- India

- /

- Electrical

- /

- NSEI:HPL

November 2024's Leading Growth Companies With Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, investors are closely watching how growth stocks perform amid cautious corporate forecasts and macroeconomic uncertainties. With major indices experiencing volatility, particularly in the technology sector, insider ownership can be a key indicator of confidence in a company's potential for long-term growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

We're going to check out a few of the best picks from our screener tool.

Hindware Home Innovation (NSEI:HINDWAREAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hindware Home Innovation Limited operates in India, focusing on the manufacturing, selling, and trading of building products and consumer appliances, with a market cap of ₹21.79 billion.

Operations: The company's revenue is primarily derived from its building products segment at ₹23.56 billion, followed by the consumer appliances business at ₹4.39 billion, and the retail business contributing ₹121.54 million.

Insider Ownership: 13.6%

Hindware Home Innovation is poised for significant earnings growth, projected at 58.6% annually over the next three years, outpacing the Indian market. However, its return on equity is expected to remain low at 18.7%. The company faces financial challenges with interest payments not well covered by earnings and recent regulatory tax demands totaling approximately INR 4.76 million under review. Analysts agree on a potential stock price increase of 66.2%, despite revenue growth forecasts below 20%.

- Dive into the specifics of Hindware Home Innovation here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Hindware Home Innovation's current price could be inflated.

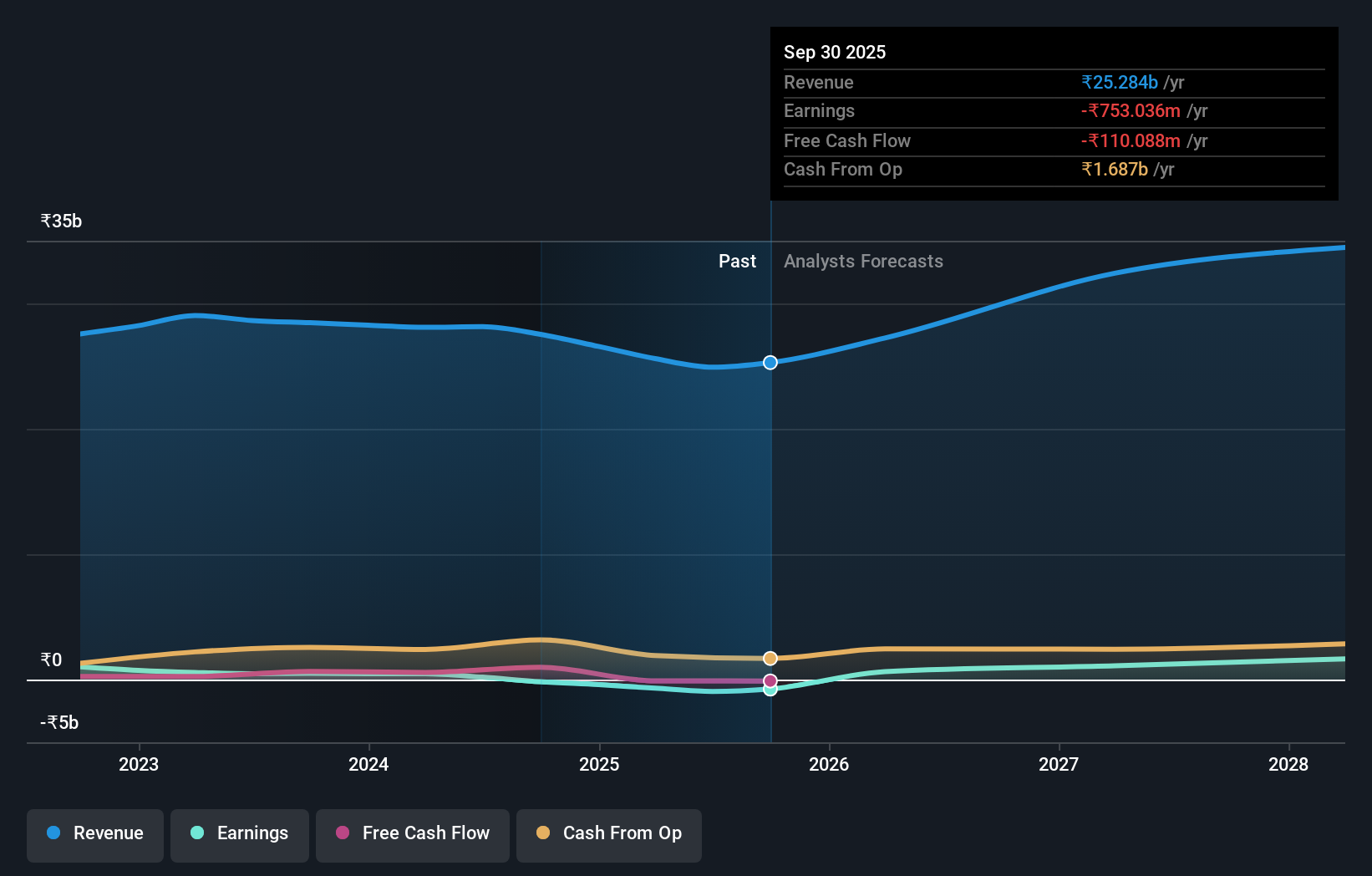

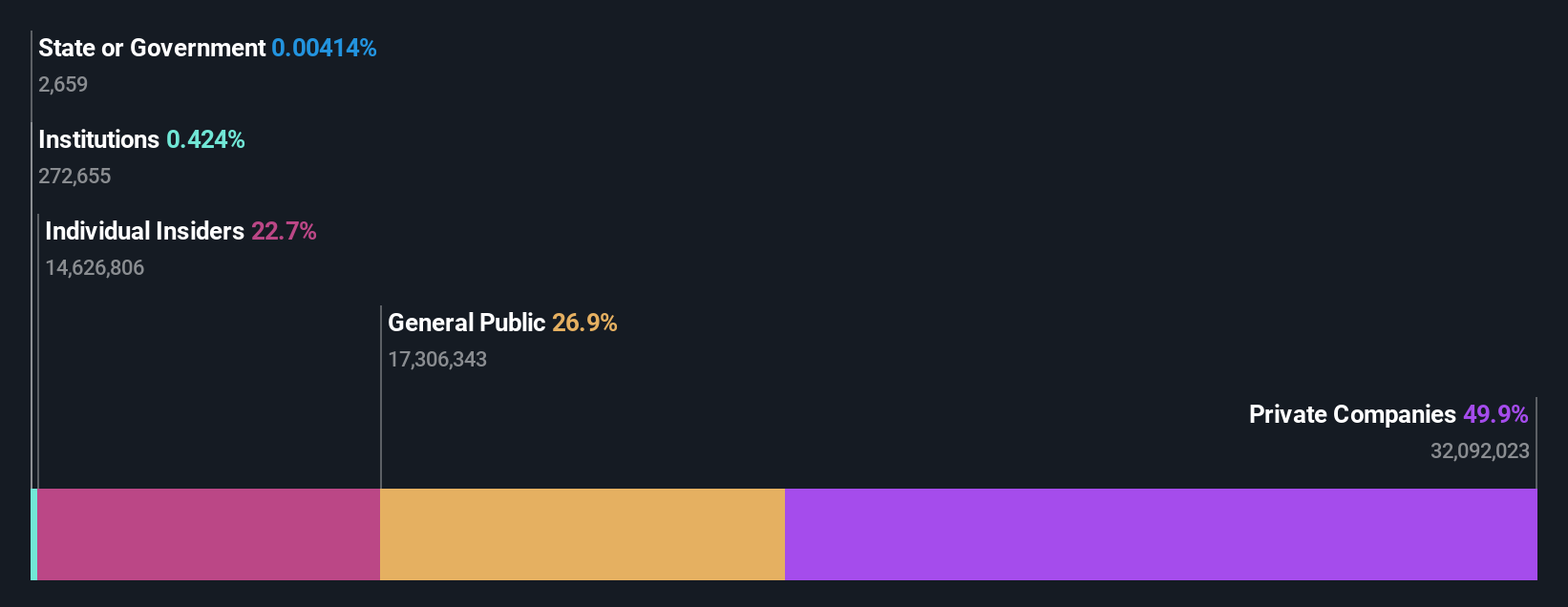

HPL Electric & Power (NSEI:HPL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HPL Electric & Power Limited manufactures and sells electric equipment under the HPL brand in India, with a market cap of ₹34.35 billion.

Operations: The company's revenue is primarily derived from its Metering, Systems & Services segment, which accounts for ₹9.15 billion, and the Consumer, Industrial & Services segment, contributing ₹6.18 billion.

Insider Ownership: 22.7%

HPL Electric & Power is set for substantial growth, with earnings projected to rise 44.8% annually, surpassing the Indian market's average. Revenue is also expected to grow at 23.5% per year. Despite these prospects, interest payments remain a concern as they are not well covered by earnings. Recently added to the S&P Global BMI Index and securing significant orders worth INR 1,437.7 million underscores its expanding market presence and potential for future growth.

- Navigate through the intricacies of HPL Electric & Power with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that HPL Electric & Power is priced higher than what may be justified by its financials.

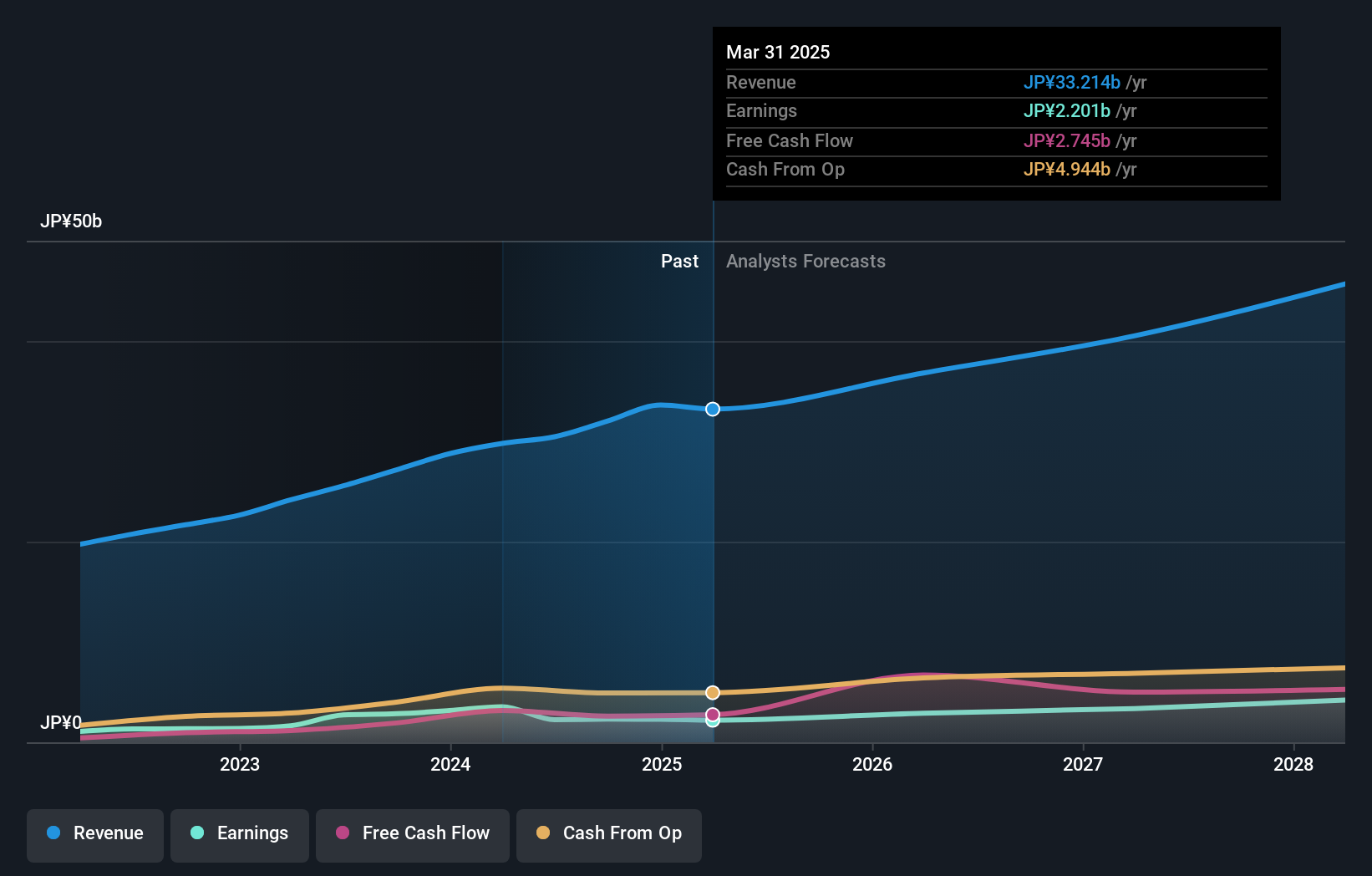

LITALICO (TSE:7366)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LITALICO Inc. operates schools for learning and preschool in Japan, with a market cap of ¥41.07 billion.

Operations: The company's revenue segments include the Employment Support Business at ¥11.59 billion, the Child Welfare Business at ¥9.19 billion, and the Platform Business at ¥4.19 billion.

Insider Ownership: 37.2%

LITALICO faces a mixed outlook, with revenue projected to grow at 13.7% annually, outpacing the Japanese market average. However, recent guidance revisions lowered profit expectations due to operational challenges in its child welfare and vocational segments. The acquisition of DDCN is expected to contribute positively but not enough to offset these issues. Despite trading below fair value and a high forecasted return on equity of 22.3%, interest coverage remains weak, reflecting financial vulnerabilities.

- Get an in-depth perspective on LITALICO's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that LITALICO's share price might be on the cheaper side.

Summing It All Up

- Investigate our full lineup of 1520 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HPL Electric & Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HPL

HPL Electric & Power

Manufactures and sells electric equipment under the HPL brand in India.

High growth potential with solid track record.

Market Insights

Community Narratives