Japanese Stocks Trading Below Estimated Value In September 2024

Reviewed by Simply Wall St

As Japan's stock markets have recently experienced notable declines, driven by a U.S.-led sell-off in semiconductor stocks and the strengthening yen, investors are increasingly seeking opportunities to capitalize on undervalued assets. Identifying stocks trading below their estimated value can be particularly advantageous in such volatile market conditions, offering potential for growth when the broader economic environment stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3455.00 | ¥6781.93 | 49.1% |

| Kotobuki Spirits (TSE:2222) | ¥1759.50 | ¥3434.73 | 48.8% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2136.00 | ¥4160.79 | 48.7% |

| Avant Group (TSE:3836) | ¥2071.00 | ¥4002.33 | 48.3% |

| Pilot (TSE:7846) | ¥4516.00 | ¥8906.20 | 49.3% |

| SaizeriyaLtd (TSE:7581) | ¥5190.00 | ¥10229.18 | 49.3% |

| KeePer Technical Laboratory (TSE:6036) | ¥4040.00 | ¥7899.28 | 48.9% |

| CIRCULATIONLtd (TSE:7379) | ¥645.00 | ¥1283.51 | 49.7% |

| SHIFT (TSE:3697) | ¥11765.00 | ¥23359.31 | 49.6% |

| BayCurrent Consulting (TSE:6532) | ¥4830.00 | ¥9520.31 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

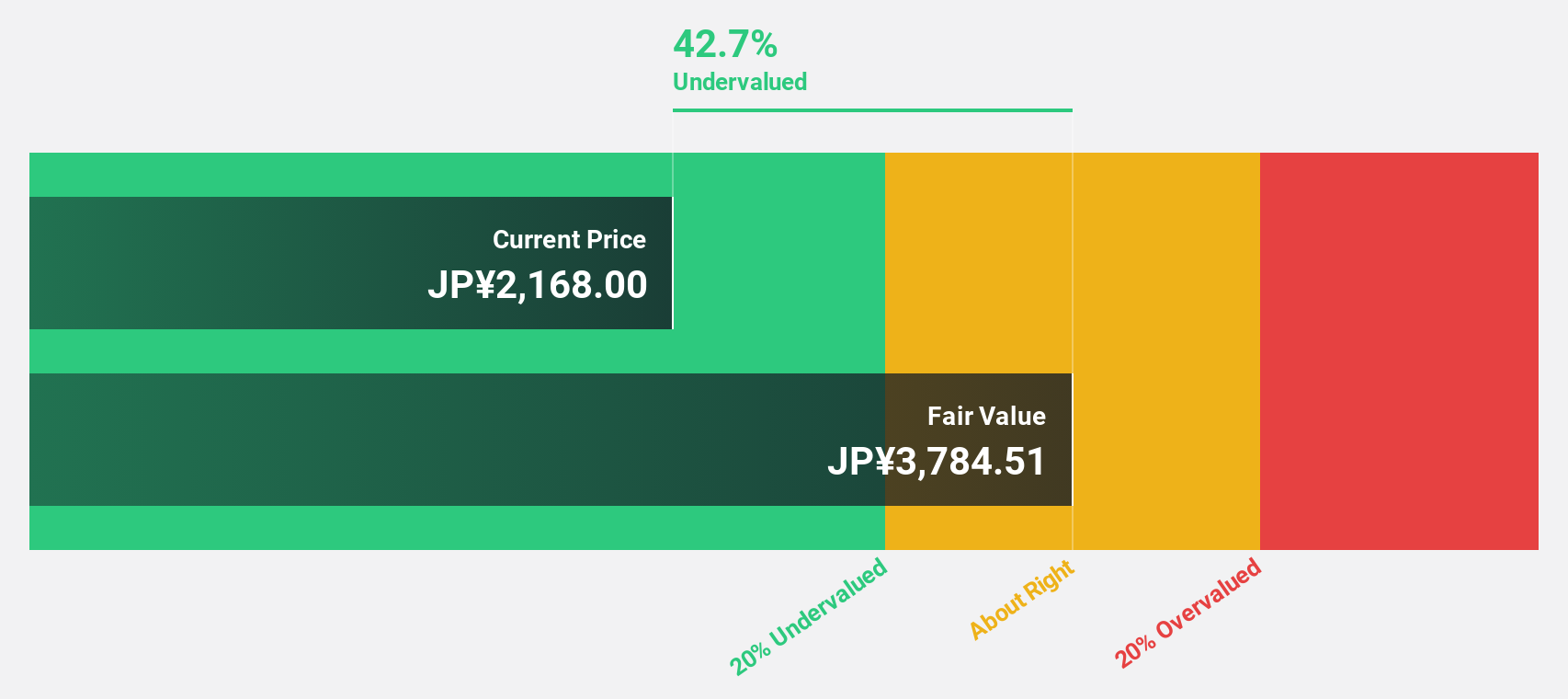

Plus Alpha ConsultingLtd (TSE:4071)

Overview: Plus Alpha Consulting Co., Ltd. provides marketing solutions and has a market cap of ¥90.39 billion.

Operations: The company generates revenue from HR Solutions, amounting to ¥9.27 billion.

Estimated Discount To Fair Value: 48.7%

Plus Alpha Consulting Ltd. is trading at ¥2136, significantly below its estimated fair value of ¥4160.79, making it highly undervalued based on discounted cash flow analysis. Despite a volatile share price over the past three months, earnings grew by 21.1% last year and are forecast to grow at 21.27% annually, outpacing the JP market's growth rate of 8.6%. Analysts agree on a potential stock price rise of nearly 50%.

- Our growth report here indicates Plus Alpha ConsultingLtd may be poised for an improving outlook.

- Take a closer look at Plus Alpha ConsultingLtd's balance sheet health here in our report.

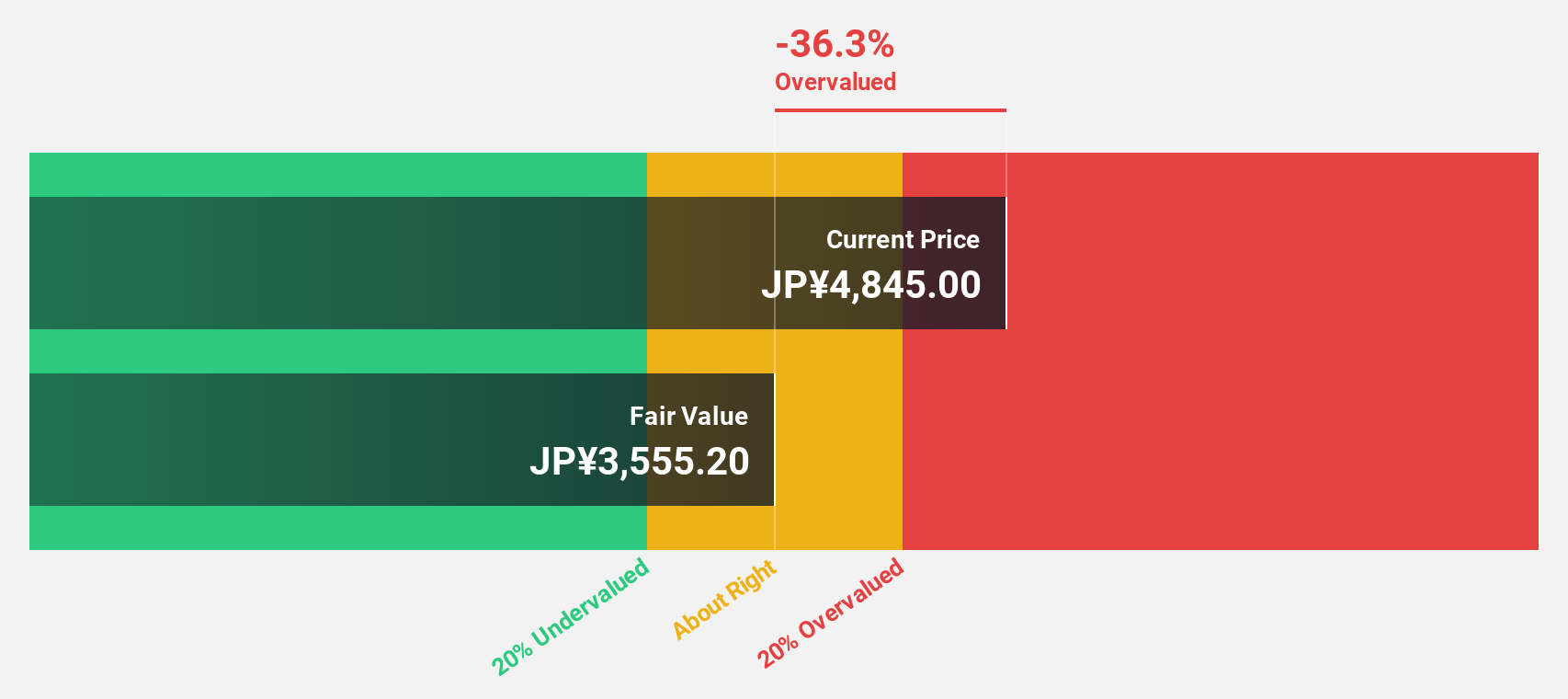

SaizeriyaLtd (TSE:7581)

Overview: Saizeriya Co., Ltd. operates restaurants in Japan, Australia, and Asia with a market cap of ¥254.60 billion.

Operations: Revenue segments for Saizeriya Co., Ltd. include ¥111.20 billion from Japan, ¥13.50 billion from Australia, and ¥23.75 billion from Asia.

