- Japan

- /

- Hospitality

- /

- TSE:4680

Top Growth Companies With High Insider Ownership For December 2024

Reviewed by Simply Wall St

As global markets continue to climb, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investor sentiment remains buoyed by positive economic indicators despite geopolitical uncertainties. In this environment of robust market performance, identifying growth companies with high insider ownership can be particularly appealing as it often suggests strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

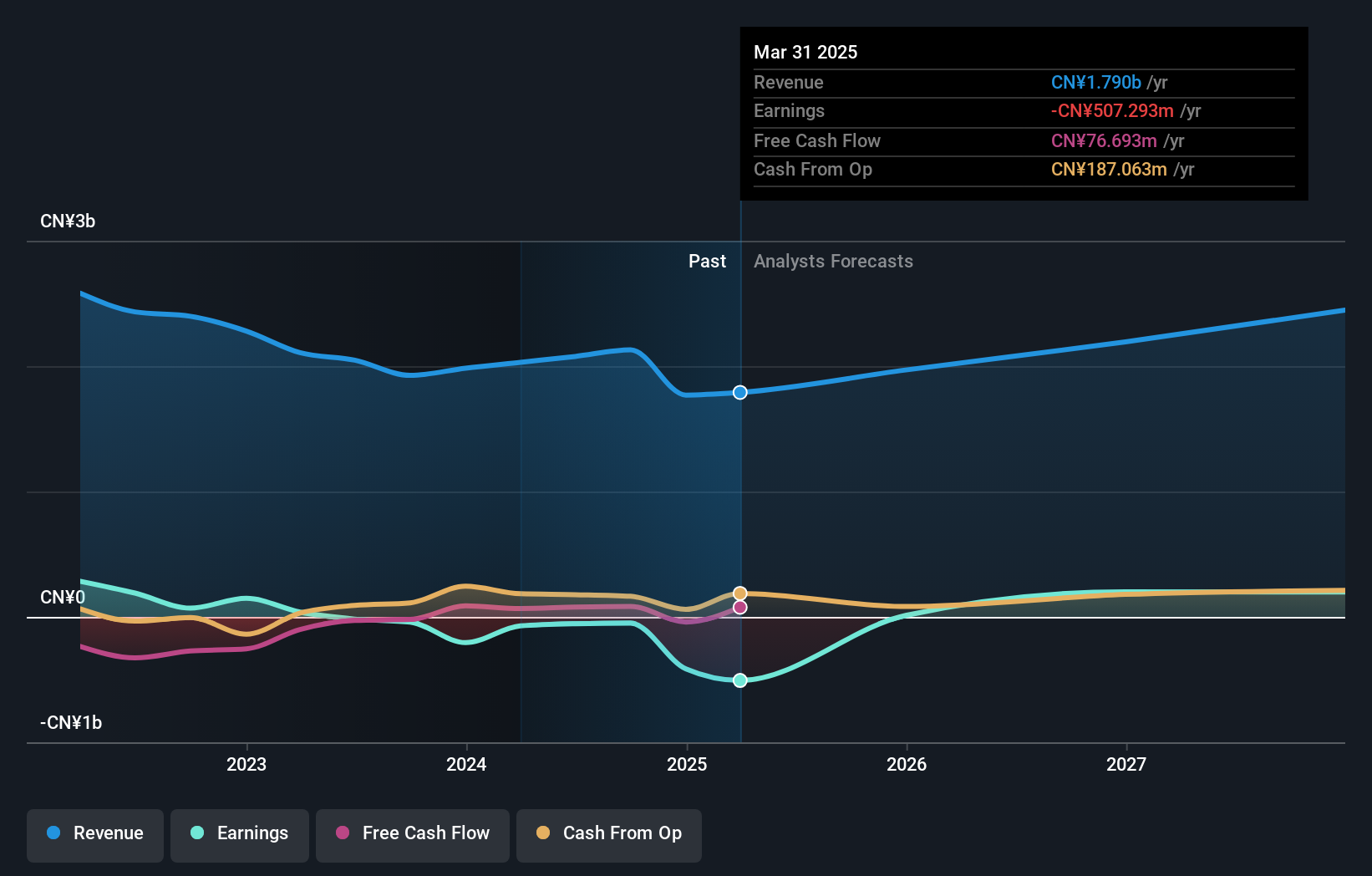

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd. operates in the information technology sector and has a market cap of CN¥13.55 billion.

Operations: SDIC Intelligence Xiamen Information Co., Ltd. generates its revenue from various segments within the information technology sector.

Insider Ownership: 29.8%

Earnings Growth Forecast: 65.7% p.a.

SDIC Intelligence Xiamen Information demonstrates potential as a growth company with high insider ownership. Despite recent volatility in its share price, the company is forecast to grow earnings by 65.72% annually and achieve profitability within three years, surpassing average market growth. Recent financials show revenue increased to CNY 897.38 million for the first nine months of 2024, reducing net loss from CNY 397.09 million to CNY 241.83 million year-over-year, indicating improving financial health amidst rapid revenue expansion at a rate of 22.6% per year.

- Get an in-depth perspective on SDIC Intelligence Xiamen Information's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, SDIC Intelligence Xiamen Information's share price might be too optimistic.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. operates in the environmental technology sector and has a market cap of CN¥17.20 billion.

Operations: Qingdao Huicheng Environmental Technology Group Co., Ltd. generates its revenue from various segments within the environmental technology sector.

Insider Ownership: 31.8%

Earnings Growth Forecast: 65.2% p.a.

Qingdao Huicheng Environmental Technology Group shows potential for growth with high insider ownership, despite recent earnings challenges. The company forecasts significant annual earnings growth of 65.23%, outpacing the CN market. Revenue increased to CNY 862.19 million for the first nine months of 2024, though net income declined from CNY 136.28 million to CNY 43.44 million year-over-year due to lower profit margins and interest coverage issues, reflecting mixed financial stability amidst rapid revenue expansion at a rate of 34.5% per year.

- Take a closer look at Qingdao Huicheng Environmental Technology Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Qingdao Huicheng Environmental Technology Group's current price could be inflated.

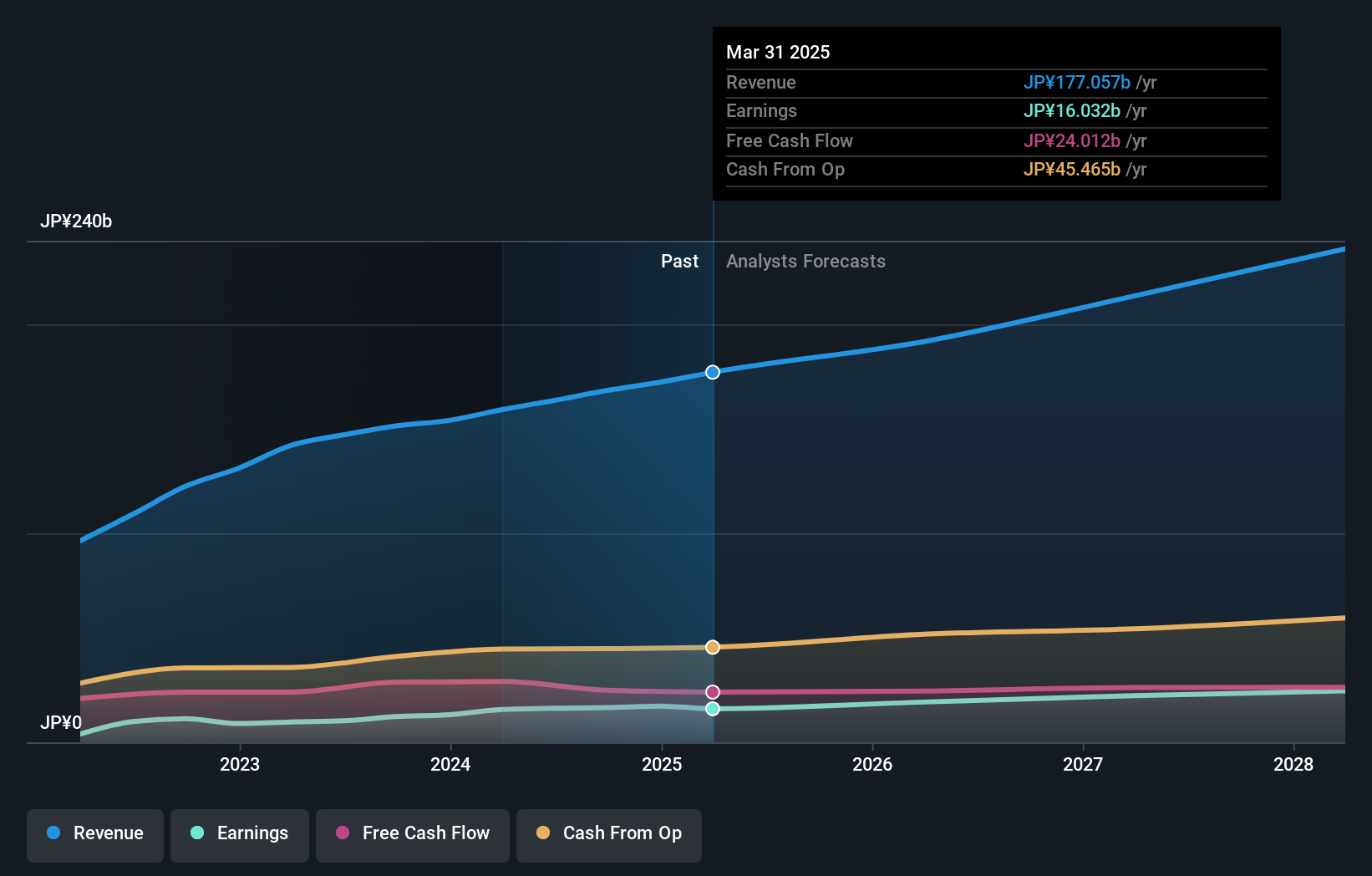

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥291.49 billion.

Operations: The company generates revenue from its operations in Japan, contributing ¥100.87 billion, and the United States of America, adding ¥65.87 billion.

Insider Ownership: 35.2%

Earnings Growth Forecast: 10.4% p.a.

Round One Corporation is trading at a significant discount to its estimated fair value, indicating good relative value compared to peers. The company forecasts revenue growth of 6.7% per year, outpacing the JP market's 4.2%. Earnings grew by 34.8% over the past year and are expected to grow by 10.44% annually, surpassing market expectations. Recent buyback announcements highlight a flexible capital strategy amid volatile share prices, with a plan to repurchase shares worth ¥10 billion by April 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Round One.

- Our valuation report here indicates Round One may be undervalued.

Next Steps

- Embark on your investment journey to our 1516 Fast Growing Companies With High Insider Ownership selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4680

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives