- Japan

- /

- Semiconductors

- /

- TSE:6871

Insiders Favor These 3 High Growth Companies

Reviewed by Simply Wall St

As global markets navigate rising U.S. Treasury yields and a cautious Federal Reserve, growth stocks have shown resilience, particularly in the tech-heavy Nasdaq Composite Index which managed slight gains despite broader market pressures. In this environment, companies with high insider ownership often attract attention as they suggest confidence from those who know the business best; these firms can be appealing to investors seeking stability and potential growth amid economic uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JUSUNG ENGINEERING Co., Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment both in South Korea and internationally, with a market cap of ₩1.41 trillion.

Operations: The company generates revenue primarily from Semiconductor Equipment and Services, amounting to ₩338.28 billion.

Insider Ownership: 36.9%

Earnings Growth Forecast: 21.5% p.a.

JUSUNG ENGINEERING Co., Ltd. is poised for significant growth, with revenue forecasted to increase by 22.2% annually, outpacing the broader Korean market. While its earnings are projected to grow at 21.46% per year, they lag behind the market's average growth rate of 30.2%. The recent KRW 50 billion share buyback plan aims to enhance shareholder value and stabilize its highly volatile stock price, trading below estimated fair value by 28.4%.

- Take a closer look at JUSUNG ENGINEERINGLtd's potential here in our earnings growth report.

- Our expertly prepared valuation report JUSUNG ENGINEERINGLtd implies its share price may be lower than expected.

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥261.97 billion.

Operations: The company's revenue segments include ¥99.03 billion from Japan and ¥62.90 billion from the United States of America.

Insider Ownership: 35.2%

Earnings Growth Forecast: 10.7% p.a.

Round One Corporation demonstrates potential as a growth company with high insider ownership, despite some challenges. Recent sales figures show consistent improvement, with September 2024 sales up 12.50% to ¥8,406 million. Earnings are forecasted to grow at 10.66% annually, outpacing the Japanese market's average of 8.7%. However, revenue growth of 6.9% per year is slower than desired benchmarks but still exceeds the market average of 4.2%. The stock trades at a significant discount to its estimated fair value and has shown high volatility recently without substantial insider trading activity in the past three months.

- Unlock comprehensive insights into our analysis of Round One stock in this growth report.

- Our valuation report unveils the possibility Round One's shares may be trading at a discount.

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of ¥151.27 billion.

Operations: The company's revenue segments include the TE Business, generating ¥2.19 billion, and the Probe Card Business, contributing ¥45.29 billion.

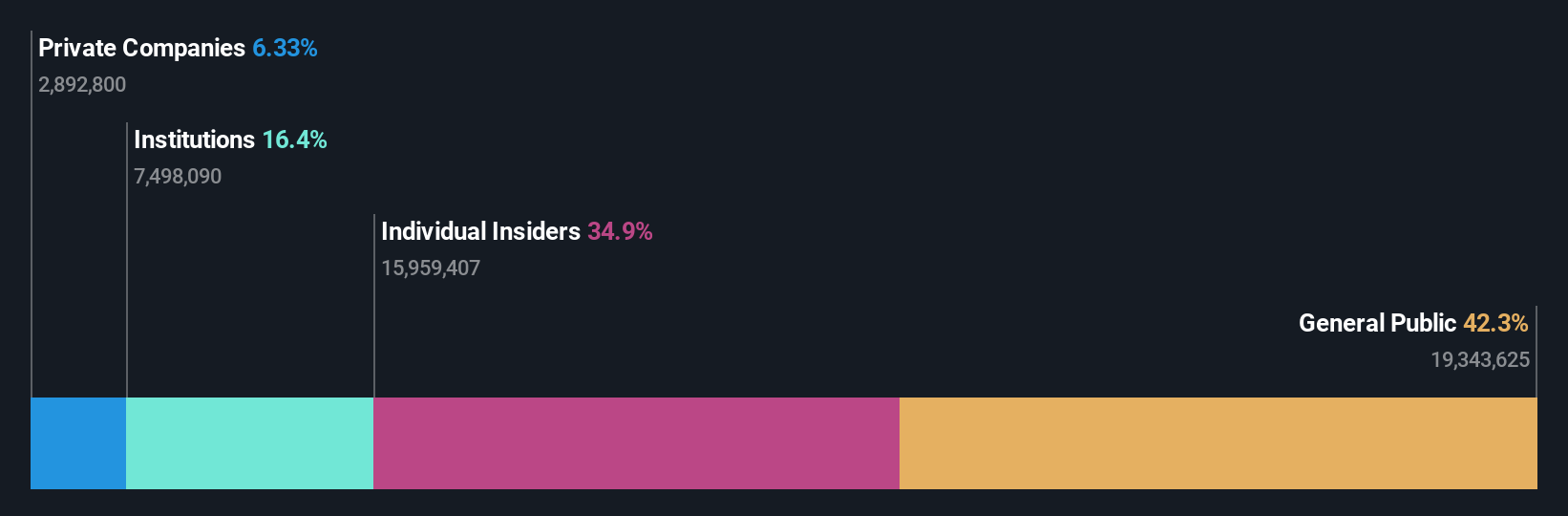

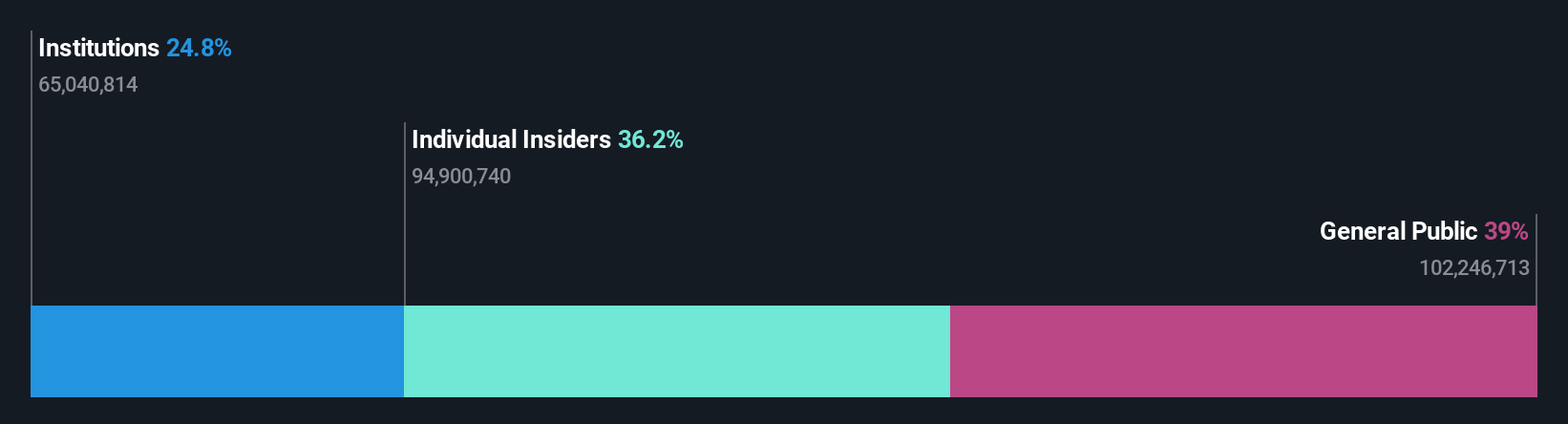

Insider Ownership: 15.3%

Earnings Growth Forecast: 31.5% p.a.

Micronics Japan is poised for substantial growth, with revenue expected to increase by 20.8% annually, surpassing the Japanese market average of 4.2%. Earnings are forecasted to grow significantly at 31.5% per year, well above the market's 8.7%. Despite high share price volatility recently and no substantial insider trading activity in the past three months, it trades at nearly 60% below its estimated fair value, indicating potential upside for investors seeking undervalued opportunities.

- Get an in-depth perspective on Micronics Japan's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Micronics Japan's share price might be on the cheaper side.

Next Steps

- Delve into our full catalog of 1522 Fast Growing Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6871

Micronics Japan

Develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing system worldwide.

Exceptional growth potential with flawless balance sheet.