Estimated Discount To Fair Value: 49.3%

Saizeriya Ltd. is trading at ¥5190, significantly below its estimated fair value of ¥10229.18, indicating it is highly undervalued based on discounted cash flow analysis. Earnings grew by 341% over the past year and are forecast to grow 26.1% annually, outpacing the JP market's growth rate of 8.6%. Analysts agree on a potential stock price rise of nearly 40%, although the Return on Equity is expected to remain low at 11.6%.

- The analysis detailed in our SaizeriyaLtd growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of SaizeriyaLtd.

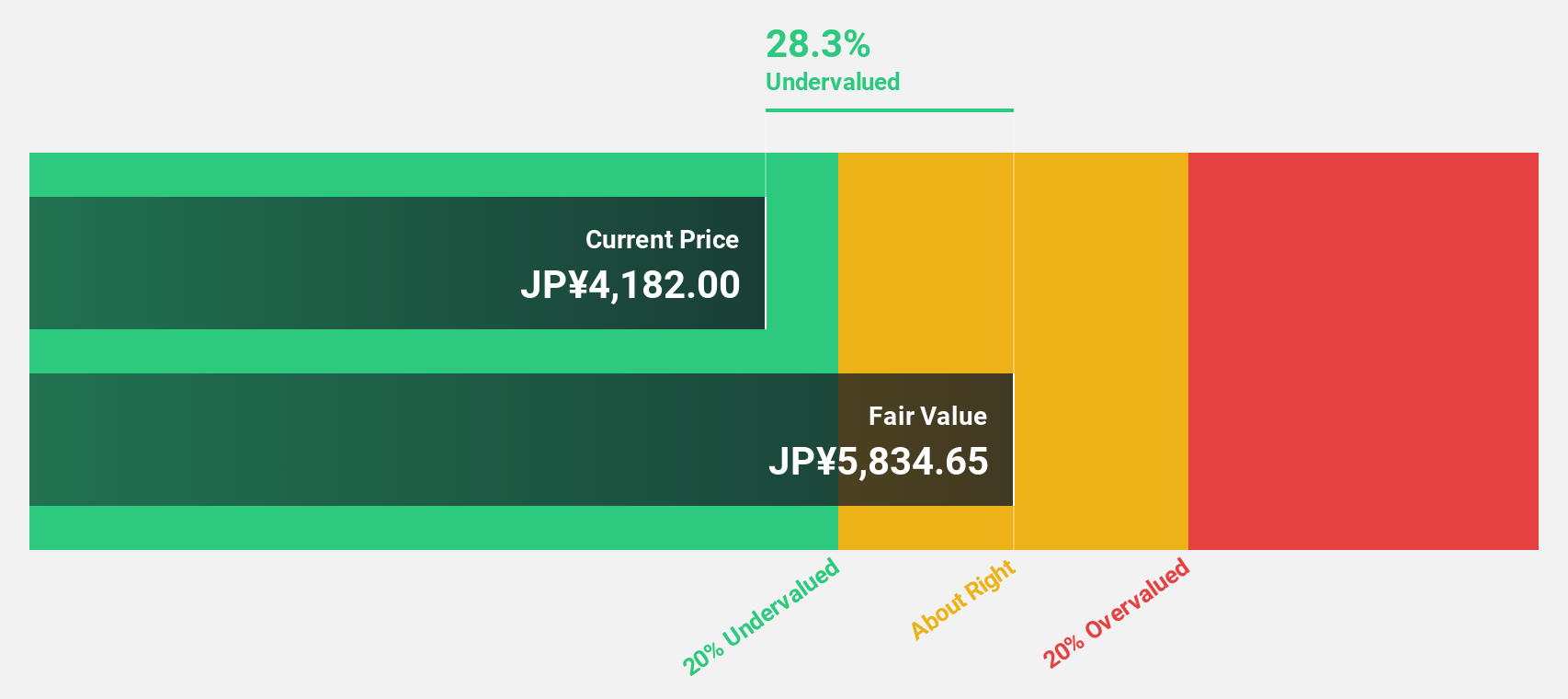

Pilot (TSE:7846)

Overview: Pilot Corporation manufactures, purchases, and sells writing instruments, stationery products, and toys across Japan, the Americas, Europe, and Asia with a market cap of ¥175.30 billion.

Operations: Revenue segments are as follows: ¥20.93 billion from Asia, ¥84.15 billion from Japan, ¥25.87 billion from Europe, and ¥37.06 billion from the Americas.

Estimated Discount To Fair Value: 49.3%

Pilot Corporation is trading at ¥4516, significantly below its estimated fair value of ¥8906.2, indicating it is highly undervalued based on discounted cash flow analysis. Earnings are forecast to grow 9.69% annually, outpacing the JP market's growth rate of 8.6%. Recent buyback activity saw the repurchase of 203,000 shares for ¥885.85 million, reflecting management's confidence in the stock’s valuation and future prospects despite a modest dividend yield of 2.35%.

- Our expertly prepared growth report on Pilot implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Pilot with our detailed financial health report.

Key Takeaways

- Navigate through the entire inventory of 84 Undervalued Japanese Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4071

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives