- Japan

- /

- Hospitality

- /

- TSE:4680

How Do Diverging Japan and US Sales Trends Shape Round One’s Growth Ambitions (TSE:4680)?

Reviewed by Sasha Jovanovic

- On October 9, 2025, Round One Corporation reported unaudited sales for September and year-to-date, revealing Japan monthly sales of ¥8,222 million (up 1.1%) and USA monthly sales of ¥35,032 million (down 4.9%) versus the same period last year.

- This update highlights steady sales growth in Japan and modest overall progress in the USA, drawing attention to differences in market performance for the company.

- We'll explore how the company's solid sales growth in Japan may influence Round One's broader investment narrative and business outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Round One's Investment Narrative?

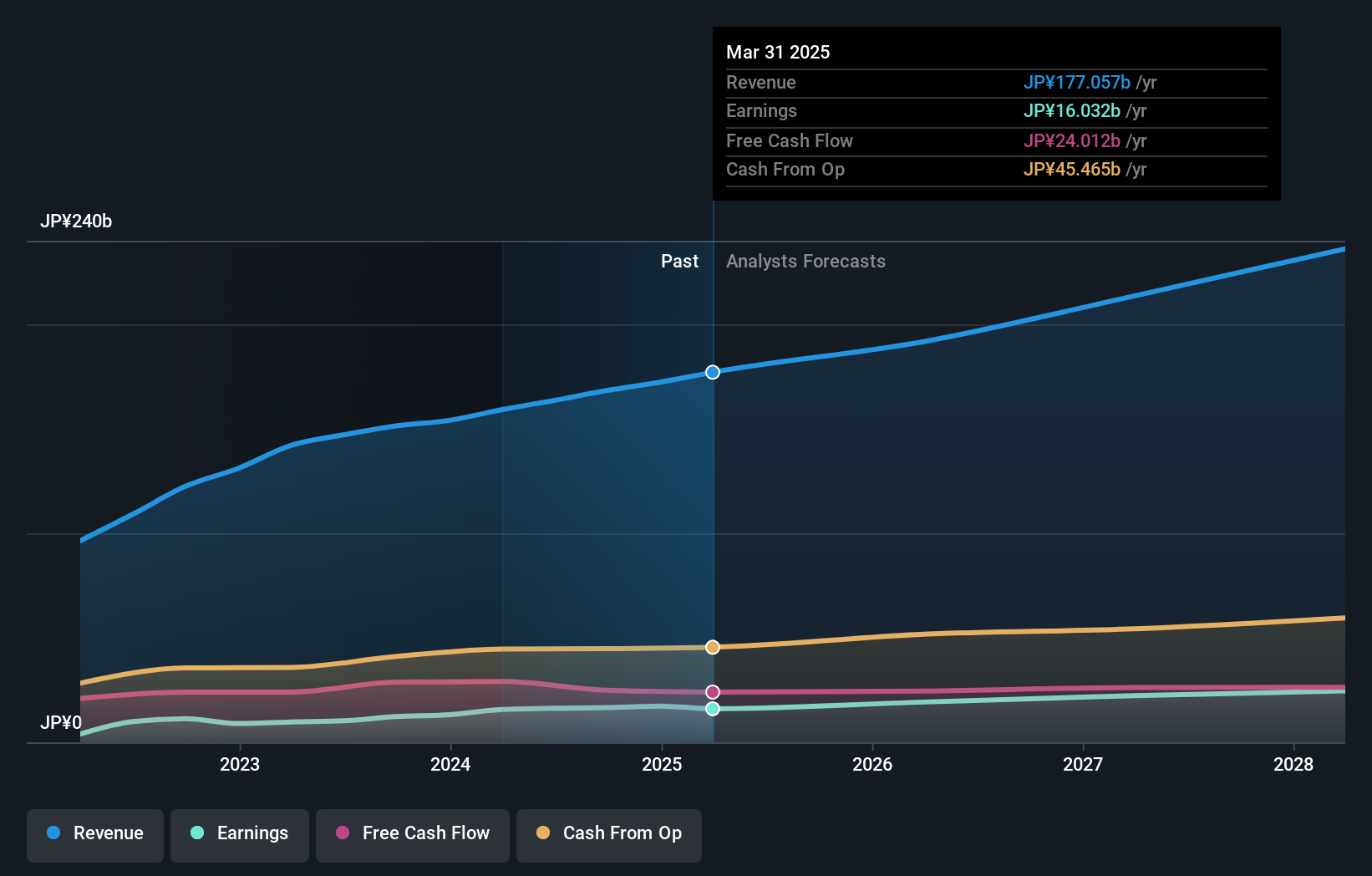

Owning shares in Round One requires confidence in its ability to maintain stable growth across both Japan and the USA, while managing region-specific challenges. The recent sales update shows Japan continuing to deliver consistent gains, but USA sales dipped for the month, raising questions about momentum there as a key short-term catalyst. Although the modest year-to-date sales increase in the USA suggests some resilience, anyone eyeing upcoming catalysts like the November earnings release should weigh current US market softness as a real risk. Investors might look to the steady dividend increases as a sign of financial health, yet the sharp share price volatility and lower-than-last-year net margins add uncertainty. While this sales news doesn’t shift the big picture dramatically, it does underscore the need to watch US performance more closely in the coming months. On the flip side, US sales trends may warrant closer scrutiny for those following Round One.

Round One's shares have been on the rise but are still potentially undervalued by 27%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Round One - why the stock might be worth as much as 55% more than the current price!

Build Your Own Round One Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Round One research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Round One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Round One's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4680

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives