As global markets react to the Federal Reserve's cautious stance on future rate cuts and political uncertainties loom, smaller-cap indexes have faced notable challenges, with broad-based losses impacting investor sentiment. Despite these headwinds, the resilience of economic indicators such as consumer spending and job data provides a backdrop for identifying promising opportunities within small-cap stocks. In this environment, finding undiscovered gems involves looking for companies that demonstrate strong fundamentals and adaptability to navigate market fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Bunka Shutter (TSE:5930)

Simply Wall St Value Rating: ★★★★★★

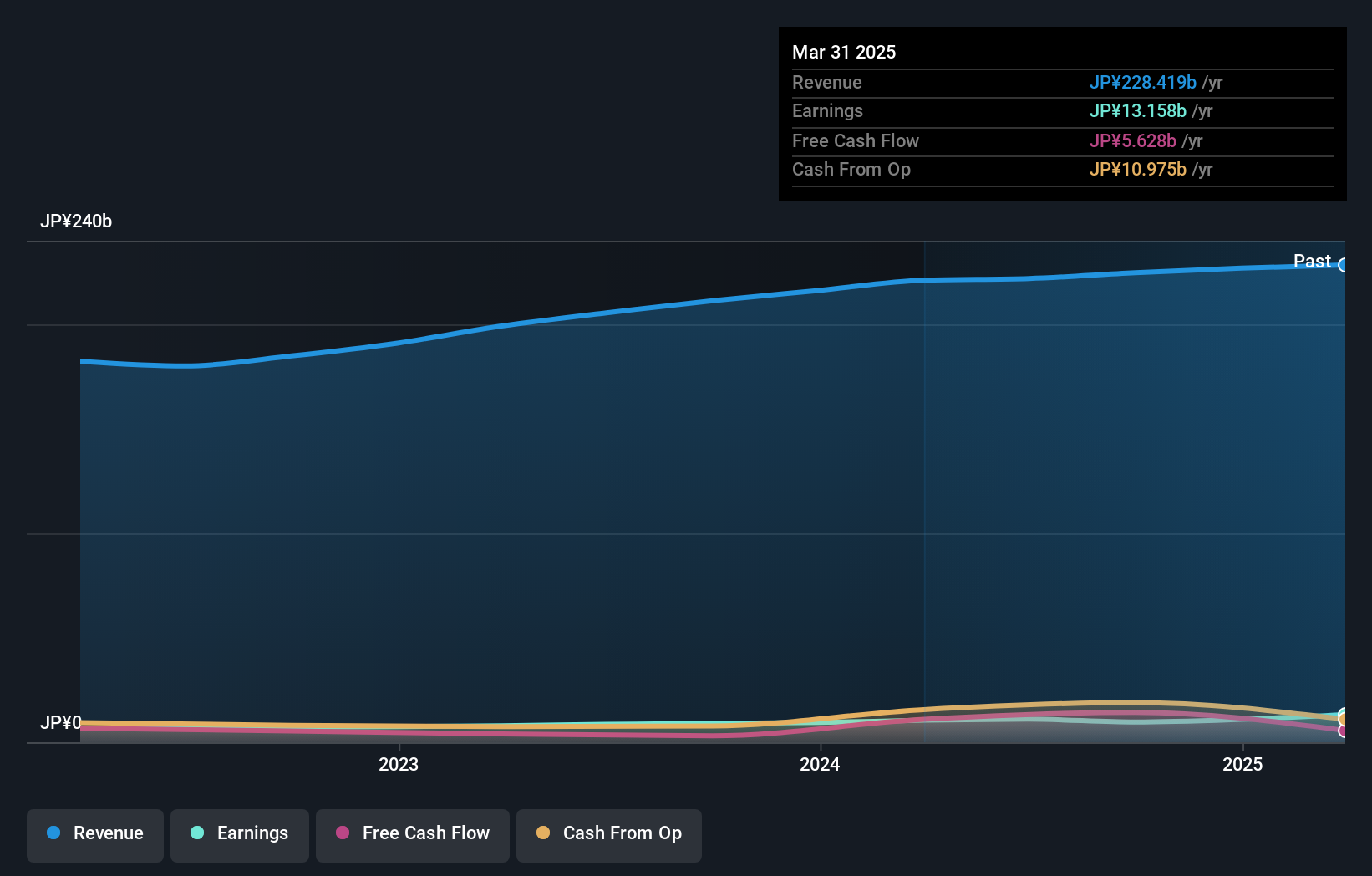

Overview: Bunka Shutter Co., Ltd. is a Japanese company that specializes in the manufacturing and sale of shutters and construction materials, with a market capitalization of ¥135.19 billion.

Operations: Bunka Shutter generates revenue primarily from its Shutter Business and Construction-Related Materials Business, contributing ¥98.54 billion and ¥88.31 billion respectively. The Service Business also adds to the revenue stream with ¥30.87 billion in sales.

Bunka Shutter, a smaller player in the building industry, has seen its earnings grow 7.5% annually over the past five years. Despite not outpacing the industry's 7.6% growth this past year, it trades at an attractive 84.2% below estimated fair value. The company has successfully reduced its debt to equity ratio from 18.5% to 14.1%, with interest payments well-covered by EBIT at a multiple of 133x, indicating financial stability and high-quality earnings. Recently, Bunka Shutter increased its dividend to ¥32 per share from ¥21 last year, reflecting confidence in future profitability and shareholder returns.

- Delve into the full analysis health report here for a deeper understanding of Bunka Shutter.

Explore historical data to track Bunka Shutter's performance over time in our Past section.

H2O Retailing (TSE:8242)

