- Japan

- /

- Industrials

- /

- TSE:3105

3 Japanese Stocks Estimated To Be Trading At Discounts Of Up To 36.3%

Reviewed by Simply Wall St

Japan's stock markets recently experienced a decline, with the Nikkei 225 Index and the TOPIX Index both showing losses, amid easing domestic inflation and speculation about future interest rate changes by the Bank of Japan. Despite these challenges, opportunities may exist for investors seeking undervalued stocks that could be trading at significant discounts. Identifying such stocks often involves looking for companies with strong fundamentals that are temporarily out of favor in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Nihon Dempa Kogyo (TSE:6779) | ¥1031.00 | ¥1878.95 | 45.1% |

| Akatsuki (TSE:3932) | ¥1952.00 | ¥3632.37 | 46.3% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3315.00 | ¥6606.45 | 49.8% |

| Avant Group (TSE:3836) | ¥2145.00 | ¥3957.36 | 45.8% |

| Pilot (TSE:7846) | ¥4709.00 | ¥8930.62 | 47.3% |

| Forum Engineering (TSE:7088) | ¥874.00 | ¥1604.05 | 45.5% |

| Adventure (TSE:6030) | ¥3800.00 | ¥7293.95 | 47.9% |

| BayCurrent Consulting (TSE:6532) | ¥4853.00 | ¥9299.46 | 47.8% |

| KeePer Technical Laboratory (TSE:6036) | ¥4160.00 | ¥7849.95 | 47% |

| Mercari (TSE:4385) | ¥2166.00 | ¥4210.33 | 48.6% |

We're going to check out a few of the best picks from our screener tool.

Nisshinbo Holdings (TSE:3105)

Overview: Nisshinbo Holdings Inc. operates in wireless communication, microdevice, automobile brakes, mechatronics, chemicals, textiles, and real estate sectors both in China and internationally with a market cap of ¥151.43 billion.

Operations: The company's revenue segments include Wireless Communication (¥198.40 billion), Brake Systems (¥120.79 billion), Micro Device (¥73.06 billion), Precision Mechanical Equipment (¥53.07 billion), Fiber (¥37.32 billion), Chemicals (¥11.37 billion), and Real Estate (¥10.72 billion).

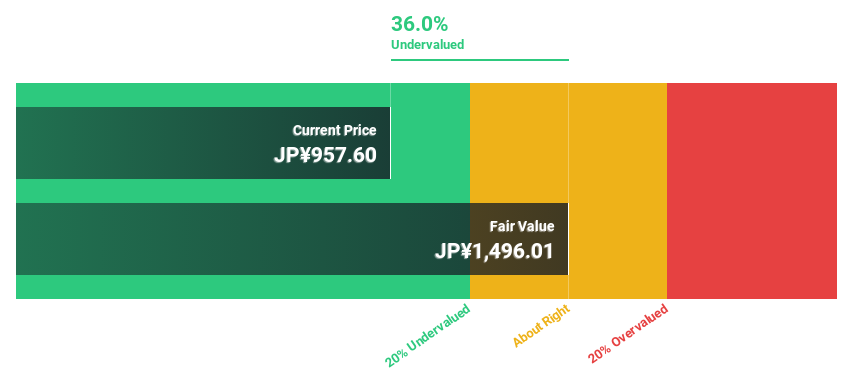

Estimated Discount To Fair Value: 34.9%

Nisshinbo Holdings is trading at ¥963.5, significantly below its estimated fair value of ¥1479.12, indicating potential undervaluation based on cash flows. Although revenue growth is modest at 4.5% annually, it surpasses the JP market average of 4.2%. However, the dividend yield of 3.74% isn't well-supported by earnings or free cash flows, and debt coverage by operating cash flow remains a concern despite expected profitability within three years with strong earnings growth forecasts at 31.17% per year.

- Our expertly prepared growth report on Nisshinbo Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Nisshinbo Holdings' balance sheet health report.

Mandom (TSE:4917)

Overview: Mandom Corporation manufactures and sells cosmetics, perfumes, and quasi-drugs in Japan, Indonesia, and internationally with a market cap of ¥55.66 billion.

Operations: The company's revenue segments are comprised of ¥44.54 billion from Japan, ¥18.24 billion from Indonesia, and ¥21.10 billion from other overseas markets.

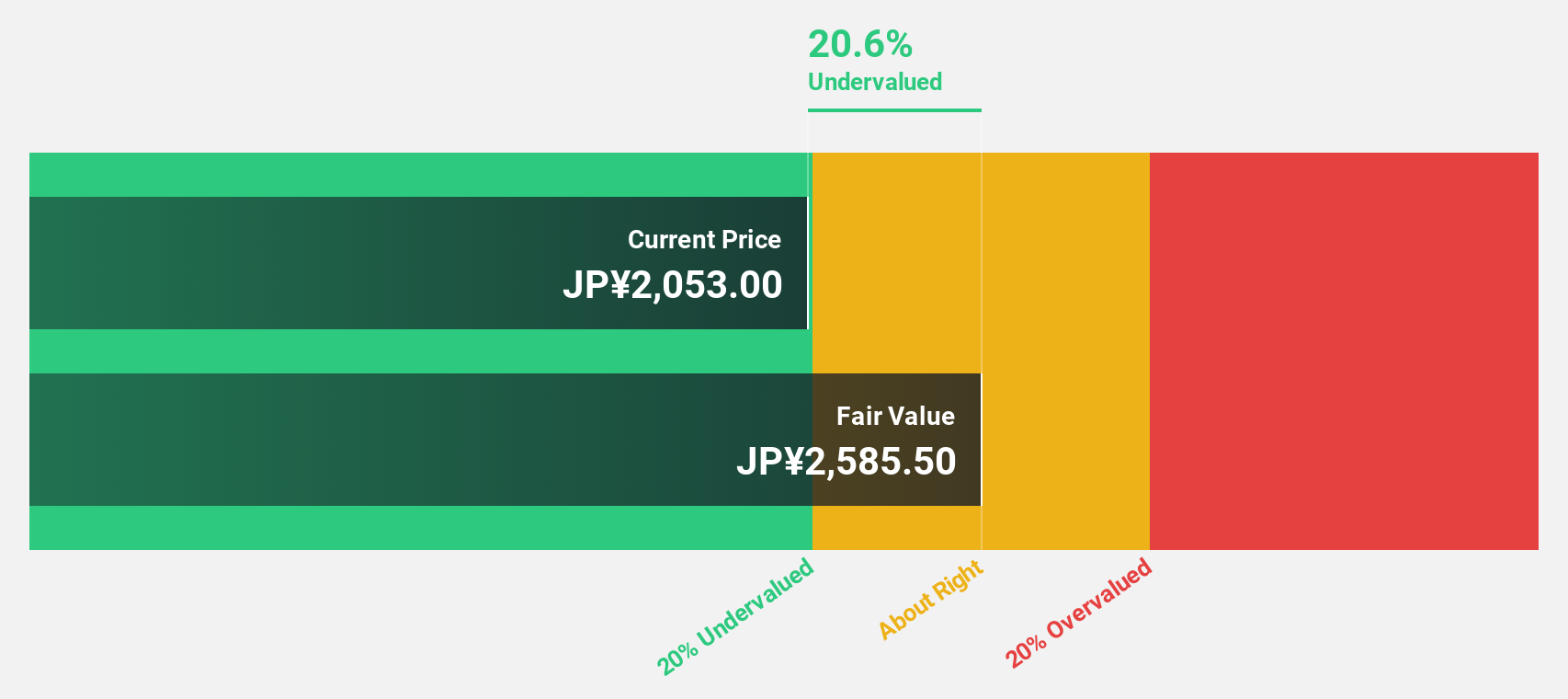

Estimated Discount To Fair Value: 22.3%

Mandom is trading at ¥1239, below its estimated fair value of ¥1595.34, highlighting potential undervaluation based on cash flows. The company forecasts strong earnings growth of 28.54% annually, outpacing the JP market's 8.7%. Revenue growth is moderate at 5.2%, above the market average but not high overall. While Mandom offers a reliable dividend yield of 3.23%, large one-off items affect earnings quality and future return on equity is expected to be low at 5.6%.

- The growth report we've compiled suggests that Mandom's future prospects could be on the up.

- Click here to discover the nuances of Mandom with our detailed financial health report.

LITALICO (TSE:7366)

Overview: LITALICO Inc. operates schools for learning and preschool in Japan, with a market cap of ¥41.74 billion.

Operations: The company's revenue segments include the Employment Support Business at ¥11.08 billion, Child Welfare Business at ¥9.39 billion, and Platform Business at ¥4.05 billion.

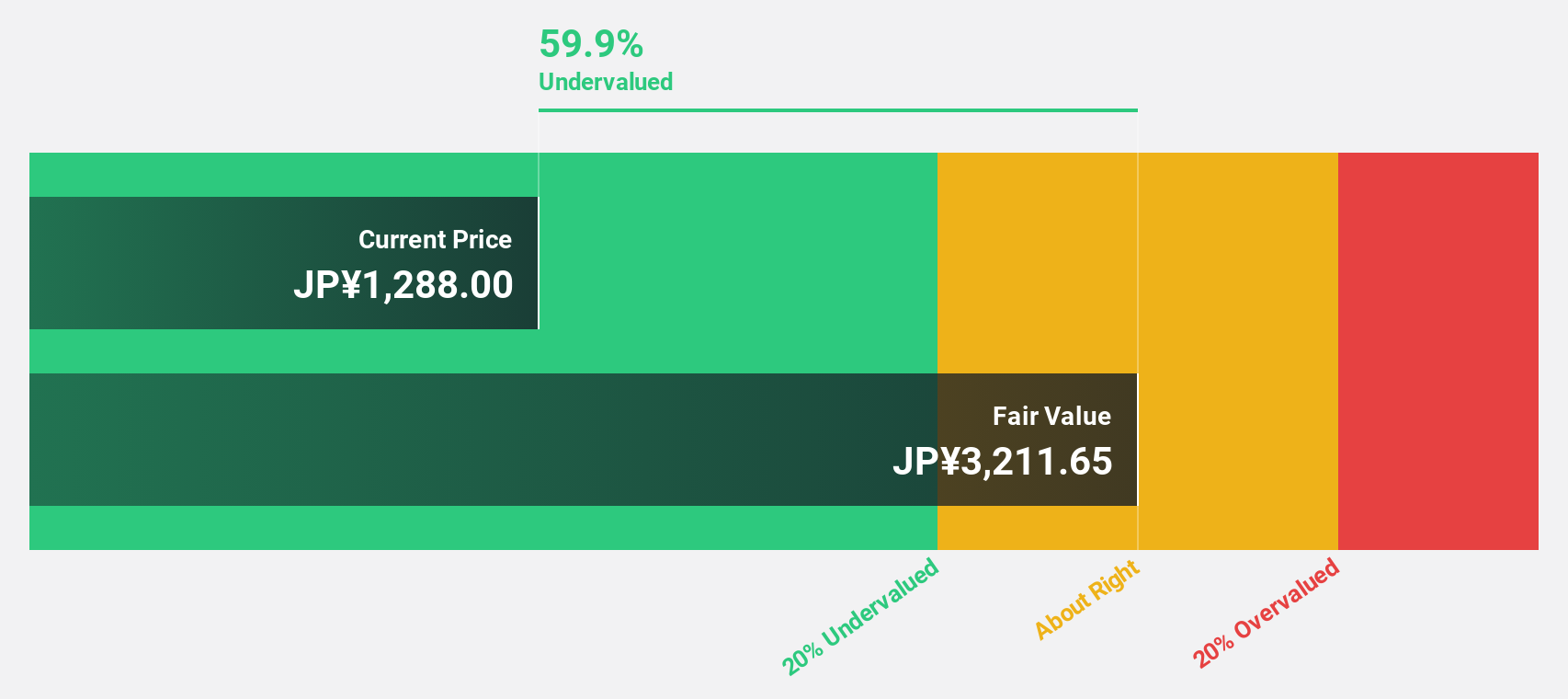

Estimated Discount To Fair Value: 36.3%

LITALICO, trading at ¥1169, is significantly undervalued with a fair value estimate of ¥1835.15. Despite its high debt levels, the company is in a good financial position and forecasts robust earnings growth of 17.42% annually, surpassing the JP market's average growth rate. However, profit margins have declined from 10.6% to 7.4%, and recent share price volatility could impact investor sentiment despite promising cash flow valuation metrics.

- Our earnings growth report unveils the potential for significant increases in LITALICO's future results.

- Take a closer look at LITALICO's balance sheet health here in our report.

Taking Advantage

- Get an in-depth perspective on all 81 Undervalued Japanese Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nisshinbo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3105

Nisshinbo Holdings

Operates wireless communication, microdevice, automobile brakes, precision instruments, chemicals, textiles, and real estate businesses in China and internationally.

Average dividend payer and fair value.

Market Insights

Community Narratives