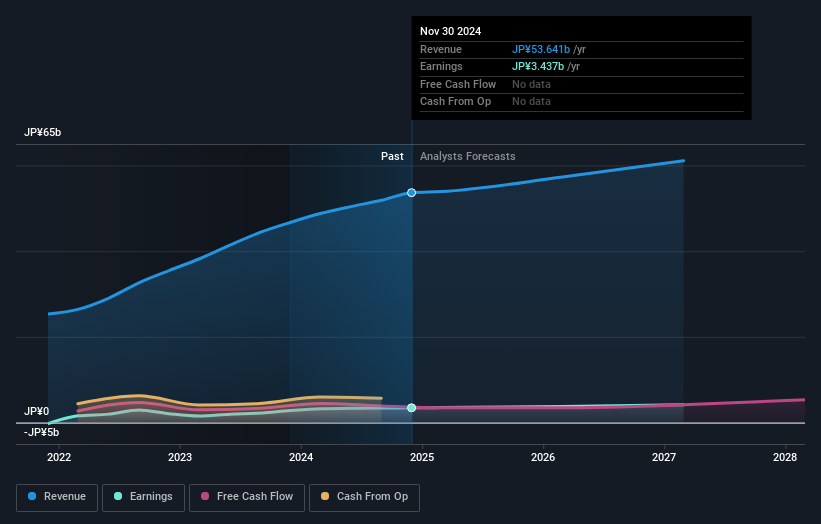

Overview: Hiday Hidaka Corp. operates in the restaurant industry in Japan and has a market capitalization of ¥105.50 billion.

Operations: Hiday Hidaka generates revenue primarily from its restaurant operations in Japan. The company's financial performance can be analyzed through its market capitalization of ¥105.50 billion.

Hiday Hidaka, a nimble player in the hospitality sector, is catching attention with its robust financial health and growth trajectory. The company stands debt-free, showcasing fiscal discipline over the past five years. Its earnings surged by 53% last year, outpacing the industry growth of 27.6%, and are projected to grow at 12.47% annually. Trading at 27.3% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recently, it increased its quarterly dividend to ¥18 per share from ¥17 last year, signaling confidence in sustained profitability and shareholder returns amidst competitive market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Hiday Hidaka.

Assess Hiday Hidaka's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 4638 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hiday Hidaka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7611

Flawless balance sheet with solid track record.