- Japan

- /

- Consumer Services

- /

- TSE:6557

We Think AIAI Group's (TSE:6557) Profit Is Only A Baseline For What They Can Achieve

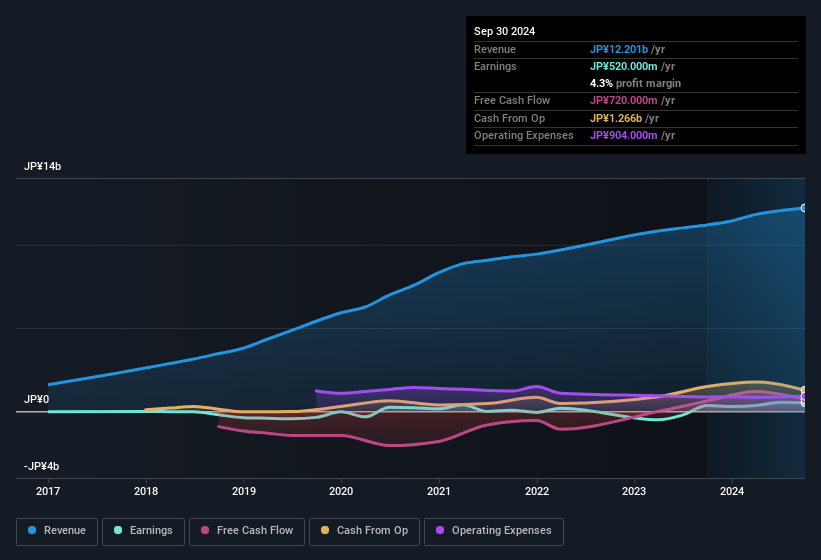

The subdued stock price reaction suggests that AIAI Group Corporation's (TSE:6557) strong earnings didn't offer any surprises. We think that investors have missed some encouraging factors underlying the profit figures.

View our latest analysis for AIAI Group

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, AIAI Group issued 6.6% more new shares over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out AIAI Group's historical EPS growth by clicking on this link.

A Look At The Impact Of AIAI Group's Dilution On Its Earnings Per Share (EPS)

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. On the bright side, in the last twelve months it grew profit by 49%. But EPS was less impressive, up only 90% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So AIAI Group shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of AIAI Group.

The Impact Of Unusual Items On Profit

On top of the dilution, we should also consider the JP¥257m impact of unusual items in the last year, which had the effect of suppressing profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to September 2024, AIAI Group had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On AIAI Group's Profit Performance

AIAI Group suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Considering all the aforementioned, we'd venture that AIAI Group's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that AIAI Group has 5 warning signs (1 can't be ignored!) that deserve your attention before going any further with your analysis.

Our examination of AIAI Group has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6557

AIAI Group

Operates nursery school and child development support office, and provides after school day services in Japan.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)