Simply Wall St Value Rating: ★★★★☆☆

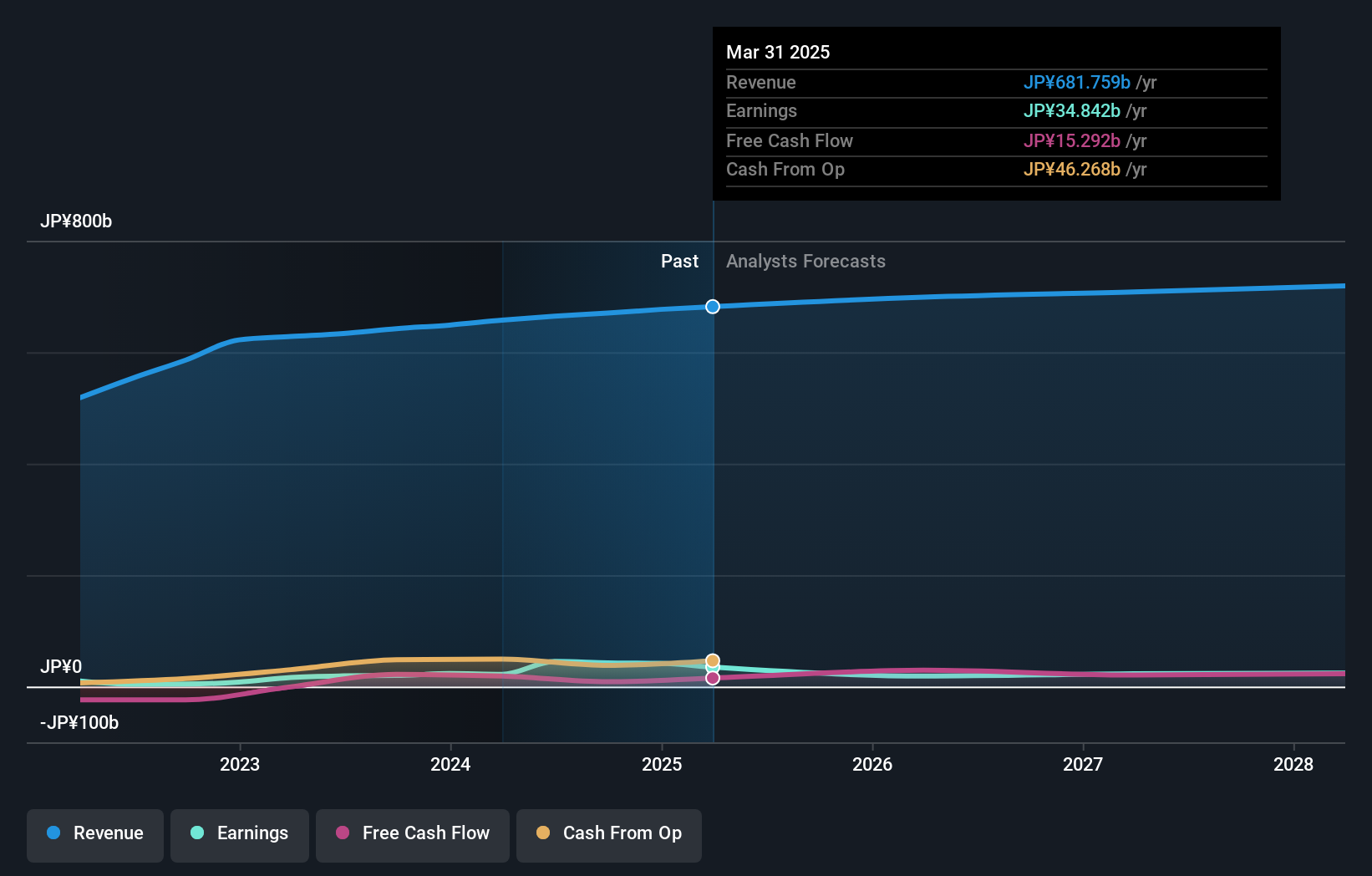

Overview: H2O Retailing Corporation is engaged in operating department stores, supermarkets, and shopping centers across Japan with a market capitalization of approximately ¥271.90 billion.

Operations: H2O Retailing Corporation generates revenue primarily from its Food Business, which accounts for ¥412.54 billion, followed by the Department Store segment at ¥189.66 billion and the Commercial Facility Business at ¥40.95 billion. The company's net profit margin reflects its profitability after accounting for all expenses related to these operations.

H2O Retailing, a prominent player in the consumer retail industry, has showcased impressive financial performance recently. The company reported a significant earnings growth of 114.6% over the past year, outpacing the industry average of 10.5%. This surge was partly influenced by a notable one-off gain of ¥19 billion impacting its financial results as of September 2024. Despite shareholder dilution in the past year, H2O Retailing is trading at 82% below its estimated fair value and maintains a satisfactory net debt to equity ratio at 37%. Recent buybacks include repurchasing 384,200 shares for ¥753.61 million, reflecting strategic capital management efforts.

- Click here and access our complete health analysis report to understand the dynamics of H2O Retailing.

Gain insights into H2O Retailing's historical performance by reviewing our past performance report.

Lemtech Holdings (TWSE:4912)

Simply Wall St Value Rating: ★★★★★★

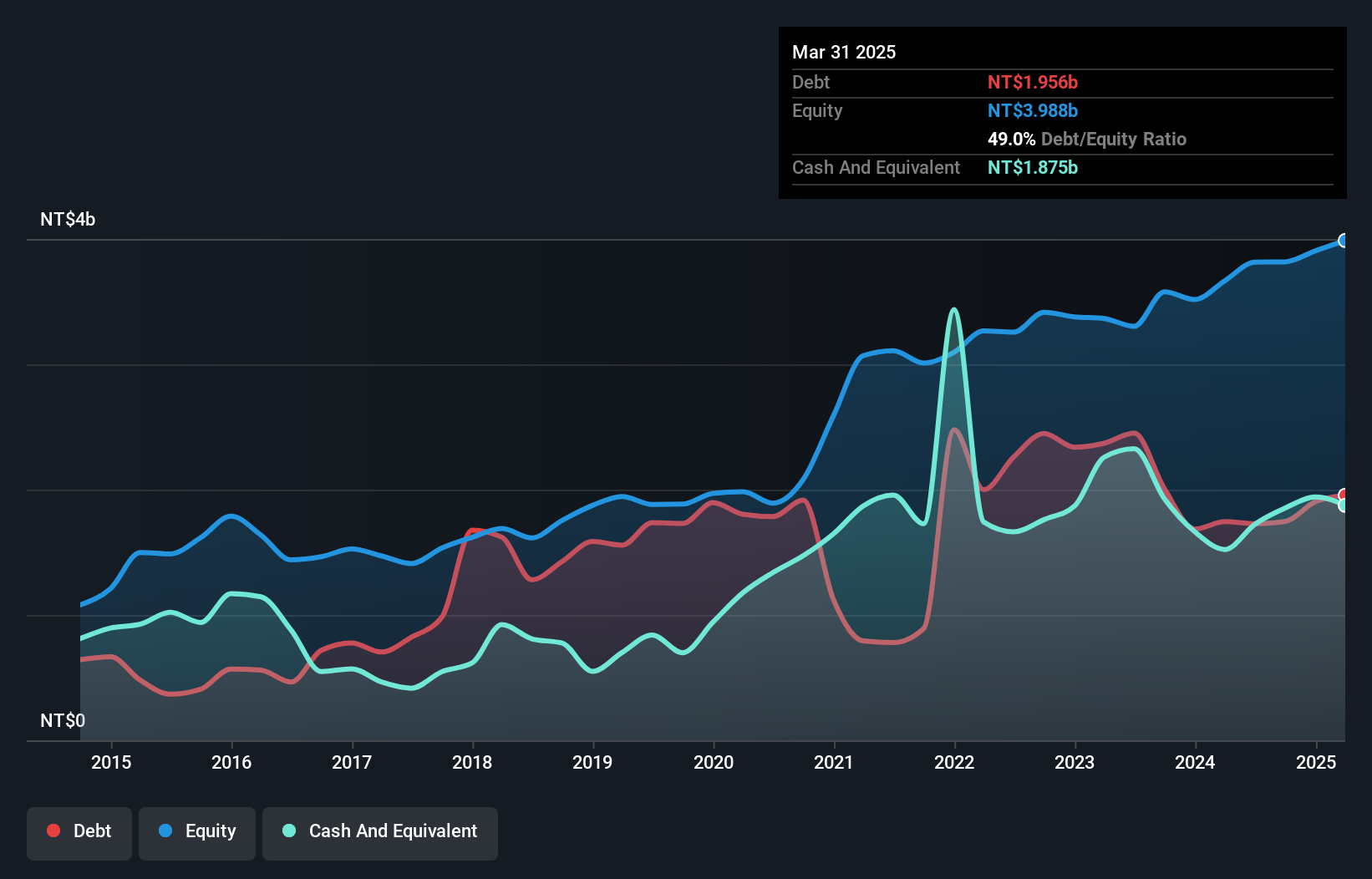

Overview: Lemtech Holdings Co., Limited specializes in the research, development, production, and sale of precision metal dies and metal stampings across Asia, the Americas, and Europe with a market capitalization of NT$8.68 billion.

Operations: The primary revenue streams for Lemtech Holdings come from its China Manufacturing Segment, generating NT$3.19 billion, and Taiwan's Manufacturing Sector, contributing NT$1.20 billion.

Lemtech Holdings has shown impressive growth, with earnings surging 150.9% over the past year, outpacing the Machinery industry's 14.6%. Their debt situation seems favorable as they have more cash than total debt, and their interest payments are well-covered by EBIT at a ratio of 16.2x. The company’s debt-to-equity ratio improved significantly from 91.8% to 45.8% over five years, indicating prudent financial management. Recent sales figures reveal a healthy increase of 21.71% for the year to date in November 2024, while net income for nine months rose to TWD 311 million from TWD 140 million last year.

- Unlock comprehensive insights into our analysis of Lemtech Holdings stock in this health report.

Evaluate Lemtech Holdings' historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 4611 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bunka Shutter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5930

Bunka Shutter

Manufactures and sells various shutters and construction materials in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives