- Japan

- /

- Consumer Services

- /

- TSE:6071

IBJ (TSE:6071) Has Announced That It Will Be Increasing Its Dividend To ¥8.00

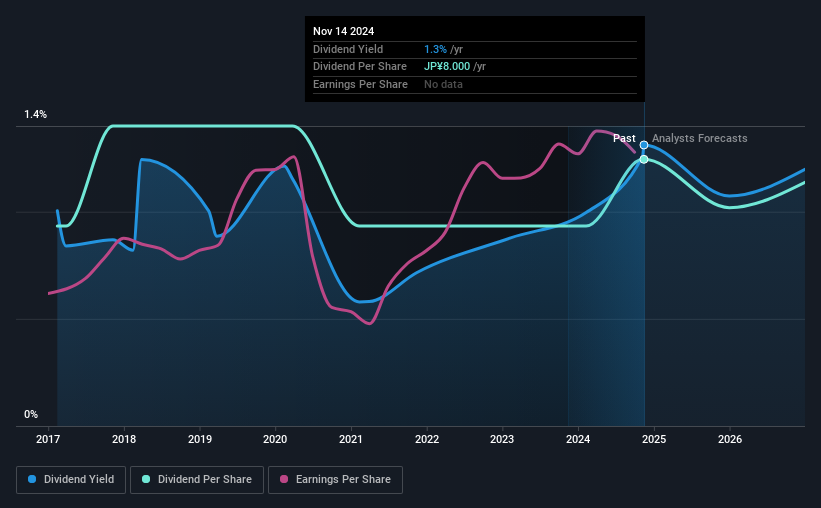

IBJ, Inc. (TSE:6071) will increase its dividend from last year's comparable payment on the 26th of March to ¥8.00. Although the dividend is now higher, the yield is only 1.3%, which is below the industry average.

Check out our latest analysis for IBJ

IBJ's Projected Earnings Seem Likely To Cover Future Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, IBJ's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to expand by 8.8%. Assuming the dividend continues along recent trends, we think the payout ratio could be 17% by next year, which is in a pretty sustainable range.

IBJ's Dividend Has Lacked Consistency

Looking back, IBJ's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2016, the dividend has gone from ¥6.00 total annually to ¥8.00. This implies that the company grew its distributions at a yearly rate of about 3.7% over that duration. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

IBJ May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Although it's important to note that IBJ's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

In Summary

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in IBJ in our latest insider ownership analysis. Is IBJ not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6071

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026